Energy Risk - Volume8/No1

Articles in this issue

Seeking a boost for crude

Venezuela’s internal conflict and the intended removal of Saddam Hussein from Iraq have meant both countries are seeking deals with international investors to boost oil production. But are the potential legal problems worth the trouble? By Maria Kielmas

Trading with a small ‘t’

What made headlines before is now becoming everyday news: energy companies are scaling back or leaving energy trading. Some industry observers are emphasising the shift to ‘trading around assets’. Anne Ku investigates just what this means

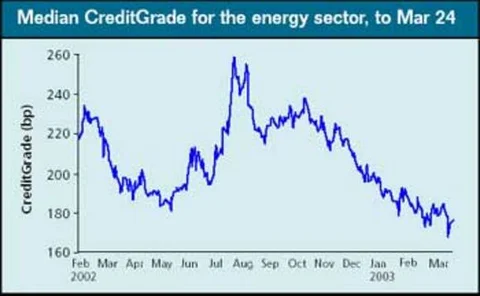

Credit watch

In this month’s analysis of energy firms’ credit quality via Riskmetrics’ CreditGrades tool, Williams and El Paso are among those with tighter spreads

The return of Russian crude

Russia has reclaimed its position as the world’s biggest oil producer for the first time in a decade – but uncertainty is still preventing some foreign oil firms from making the investments the country needs to fulfil its potential. Kevin Foster reports

Optimise this

One of the reactions to recent energy trading difficulties has been a shift away from speculative activities towards portfolio optimisation, but what does the term really mean, ask Tim Essaye and Brett Humphreys

Pumping up prices

Gasoline prices in the US hit all-time highs in March, and the price is expected to remain high throughout the summer. Kevin Foster looks at the contributing factors

Project risk: improving Monte Carlo value-at-risk

Cashflows from projects and other structured deals can be as complicated as we are willing to allow, but the complexities of Monte Carlo project modelling need not complicate value-at-risk calculation. Here, Andrew Klinger imports least-squares valuation…

Models of good behaviour

The development of new models that describe the real dynamics of energy prices have to take into account the behavioural aspects of market players. The problem is how to quantify these aspects. Maria Kielmas reports

Rethinking European power

European energy firms are seeking to reposition their products and strategies in advance of European Union market deregulation. FAME Energy reports

Greening the markets

Environmental risks are increasingly being recognised as important financial issues, but the markets are still some way from rewarding companies for good environmental performance, as Kevin Foster discovers

Pointing the index finger

Concerns over manipulative energy price reporting has led to a call for price index reform. But many market participants are apprehensive about disclosing detailed confidential data to a third party. James Ockenden looks at developments