Securitisation

On the crest of a wave

Corporate bond volumes have been soaring as companies scramble to meet their funding requirements in the wake of the loan market's demise. Simon Boughey looks at whether this wave of issuance is a temporary phenomenon or whether it heralds a permanent…

The price is right

Consensus on the input assumptions that financial institutions use to value structured finance securities is crucial if the market is to reach a universally agreed method of pricing these impaired assets. By Peter Jones of Standard & Poor's

Stopping the rot

Noises from leading banks that they may be returning to profitability are failing to mask the painful truth that vast quantities of toxic assets are still causing a stink on banks' balance sheets. Credit looks at the various plans being put forward to…

Talf requests plunge $3bn to $1.7bn in latest funding round

Demand for loans under the US Treasury's Term Asset-Backed Securities Loan Facility (Talf) has dropped precipitously since the scheme opened in March.

Time for Talf

Since its emergence in the 1970s, securitisation has provided a vital source of funding for the US economy. But with a large part of the market effectively closed since the second half of 2008, the government is pinning its hopes on the Term Asset-Backed…

Banks suffer from stricter ratings criteria

Banks may be the latest victims of a continuing drive by rating agencies to impose harsher tests on highly-rated structured finance products, analysts said.

Moody's: FGIC unable to meet payments

Moody's has warned that monoline insurer FGIC might not be able to meet its payments on the subprime-linked assets it has insured.

Market frustrated by lack of detail on US toxic-asset purchase plan

Economists and analysts have criticised the US Treasury's updated toxic-asset purchase plan for again failing to provide the granular detail or specified launch date necessary to reassure capital markets the proposals will indeed help curb the global…

Treasury launches Talf, drops compensation caps

The US Treasury and Federal Reserve Bank of New York launched the Term Asset-Backed Securities Loan Facility (Talf) yesterday, but opted to remove restrictions on executive remuneration for participating institutions.

ASF 2009 highlights challenges for securitisation market

The annual conference for securitisation professionals, held in Las Vegas, showed that the industry is under no illusions about the difficulties it is currently going through, but that there is a collective will to turn the situation round. Mark Kahn of…

ASF 2009 highlights challenges for securitisation market

The annual conference for securitisation professionals, held in Las Vegas, showed that the industry is under no illusions about the difficulties it is currently going through, but that there is a collective will to turn the situation round. Mark Kahn of…

Swap shop

The International Swaps and Derivatives Association, under its chief executive Bob Pickel (right), is the trade body for dealers of, amongst other things, credit derivatives. As such, Pickel and his members are at the centre of a storm raging around the…

Rick Watson

Securitisation has been damned as the carrier that took the subprime contagion to institutions across the world, but the head of the European Securitisation Forum insists that the real economy needs this funding source more than ever. Matthew Attwood…

Q&A: Dottie Cunningham

The CEO of the Commercial Mortgage Securities Association talks about the likely effect of the TALF scheme on the CMBS market

Long overdue

New due diligence and risk weighting guidance for resecuritisations aims to prevent a repeat of the credit crisis, but should these measures have been included in the 2006 version of Basel II? By Peter Madigan

Q4 loss of Sfr8.1 billion for UBS

Swiss banking giant UBS reported a fourth quarter net loss of Sfr8.1 billion ($7 billion), bringing its full-year net losses to Sfr19.7 billion. The bank also revealed $16.4 billion of illiquid credit assets had been transferred to the Swiss National…

Canadian ABCP restructuring finally complete

After 17 months of delays, the saga surrounding the restructuring of C$32 billion ($26.1 billion) of distressed Canadian non-bank asset-backed commercial paper (ABCP) has finally drawn to a close.

Legal Spotlight

The ECB has set minimum standards that ABS must meet if issuers are to use the securities as repo-eligible funding. Angus Duncan assesses the impact of these new rules on existing ABS

ABS collateral pools to deteriorate in 2009

Two largest rating agencies predict global economic slowdown will hit loans underlying most asset-backed securities, with consumer loans in UK, Ireland and Spain worst affected

The repo effect

The ability of banks to use securitisation deals as collateral for repo funding from central banks has resulted in larger deals with more esoteric assets. Laurence Neville looks at how this change is affecting the securitisation market as a whole

Q&A: David Pagliaro & Peter Jones

Two S&P executives explain how the rating agency's ABSXchange platform for structured products and the VSS valuations service benefit investors in today's unpredictable markets

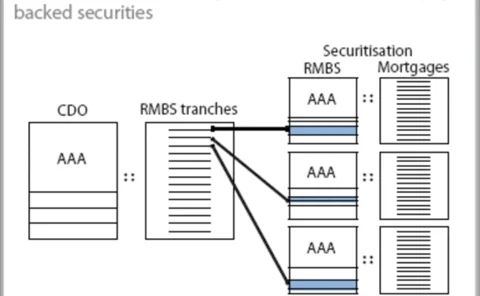

Guilty or not?

Rating agencies have been widely criticised for assigning AAA ratings to securitisations backed by subprime mortgages. Ashish Dev and Bo Qian argue that while the criticism is justified for some securitisation structures, there was a basis for assigning…