GARP

CDS market mulls settlement options for Russia contracts

Tightened US sanctions threaten CDS default auction, leaving users a choice of imperfect alternatives

Cross-currency’s €STR switch may hasten Euribor demise

Rising cost of issuer cross-currency hedges could spur greater adoption of euro risk-free rate

Back in time: a brief history of LME’s nickel meltdown

As prices went haywire, margin remained frozen and calls to suspend trading were rejected

Buy side looks to cash in on euro swap pricing anomaly

Fixed rates on long-dated €STR swaps now above their Euribor equivalents

How will US regulators perform the Basel III balancing act?

Largest banks seek offsets for higher capital requirements caused by possible end of IRB, IMM

A SwapAgent-bilat basis? Not for now

SA-CCR may make settled-to-market capital benefits more difficult to quantify

Corporates boost FX hedges as US dollar surges

Banks see more business, but also rising exposures, from corporates’ FX decision-making

Standard risk measures low-balled Archegos exposures

When a potential blow-up doesn’t show up, what use are VAR, SA-CCR and stress tests?

FTX’s ‘easy-access’ clearing stokes fears over runaway risk

Crypto exchange will auto-liquidate underwater positions, which critics say could fuel a death spiral in prices

CME to reinforce term SOFR with swap inputs

Inclusion would leapfrog a 25% OTC liquidity threshold embedded in methodology

Prop stop: SEC plan to register prop trading threatens liquidity

Rule change may also be a crypto landgrab by SEC chairman Gensler, critics say

Duck! Buy-side plan to dodge IM rules could backfire

Three-quarters of phase six firms do not expect to exchange margin for at least six months

How to stop stablecoins from hoarding precious collateral

Repo markets expert and crypto bank chief exec think Fed reserves are the right answer

From ‘cottage industry’ to quant-ready: prop data at JP Morgan

Unique information now “table stakes” for brokers as they compete for new clients

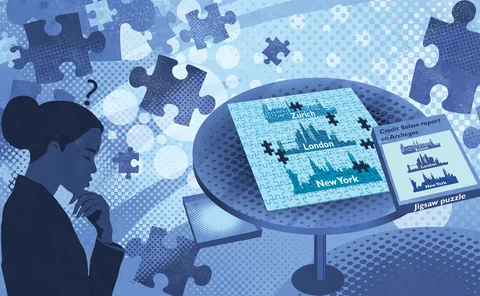

How banks got caught in Archegos’s web of lies

Risk managers quizzed and confronted the firm, but lawsuits claim they were “systematically misled”

Fortunes of VAR: dealers decry effect of war on risk models

European banks with large Russian derivatives exposures face risk of backtesting exceptions – and higher capital requirements

Banks adopt Python for faster XVA data analysis and pricing

Some banks claim the coding language permits XVA pricing in milliseconds

What’s up with the docs? Isda aims to set standard for crypto

Industry body looks to standardise digital derivatives documents, but some wonder if it is best placed to do so

US banks anticipate delay to Basel III implementation

New Fed supervision head expected to align schedule with EU and Japan, but time is tight

Platforms bring structured products to the masses

Simon, Luma and Halo fuel 80% rise in volume of structured investments in US

Archegos revisited: the gaps in Credit Suisse’s story

Ahead of shareholder vote, former execs point to gaps in key report – raising new questions about accountability

Single climate risk metric ‘not realistic’, says Bank of England

Senior official argues banks and investors must weigh up multiple factors when assessing climate risk

SA-CCR hits Citi’s FX forwards pricing

Four clients say US bank has quoted “less competitive” spreads as a result of new capital regime

SEC cyber rule could trigger more attacks, experts warn

Mandatory disclosure of cyber risks and attacks could help hackers