Energy Risk - Volume2/No10

Articles in this issue

Baiting the hook

End-users such as utilities and industrial companies are not showing the same keenness as hedge funds for trading weather derivatives, despite the efforts of banks, dealers and brokers to lure them in. By Joe Marsh

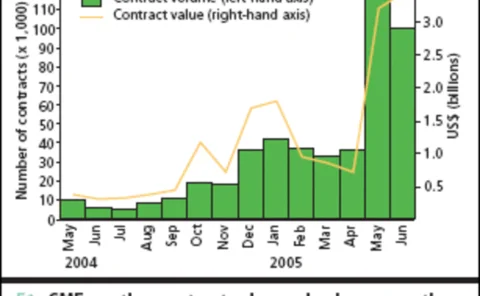

Growing up fast

Weather trading is seeing strong volume growth in the US, largely due to the influx of hedge funds into the market. Why such a big increase in interest, and what sort of strategies are the funds adopting? By Joe Marsh

Pricing the weather

Pricing weather derivatives is different from valuing other derivatives contracts – actuarial methods play a greater role. Steve Jewson looks at the varied approaches available

Strength in numbers

Weather derivatives seem to have a bright future: the market is enjoying record liquidity levels as new players, trading ever more diverse products, flood into the market. Oliver Holtaway reports

Editor

"Although end-users seem slow to enter the weather space, hedge funds already see it as a hotspot"

Blowing hot and cold

Across Europe, government enthusiasm and support for wind energy will dictate the ability for wind project sponsors to refinance project loans via the bond market. Jan Willem Plantagie of Standard & Poor’s explains

Making an impact

It can affect as much as 20% of the US economy, and nearly every industry worldwide is affected by it. But blaming poor results on the weather is no longer an excuse: weather derivatives are on the rise. Eric Fishhaut reports from Chicago on the growth…

Great expectations?

Risk and expectation are two sides of the same coin. But could you quantify your own risk appetite? explores some ways to put a price tag on those hazards you can’t avoid Neil Palmer

Weatherproofing the VAR

The weather derivatives market shares some similarities with other markets, but applying existing models can sometimes have disastrous results. Brett Humphreys and Eric Raleigh discuss how weather derivatives differ from financial derivatives and how we…

Growing up fast

Weather trading is seeing strong volume growth in the US, largely due to the influx of hedge funds into the market. Why such a big increase in interest, and what sort of strategies are the funds adopting? By Joe Marsh

Pipelines and politics

The latest in a long line of disputes over natural gas supplies from Russia is raising concern among utility customers and investors that future supplies to the West may be disrupted. But is this a long-term problem? Oliver Holtaway reports

The energy equation

Quantitative analysis in the energy industry is undergoing a crucial transition as it moves out of the role of secondary support to sit at the heart of business decision-making. Stella Farrington looks at its advance

Chris Bowden

With energy prices skyrocketing, risk management is now a necessity, not an option, says energy risk pioneer Chris Bowden . By Stella Farrington

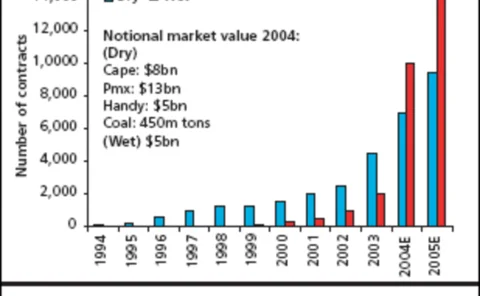

Delivering the goods

There’s huge scope for growth in the freight derivatives market, but to attract more players, existing participants need to adopt more innovative and sophisticated trading practices, participants say. Stella Farrington reports