Risk Appetite Setting and Modelling Conduct Risk

Introduction

An Overview of Conduct Risk

How Does Conduct Risk Manifest and What Are Its Root Causes?

What Are the Driving Forces of and Who Owns Conduct Risk?

Scope and Ownership within the Business

Conduct Risk in Financial Services: Lessons from the Hospitality and Leisure Industry

Ethical Culture: What, Why and How?

Language and Conduct Risk: Limited Language – Big Blind Spots

An Anthropological Perspective on Conduct Risk

Identifying and Measuring Conduct Risk

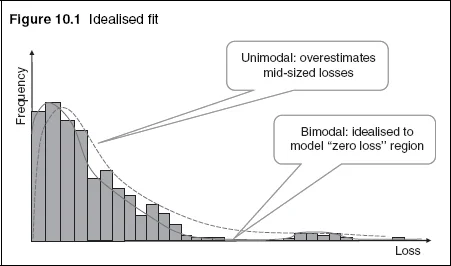

Risk Appetite Setting and Modelling Conduct Risk

The Effect of Conduct Risk Losses on Reputation

Bringing the Customer Back to the Foreground: The End of Conduct Risk?

Managing Conduct Risk

Closing Comments on the Future of Conduct Risk

81 percent of firms remain unclear about what it [conduct risk] is and how to deal with it.

This somewhat surprising statement, reported in Thomson Reuters (2015), might cause very severe problems indeed for modelling. Perhaps the statement should be rephrased as “81 percent of firms disagree on what conduct risk is precisely”. In that case, it is easy to state that particular aspects of conduct risk cause problems for the modelling process. In this chapter we examine the origins of those problems, and propose a solution.

As a general guideline, Thomson Reuters (2013) lists, presumably according to the remaining 19%, the principal components of conduct risk. In terms of frequency of response, the most significant five are (in decreasing order of frequency):

-

- culture;

- corporate governance;

- conflicts of interest;

- reputation;

- sales practices.

Of these, all except “reputation” have a bearing on the modelling process. The way they affect models will be discussed in the next section (see Characteristics of Conduct Risk Losses). How conduct affects reputation is the subject of Chapter 11.

What is a conduct risk model?

I

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net