Asia Risk - Feb 2019

In this issue: banks go their own way with e-trading; IMO 2020 to affect shipping firms; MUFG’s Matsuura on Tonar; and more

Articles in this issue

China sees slowdown in structured deposit volumes

Easing of restrictions on wealth management products tips market away from structured deposits

Brexit threatens to reopen Asian bail-in clauses for EU banks

EU27 dealers had used English law contracts for Asian counterparties to comply with BRRD

Isda seeks consensus on CDS clean-up

Credit definitions amendments expected in Q1 to stamp out manipulated triggers

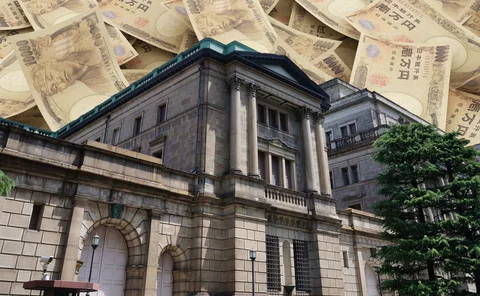

Fallback decision will lift yen OIS, says Japan RFR group chair

Move should kick-start dormant Tonar OIS market – key requirement to building a term rate

Asia moves: Nomura boosts Asia ex-Japan, Bank of America picks two Apac co-heads, and more

Latest job changes across industry

Non-netting status denies capital boost for Chinese banks

Reliable close-out netting could cut China’s SA-CCR capital requirements by around 20%

Natixis’s €260m hit blamed on big books and Kospi3 product

Rivals say French dealer grew business too quickly – with leveraged version of Korean index one source of pain

Q&A: Japan RFR group head on term rates and Tonar liquidity

MUFG’s Matsuura discusses term benchmark options, cross-currency swaps and Tibor’s future

How quants at Value Partners pick Macau’s casino winners

Hotel data on ‘high rollers’ helps group make casino investment calls, as quant influence grows

A threat to the Ion throne?

Banks need connections to e-trading venues; they don’t want the other services that come with them

AIIB risk chief on steering China’s World Bank rival

Martin Kimmig on the Asian Infrastructure Investment Bank’s challenge of overcoming patchy credit data

Shipping and energy firms revisit hedging on IMO 2020

Upcoming shipping rules set to impact fuel prices across the energy complex

You don’t need to sacrifice accuracy for flexibility

BAML quant proposes option pricing model that softens conflict between the two properties

Local stochastic volatility: shaken, not stirred

Dominique Bang introduces a novel LSV approach to term distribution modelling