Case Study 1: Applying ESG considerations to a pension fund’s equity portfolios

Jens-Jakob Kratmann Nissen and Christian Kjær

Linking ESG scenarios to real economy outcomes

Analysing ESG policy, market and portfolio construction considerations

Case Study 1: Applying ESG considerations to a pension fund’s equity portfolios

Case Study 2: Applying ESG concepts to wealth management portfolios

Managing environmental and climate transition risks and opportunities within portfolios

Considering physical climate risks and resilience in real asset investment

Case Study 3: Practical issues and considerations for implementing a Net Zero emissions strategy for asset owners

Evaluating social criteria in fundamental and thematic investment portfolios

Case Study 4: Defining impact investing for today‘s ethical investor – evaluating the efforts of Evangelisches Johannesstift

Developing governance and active ownership frameworks for investment analysis

Case Study 5: Applying active ownership and stewardship to a pension fund portfolio

Identifying ESG risks and opportunities in alternative investments

Reviewing the EU regulatory framework for ESG investors

Assessing data and disclosure challenges in ESG investing

Corporate social responsibility across industries: When and who can do well by doing good?

Reflecting on how ESG investing, accounting and governance have evolved over time

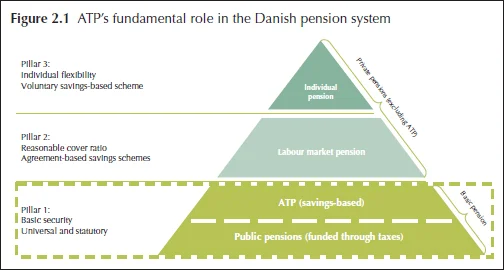

As a public (pillar 1) pension scheme (see Figure 2.1) for almost the entire population of Denmark, acting as good and responsible stewards of our beneficiaries’ asset is our most important task. A central aspect of responsible investing is to deal with ESG aspects of portfolio construction. This chapter will therefore discuss some of the ideas and principles underlying the choices ATP has made for the integration of ESG considerations across all types of investments.

To illustrate, we will use our global smart beta equity portfolio as an example. Our aim here is to summarise how we integrate ESG considerations in the portfolio construction process and analyse their implications.

The chapter is organised as follows. First, we will outline the general guiding principles and investment beliefs underpinning our approach, and resolve the dilemmas that naturally arise in the actual implementation. Second, we will discuss the aspects highlighted above using the smart beta equity portfolio that we manage at ATP. The discussion is broken down into three parts: guiding principles/investment beliefs; integration and active ownership; and the ESG

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net