GARP

Inside the Fed’s secret liquidity stress tests

Lobbyists and Quarles train sights on horizontal exams that can shape bank risk appetite

New Tradeweb/IBA benchmark tipped as ‘competitor’ to SOFR

Forward-looking risk-free rate aimed at US mortgage market could have broader applications

Moonshots shelved: banks spend on home-working tech

Dealers made success of remote working switch – now they’re investing in its future, and pausing grander ambitions

FX swaps platform aims to cut out the banks – but not entirely

Peer-to-peer newcomer FX HedgePool targets asset managers’ month-end hedging activity

Fed’s approach to stressing op risk frustrates banks

Regulator’s stress test results overshoot banks’ numbers, threatening capital plans

Buy side hopes for best execution reporting carve-out

After EC exempts venues from best execution reporting, Aima hopes RTS 28 reports will be next

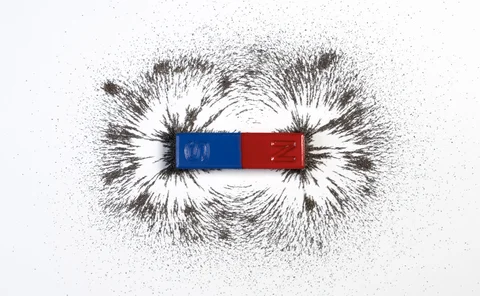

The unintended impact of collateral on financial stability

Initial margin requirements for OTC derivatives can increase risk of contagion, writes economist

Slump in €STR swap volumes at LCH leaves market guessing

Market participants are counting on July 27 discounting switch to revive key euro benchmark

Singapore to end Sibor by 2024

Multi-rate approach ditched after failed efforts to enhance Sibor

Transparency vs clarity: the Mifid swaps conundrum

Participants want better OTC transparency, but say Esma’s efforts at clarity could muddy the picture

Good citizenship can signal better creditworthiness – study

Environmental and social behaviour predicts credit ratings in North America – less so in Europe

Investors rethink ops resilience for a pandemic-proof future

Shift to remote working sees asset managers focus on comms, tech and cyber risks

Clearing banks show they’ve learned lessons of the past

CCP members were able to meet massive margin calls in March. But could they do it again?

EU’s Brexit clearing grab slow to lift off

Clearing members say clients aren’t transferring material volumes from LCH to Eurex rapidly

‘Improving’ Mifid post-trade transparency splits markets

Mooted changes to Europe’s transparency regime are dividing markets – largely along functional lines

SA-CCR adoption may spur wider FX swaps clearing

With up to 90% lower exposures on offer, dealers say capital benefits could outweigh margin costs

Oil funds want to reduce risk. Will investors let them?

Despite posting big losses, funds that track front-month contracts remain popular with investors

Why a European bad bank may not be the right answer

Types of loans most likely to become distressed due to coronavirus don’t suit EU-wide solution

Beware of cliff edge in Libor fallbacks

Derivatives users may see a sudden change in the value of payoffs when Libor ends, Coremont analysts write

Banks eye post-pandemic shake-up of op risk scenarios

Firms seek better handle on impact of global shocks, and hope to avert regulatory attention

Contagion can spread via cross-asset links, ECB study shows

Research throws more light on the hidden risks of central clearing

Firms hone use of new data to pick Covid-19’s winners

Investment managers are starting to use alternative data to assess the pandemic’s effect on individual stocks

European regulator U-turns on synthetic securitisations

Deals with use-it-or-lose-it mechanism can qualify for capital relief, EBA policy expert says

Attention turns to Esma after UK quashes CSDR buy-ins

Esma launched informal review just before UK Treasury opted out of settlement regime