GARP

Traders hedge on Jane Street manipulation claims

Market-makers side with Sebi, while bankers accept arbitrage explanation. Most want more details.

Japan regulator calls on laggards to keep Basel promise

After EU and UK delays – and amid fears of US divergence – Japan is keeping a close eye on its peers, says Shigeru Ariizumi

Derivatives players divided over 24/7 trading

For some, round-the-clock markets are inevitable. Others see “enormous risks”

For Esma to triumph as supervisor, it must stop being Esma

Europe’s markets watchdog may soon have sweeping new powers, but experts say it will have to shed its reputation as slow, expensive and process-driven if it is to succeed

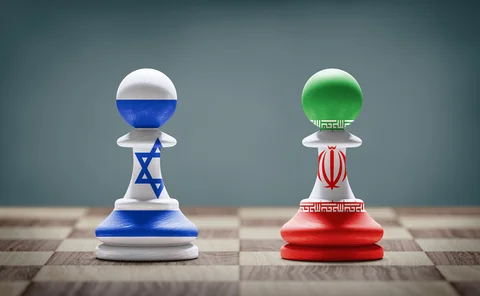

Why Iran tensions failed to rattle markets

Despite initial fears, traders say risks were signposted and investors had deleveraged after April

Stock-picking bots and models that don’t trade: AI at Vontobel

Early experiments are already bearing fruit, in sometimes surprising ways

For variation margin payments, cash is no longer king

Dealers are being pressed to accept corporate bonds and even equities as collateral for non-cleared trades

Bank of England urged to rethink HHI concentration risk add-on

Experts think overhaul of credit risk measure should be part of PRA’s ongoing Pillar 2 review

BNP Paribas eyes selective algo white label tie-ups

The French bank struck its first FX algo white-labelling partnership with Lloyds

Cboe pushes to harmonise equity options specs

Standardisation of expiry times and dates will boost European markets, exchange exec says

FCMs take wait-and-see approach to digital collateral

“It takes a very brave person to be the first mover,” says David Martin at GH Financial

Bankers feeling even more bullish after tariff selloff

Risk Live: “This is a powerful bull market that has legs to run,” says former Credit Suisse CIO

BoE analysis sparks debate over reuse of repo collateral

Central bank policy analyst contends reuse of collateral may amplify volatility in repo rates

Macro traders tread carefully ahead of tariff pause deadline

Uncertainty has held buy-siders back from both hedging and directional trades

Hedge funds return to HKD carry trade after May stop-outs

Widened interest rate differentials spur investors to re-enter positions, but risks remain

Citi close to launching GenAI investment tools

New tech will be used to improve investment recommendations and increase cross-selling

SEC faces debate over possible cull of cyber security rules

Lobby groups pushing for regulator to roll back disclosures, but investors take a different view

Oxford quantum start-up to offer high-speed arb trading in NYC

OQC to select data centre for super-fast computing in September 2025, plans to launch in 2028

Isda moves to fix outdated CDS obligations list

Updated process would allow for mass updates, reserving legal review for most complex challenges

Are EU banks buying cloud from Lidl’s middle aisle?

As European banks seek to diversify from US cloud hyperscalers, a supermarket group is becoming an unlikely new supplier

Esma sounds out industry for ways to cut reporting burden

Markets watchdog asks consultative groups for ideas to simplify reporting rules

LCH adds China sovereign bonds to collateral pool

Acceptance of euro and dollar debt could be widened to offshore renminbi bonds by year-end

LCH to expand access to FMX futures clearing

Clearing house is awaiting regulatory approval to allow client clearing via FCM affiliates

Academics call for tenfold jump in CCP capital cover

New framework finds mono-layer clearing houses may require biggest skin-in-the-game