Feature

Top 10 op risks 2020: organisational change

New tech has created perennial state of flux in banking, as other kinds of shake-ups continue

Top 10 op risks 2020: resilience risk

In an entwined financial system, an outage at one bank can reverberate through many more

Top 10 op risks 2020: outsourcing and third-party risk

Respondents worry about risks stemming from an opaque web of vendors with poor controls

All aboard for LNG freight derivatives?

Tools to manage LNG freight risk were developed last year, but how is the market responding?

Treasurers turn to AI in bid for sharper forecasting

Wider automation could usher in future of ‘hands-free hedging’, but obstacles lurk in data standards and sharing

Fund securitisation makes capital vanish – and watchdog growl

Probe into possible “abuses” of CFO structure could hit wider investments, experts say

Prising open the black box of AI

Shapley values, Lime and other tools can help decipher machine learning’s output. It’s a start…

Clearing members in cash clash with Apac CCPs

Banks and clearing houses wrangle over who should pay for losses on invested collateral

Fuzzy data stalls ESG alpha hunt

Quants searching for ESG signals have reached very different conclusions. Mostly they blame the data

The age of ethical investing, but can quants cope?

Systematic managers grapple with ESG demands of clients

BNP leads a comeback for Europe’s clearers

Brexit, leverage ratio tweaks and concentration fears could help European banks compete with US FCMs

Why the numbers don’t add up for post-Libor hedge accounting

Experts raise concerns over IASB’s Phase II plans to move on from Libor

The corporate bond revolution will be streamed

Dealers are piping feeds of live, executable prices direct to select clients

Libor limbo: loan market fallback language upends lenders

Banks seek to replace painful fallback language in loan docs and avoid a cost-of-funds contingency

Frustrated authorities resort to BCBS 239 ‘fire drills’

ECB and Finma lob impromptu data requests at banks, as BCBS 239 quietly permeates everyday supervision

Custody battle: competing tensions put IM prep in jeopardy

Conflicting custody interests and delayed docs call IM phase five readiness into question

Worth the cost? EU rethinks Mifid disclosure rules

Banks would gladly be rid of cost disclosures, but some clients want them improved, not scrapped

Show don’t tell: BoE’s climate stress test dilemma

Making the test easier to run could come at the expense of building risk management capacity

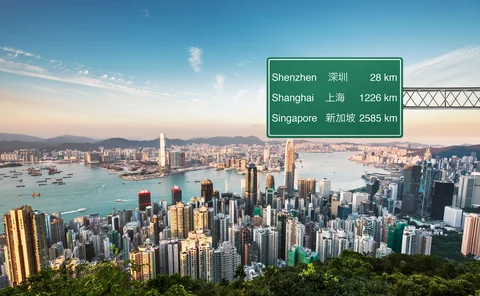

Fund managers look beyond Hong Kong as instability bites

Contingency planning for Hong Kong protests could turn into structural shift for asset management industry

Judgement day looms for dealers in swap shift to Sonia

Regulator pushes Q1 deadline for users to adopt risk-free rate as norm for interdealer trades

Trading venues decry disruptors as MTF battle heats up

Unregulated tech vendors accused of operating as de facto venues; a claim dismissed as “entirely outrageous”

Mifid’s free data mirage vexes markets

Users struggle to access post-trade data despite European regulator’s push for transparency

US sidetracks bid to end European CVA exemption

Fed’s change to SA-CCR capital renews EU industry calls to preserve carve-out