Infrastructure

Back to Bayesics

RISK INDICATORS

Basel II will lead to more instability, critic argues

BASEL II UPDATE

The Basel II capital accord: op risk proposals in brief

BASEL II UPDATE

QIS 3: Banks can use internal pricing for standardised approach

BASEL II UPDATE

Microsoft seeks to reduce cost of STP

TECHNOLOGY

Reaping integration rewards

In the October issue of Risk, Clive Davidson discussed the integration of ALM and ERM technology. Here, in a second article, he profiles the firms that have tackled this project and reviews the challenges, advantages and pitfalls of the integration…

RiskNews review

October’s leading stories from RiskNews. Breaking news on derivatives and risk management, see RiskNews – www.RiskNews.net

Banding together for SME credit risk analytics

Germany’s banking associations are taking a leading role in getting the country’s fragmented banking sector ready to comply with the Basel II capital Accord. Germany’s savings banks association, in particular, says it has internal ratings-based systems…

Currency overlay set to hit $500 billion

Currency overlay, the management of currency exposures in an investment portfolio separate from underlying asset exposures, is set to become a $500 billion dollar industry within the next three years, according to Piero Overmars, Dutch bank ABN Amro’s…

Fallacies about the effects of market risk management systems

This paper takes another look at allegations that risk management systems have contributed to increased volatility in financial markets, with the particular example of the summer of 1998. The paper also provides new evidence on the potential effect of…

RMS publishes daily weather derivatives data

Risk Management Solutions (RMS), a California-based provider of software for the management of natural hazard risks, has begun publishing daily weather market price data on the internet.

Thomson reorganises in Europe and targets low-cost data provision

Thomson Financial Europe has promoted its sales and trading head, Donal Smith, to the newly created position of chief operating officer as part of a reorganisation today that centralises sales, application and product management, and customer services…

Gensec structures first South African weather derivatives contract

ZZ2 Ceres, one of South Africa’s largest fruit and vegetables businesses, has become the first company in the country to use weather derivatives. Its frost protection contract was structured by Gensec Bank, and runs from October 14 to November 30 2002…

QIS 3 suggests Basel II op risk charges and insurance role

BASEL - The third Basel II quantitative impact study, or QIS 3, brings bankers up to date with the latest thinking of global banking regulators on the treatment of operational risk under the complex Basel II bank protective capital accord.

BofA develops new credit risk model

Bank of America is developing a sophisticated model that uses derivatives data to help asset managers get a better handle on credit risk within their portfolios.

No op risk surprises in QIS 3

BASEL - Some 265 banks in more than 50 countries were absorbing the contents of the key QIS 3 survey, which seeks information on how the complex Basel II capital pact would affect them, as Operational Risk went to press.

Credit risk systems: Getting the risk right

The requirements of the new Basel Accord are prompting some banks in Asia to begin implementing sophisticated credit systems, but there are still some obstacles to overcome.

Interest rate derivatives house of the year

Asia Risk Awards 2002

Factoring in stock options

In the wake of recent corporate scandals, support has spread rapidly for including the cost of employee stock options as an expense item in corporate income statements. David Rowe argues that while some reform is appropriate, present trends could end up…

ABN Amro to release second iBoxx-linked note

ABN Amro is to issue a second credit-linked note early next week, called iBoxx 40, following the release of its iBoxx 50 credit-linked note in July. iBoxx 40 will be the first index-derived credit product issued in Swiss francs, with an initial issue…

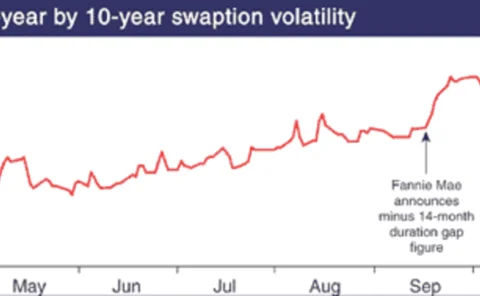

Fannie Mae’s duration gap figure down in September

US mortgage agency Fannie Mae took the unusual step of disclosing its September duration gap figure yesterday, in a bid to alleviate concern about its risk management practice. The figures showed that the duration gap had fallen from minus 14 months in…