Infrastructure

Tied up in FASB’s knots

Corporate equity tools

Portfolio allocation to corporate bonds with correlated defaults

This article deals with the problem of optimal allocation of capital to corporate bonds in fixed income portfolios when there is the possibility ofcorrelated defaults. Under fairly general assumptions for the distribution of thetotal net assets of a set…

All power to PRDC notes

Forex structured products

Reacting to spreads

Credit derivatives

A question of priorities

Basel Accord

Pooling the resources

Securitisation

Looking for alternatives

Hedge funds

Tracing Transparency

Corporate bond traders are hesitantly embracing greater transparency and trying to figure out how to use it.

Budgeting for 2003

Deutsche Bank, Merrill Lynch and State Street outline how next year's budget will be spent. For starters, it will be spent cautiously.

Diversification of Morgan Stanley

One year after Sept. 11, Morgan Stanley contemplates a simple thought with complex repercussions: Don't put all of your eggs in one basket.

Back to Bayesics

Gerald Sampson, of Saratoga Consulting, argues that a Bayesian approach to analysing transaction failures produces superior results.

Legg Mason Gets a Leg Up on Disclosure

Baltimore-based Legg Mason is one of the first firms to tap software to comply with NASD Rule 2711 about disclosing conflicts of interest.

Reaping integration rewards

In the October issue of Risk, Clive Davidson discussed the integration of ALM and ERM technology. Here, in a second article, he profiles the firms that have tackled this project and reviews the challenges, advantages and pitfalls of the integration…

Forced to fit in

Cover story

Hunter hunted

People news

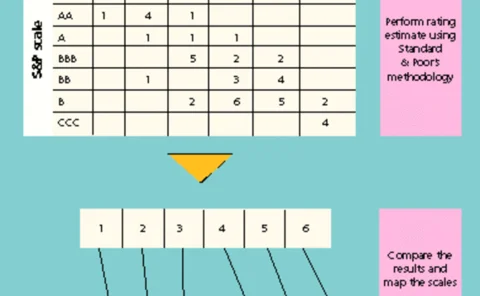

Internal risk rating systems for banks

Sponsored article

Deconstructing the market

High yield

Trouble from above

Pension funds

Credit Crunch

Clive Horwood

JPM Merits CDOs

Credit tech

Slim pickings

New Issues

Losses and lawsuits

LOSS DATABASE