Credit markets

Linear, yet attractive, Contour

Technical

Bondholders rights: the gloves are off

Restructuring

Job moves

QUOTE OF THE MONTH: - “The FSA has successfully put the fear of God into senior managers” Simon Gleeson, a partner in the regulatory group at Allen & Overy in London, on the FSA’s new unlimited liability rules for risk management errors Source: RiskNews,…

Fallout for energy markets

Enron’s collapse led to short-lived increases in electricity and natural gas volatility. As the markets settle down, the question now is who will fill Enron’s shoes? By Kevin Foster

Software survey 2002 |

Some online risk management products failed to live up to expectations last year, but software vendors forge ahead, developing products that support fast-growing markets such as credit derivatives and CDOs, and tools to help banks meet Basel II…

Enron collapse a test, not threat, to credit market

Enron’s bankruptcy may be the biggest test of the credit derivatives market to date. But when the dust settles, its most profound effect may be on credit investors’ preference for managed portfolio transactions. Rob Dwyer reports

Is there hope in the advanced measurement approaches?

Basel II is mistaken in assuming a stable relationship between expected and unexpected losses, argues Jacques Pézier in his second article on the Basel Committee’s recent operational risk working paper.

A spanner in the works

The US and Germany are in a standoff over Basel II’s capital charge calculation for SME lending. Without a compromise this month, the issue threatens to derail implementation of the Accord and the European Directive.

Mezz funds facing supply scramble

Mezzanine

Down but not out

High yield poll

Risk measurement under the spotlight

Portfolio management

Is there hope in the advanced measurement approaches?

BASLE II UPDATE

Indosuez in equity derivatives reorganisation

Credit Agricole Indosuez’s equity arm, CAI Equities, plans to introduce a single trading platform as part of its plans to integrate its global trading and derivatives operations. As a result, the firm's WI Carr Securities Asian derivatives team will…

ING Barings debuts with synthetic CDO in Asia

ING Barings, the investment banking arm of Dutch bancassurer ING, has arranged what it claims to be the first arbitrage synthetic collateralised debt obligation (CDO) transaction managed by a portfolio manager in Asia, in an attempt to cater to the…

Basic shortcomings

The Basel regulators have missed their chances with their latest op risk paper, argues Jacques Pézier.

Basic shortcomings

BASLE II UPDATE

BNP Paribas launches first leveraged funds CDO

The leveraged funds group at French banking group BNP Paribas has launched its first collateralised debt obligation (CDO) fund focusing exclusively on Western European Leverage Buy-outs (LBOs), in a bid to strengthen its asset management business.

Cat bond activity set for ‘dramatic’ rise, claims Stonberg

The large pay-out expected by the reinsurance industry following the terrorist attacks of September 11, combined with a recent trend towards more capitalised investment banking firms, could stimulate a “dramatic increase” in the growth of the catastrophe…

S&P offers CDO manager ratings on the Web

International debt rating agency Standard & Poor’s (S&P) has begun offering evaluations of collateralised debt obligations(CDOs) managers for free on its website. While the move appears timely given the current turbulent environment for non-investment…

S&P moves to rate hedge fund of funds

International rating agency Standard & Poor’s (S&P) has started to develop ratings criteria for securitisations of hedge fund of funds, due to growing interest in the past year from structured finance teams at investment banks.

Basel inflicts collateral damage

The current Basel proposals could lead to the global spread of the type of systemic loan loss problems Japan is now experiencing, argues John Frye of the Federal Reserve Bank of Chicago.

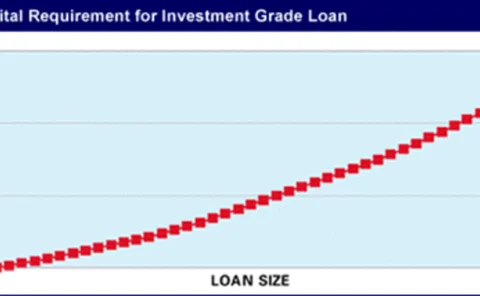

Pro-cyclicality in the new Basel Accord

Could Basel II worsen recessions? By backtesting the proposed capital rules to the last recession, D. Wilson Ervin and Tom Wilde argue that the increased risk sensitivity of loan portfolio regulatory capital in the new Accord could have unwelcome…

A healthy exposure

Credit derivatives

Credit is the key in Asia

Comment