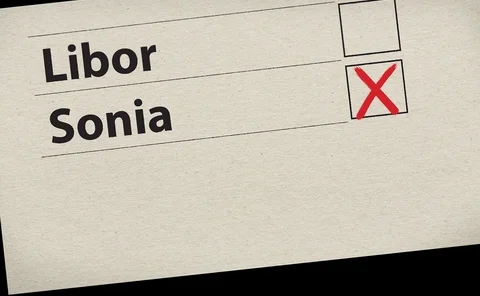

Libor Risk – Quarterly report Q1 2020

Bankers may be looking back with fondness to more normal times, when the biggest problem they faced was how to prise trillions of financial contracts away from Libor. Now, when they’re fighting a full-blown financial meltdown from makeshift offices at their own kitchen tables, Libor transition might be starting to look like run-of-the-mill stuff.

Regulators want to detach the market from Libor before the end of 2021, when panel banks will be free to stop supporting the rate and it could vanish. An array of deadlines for re-hitching segments of the market to overnight risk-free rates were already a tall order. Since coronavirus panic sent stocks, bonds and oil prices tumbling – and tested business continuity plans in all manner of new ways – the timetable is beginning to look impossible.

Regulators may have to accept Libor transition will be slower than they hoped. But the final framework may yet be more robust as a result. Knowing how rates perform in times of stress will be crucial to the success of benchmarks intended for real economy use, and there’s been no bigger stress test for rates markets than that seen in March.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

BoE to publish ‘golden source’ compounded Sonia index in July

UK to align with US in effort eliminate interest calculation mismatches and turbo-charge adoption

First SOFR versus CORRA cross-currency swap hits market

JP Morgan and National Bank of Canada extend SOFR cross-currency trading into Canadian market

SOFR discounting – Analysing the market impact

The switch to secured overnight financing rate (SOFR) discounting brings several complex issues and is impacting market practices. Ping Sun, senior vice‑president of financial engineering at Numerix, discusses the key issues, such as the differences…

FCA: sign up to fallback protocol or face ‘serious questions’

UK regulator urges derivatives users to accept Isda swap fallbacks to ensure compliance with benchmark law

Operational uncertainty – An unavoidable challenge

The transition from Libor to a new risk-free rate has revealed a number of challenges for all financial markets participants – the nature and scope of what lies ahead is vast, impacting businesses, operations and support functions. KPMG‘s global Libor…

Synthetic Libor faces legal obstacles

EU benchmark rules may thwart ‘tough legacy’ fix, reviving calls for blanket legislation

Signing the Libor fallback protocol: a cautionary tale

As Orwell’s Room 101 beckons for Libor publication, muRisQ Advisory’s Marc Henrard warns of a potential pitfall in the fallback protocol

Why the numbers don’t add up for post-Libor hedge accounting

Experts raise concerns over IASB’s Phase II plans to move on from Libor

Managing the cost of transition and the risk of delay

A forum of industry leaders, which includes sponsors of this report, discusses key industry concerns around the transition away from Libor, including the risks investors will face once the rate is discontinued and how to manage them, whether forward…

Secrets and Libor fallbacks

Lenders may be forced to reveal sensitive funding data when Libor disappears

Libor limbo: loan market fallback language upends lenders

Banks seek to replace painful fallback language in loan docs and avoid a cost-of-funds contingency

Judgement day looms for dealers in swap shift to Sonia

Regulator pushes Q1 deadline for users to adopt risk-free rate as norm for interdealer trades