Technology

Banks urged to track vendor AI use, before it’s too late

Veteran third-party risk manager says contract terms and exit plans are crucial safeguards

JP Morgan, Eurex push for DLT-driven collateral management

The high-stakes project could be a litmus test for the use of blockchain technology in the capital markets

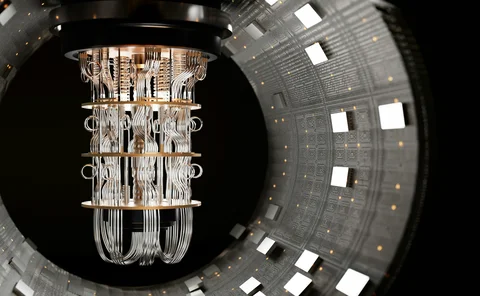

Start planning for post-quantum risks now

Next-gen quantum computers will require all financial firms to replace the cryptography that underpins cyber defences, writes fintech expert

Researchers, quants, strats – AI is coming for you

Survey IDs roles to be most impacted by front-office AI, but experts say many will change, not disappear

For AI’s magic hammer, every problem becomes a nail

Risk.net survey finds banks embracing a twin-track approach to AI in the front office: productivity tools today; transformation tomorrow

How Citi moved GenAI from firm-wide ban to internal roll-out

Bank adopted three specific inward-facing use cases with a unified framework behind them

Technology risk management: detection to protection

From simple risk detection to comprehensive protection by expanding your vision, capabilities and influence

Technology risk management: detection to protection

From simple risk detection to comprehensive protection by expanding your vision, capabilities and influence

How a serverless risk engine transformed a digital bank

Migrating to the cloud permitted scalability, faster model updates and a better team structure

Osttra to launch Treasury clearing middleware

Mid-year delivery expected for system that aids credit checking for repo trades

Bloomberg offers auto-RFQ chat feed – but banks want a bigger prize

Traders hope for unfettered access to IB chat so they can build their own AI-enhanced trading tools

Amazon, Meta and Tesla reject FX hedging

Risk.net study shows tech giants don’t hedge day-to-day exposures

SGX suffered five-hour op failure from CrowdStrike outage

First major service disruption at CCP’s Central Depository service in nine years

The path to operational resilience begins with reliability and risk management

The challenges Apac financial services firms face enhancing operational resilience and leveraging data and hybrid cloud

Revolutionising compliance: next-gen technology for new-age regulation

A whitepaper exploring prevailing compliance challenges and the implications of regulatory changes on data and reporting technology

Revolutionising compliance: next-gen technology for new-age regulation

This white paper explores prevailing compliance challenges and the implications of regulatory changes on data and reporting technology, and outlines the opportunities these changes present for financial institutions.

As supplier risk grows, banks check their third-party guest lists

Dora forces rethink of KRI and appetite frameworks amid reappraisal of what constitutes a key counterparty

Public enemy number one: the threat to information security

Nearly half of domestic and regional banks report risk appetite breaches amid heightened sense of insecurity

Elevating risk management to a strategic partner in investment decision-making

Based on insights from a Risk.net webinar sponsored by S&P Global Market Intelligence, this article explores how risk management is evolving from a compliance role to a strategic partner.

LSEG shelves replatforming project for FX Matching venues

After EBS migration, dealers had little appetite for another major technology project

Too ’Berg to fail? What October’s Instant Bloomberg outage means for the industry

The ubiquitous communications platform is vital for traders around the globe, especially in fixed income and exotic derivatives. When it fails, the disruption can be great

Best use of machine learning/AI: CompatibL

CompatibL won Best use of machine learning/AI at the 2025 Risk Markets Technology Awards for its use of LLMs for automated trade entry, redefining speed and reliability in what-if analytics

Markets Technology Awards 2025 winners’ review

Vendors jockeying for position in this year’s MTAs, as banks and regulators take aim at counterparty blind spots

Rising star in quant finance: Milena Vuletić

Risk Awards 2025: Machine learning-based volatility model confounds sceptics