Technical paper/Risk management/Risk management

Rating properties and their implications for Basel II capital

Internal ratings

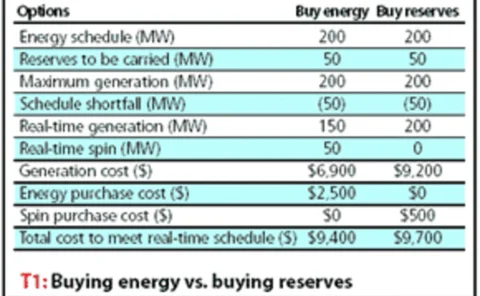

Real-time trading

Rankings 2005

Understanding variations in the risk of multi-strategy portfolios

Investors spend a great deal of time and effort setting a thoughtful risk budget for their portfolio,only to see all too frequently that the targeted risk will be missed by a wide margin when theinvestment process gets started. In this article, Gang…

Estimating default correlations using a reduced-form model

Credit risk : Cuttingedge

Caring competition

What are the theoretical consequences of restructuring electricity markets on emissions? Here, Benoît Sévi shows that changes in supply and consumption and restructuring for competition has environmental effects, and argues that strong public policies…

Maximum likelihood estimate of default correlations

Estimating asset correlations is difficult in practice since there is little available data andmany parameters have to be found. Paul Demey, Jean-Frédéric Jouanin, Céline Roget andThierry Roncalli present a tractable version of the multi-factor Merton…

Mixed default modelling

Structural and reduced-form models are two well-established approaches to modelling afirm’s default risk. Here, Li Chen, Damir Filipovic/ and Vincent Poor develop a new default riskmodelling strategy based on combining these two frameworks in order to…

Premier Fund Managers

Quant analysis by StructuredRetailProducts.com

Counting on foreign cash

foreign investment

Maximum drawdown

The maximum loss from a market peak to a market nadir, commonly called the maximum drawdown (MDD), measures how sustained one’s losses can be. Malik Magdon-Ismail and Amir Atiya present analytical results relating the MDD to the mean return and the…

A credit loss control variable

Viktor Tchistiakov, Jeroen de Smet and Peter-Paul Hoogbruin explain and demonstrate how the efficiency of Monte Carlo simulation in valuing a portfolio of credit risky exposures is improved by the use of the Vasicek distribution as a control variable. An…

Estimating economic capital allocations for market and credit risk

Value-at-Risk (VAR) measures often are used as a basis for setting so-called"economic capital" or buffer stock measures of equity capitalization requirements.VAR measures do not account for the time value of money or theequilibrium required return…

Quantifying operational risk

This is the fifth of Charles Smithson's latest series of Class Notes, which will run in alternate issues of Risk through to the end of 2004. Class Notes is an educational series, designed to pull together the threads of recent developments and thinking…

A credit loss control variable

Viktor Tchistiakov, Jeroen de Smet and Peter-Paul Hoogbruin explain and demonstrate how the efficiency of Monte Carlo simulation in valuing a portfolio of credit risky exposures is improved by the use of the Vasicek distribution as a control variable. An…

Correlated defaults: let's go back to the data

Estimates of asset value correlation are a key element of Merton-style credit portfoliomodels. Many practitioners have access to asset value data for a large universe of listedfirms, so estimation is within reach. Alan Pitts describes a statistical…

Covering all the bases

Natural Gas

Correlated defaults: let’s go back to the data

Estimates of asset value correlation are a key element of Merton-style credit portfolio models. Many practitioners have access to asset value data for a large universe of listed firms, so estimation is within reach. Alan Pitts describes a statistical…

Time to adapt copula methods for modelling credit risk correlation

In an evolving market, a new standard for the price quotation of credit products that models correlated changes in credit spreads as well as default times is needed, argues Darrell Duffie.