Environment-Renewables

UK to set up information clearing house for disaster recovery

WORLD TRADE CENTER AFTERMATH

Round-up of recent publications

RECENT BOOKS

The vanilla explosion

Business in three- to five-year vanilla default swaps now accounts for around a third of the market’s total notional outstandings. With many dealers reporting twofold or more growth in volumes, the credit derivatives market is now in full stride.

The missing piece

Thailand

Basel shortcomings: Danger lurks on the rocky road to Basel II

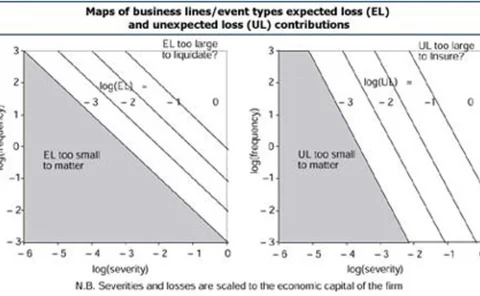

The Basel Accord proposals to define operational risk contain many fatal flaws, says Jacques Pézier. He argues that it would be better to focus management time on managing key risks than on developing op risk databases and measurement procedures.

2002 the year ahead

Market overview

Utilities: Enron’s ripple effect

Cover story

Job moves

QUOTE OF THE MONTH: - “The FSA has successfully put the fear of God into senior managers” Simon Gleeson, a partner in the regulatory group at Allen & Overy in London, on the FSA’s new unlimited liability rules for risk management errors Source: RiskNews,…

Brokers allocate $4.6 million WTC disaster relief

The world’s seven leading interdealer brokers have determined which charity funds will receive the $4.6 million they raised as disaster relief for victims of the World Trade Center terrorist attacks on September 11.

Icap loses head of weather

Dan Tomlinson, head of weather derivatives at Icap, has left the London-based inter-dealer broker and joined WeatherXchange, a joint initiative between the UK’s Meteorological Office and Umbrella Brokers.

Japan's non-performing loans undermining economy

Tokyo could be in danger of losing its standing as a top financial centre, unless efforts are made to restructure the economy and cure Japanese banks' vast non-performing loans problem, warned Bank of Japan official Hiroshi Nakaso, speaking at Risk…

Adorning Asia’s markets

Interbank derivatives survey 2001

Basic shortcomings

The Basel regulators have missed their chances with their latest op risk paper, argues Jacques Pézier.

Basic shortcomings

BASLE II UPDATE

Preparing for the worst

Small and medium-sized banks in the US and Europe are bracing themselves for Basel II. Gallagher Polyn examines how these institutions plan to adapt to the new Accord.

The second annual Asia Risk Awards

Awards 2001

A credit conundrum

Credit risk

Banking on progress

Technology

Disaster recovery experts get firms up and running

WORLD TRADE CENTER AFTERMATH

We remember our colleagues and friends

WE REMEMBER OUR COLLEAGUES AND FRIENDS

Attacks on US demonstrate extremes of operational risk

FRONT PAGE NEWS

Rating agencies to keep an eye on the banking sector

The world’s three key rating agencies have released statements about the possible repercussions on the banking sector of last week’s tragic attacks in New York. Moody’s said it is not contemplating any immediate rating downgrades for European banks…