Tail risk

Investors turn to costly ‘all weather’ hedging strategies

Geopolitical and technology risks spur demand for multi-strategy QIS tail hedges

Asymptotic behavior of systemic risk based on the higher-moment capital allocation

Forecasting extreme tail risk in China’s banking sector: an approach based on a component generalized autoregressive conditional heteroscedasticity and mixed data sampling model and extreme value theory

Barclays braces for a macro storm

Risk measures associated with insurance losses in Ghana

The authors investigate VaR and TVaR comprehensive motor insurance claims paid by an insurance company in Ghana and compare the estimates obtained by these risk measures.

Podcast: Fabrizio Anfuso on computing for Archegos-like event exposures

BoE quant discusses top-down counterparty risk framework using Gaussian distributions and copulae

The WWR in the tail: a Monte Carlo framework for CCR stress testing

A methodology to compute stressed exposures based on a Gaussian copula and mixture distributions is introduced

A tale of two tail risks

This paper investigates the relationship between banking credit risk and the financial market jump hazard rate, finding the two risks to have opposing behaviors.

Are investors betting on Kamala or Donald? Neither

Hedge funds and others shun election-based trades and rely on existing hedges to guard against surprise market moves

Inside Nomura’s European equities rebuild

Talking Heads: Global chief Simon Yates also addresses US crowding and Japan’s prospects post-carry trade

The unknown risk on the flip side of the basis trade

US mutual funds have amassed record notionals in Treasury futures that in some cases exceed their AUM

Extremiles, quantiles and expectiles in the tails

The author investigates quantiles, expectiles and extremiles in tail estimators for linear regression.

Roll up for the BoE’s counterparty mystery tour

Letter warns of cross-currency repo risks, but they didn’t feature in Archegos or LDI blow-ups

Research on the premium for the joint lower-tail risk of liquidity and investor sentiment

The authors put forward the concept of the joint lower-tail risk of liquidity and investor sentiment and investigate the issue of lower-tail risk premiums in the Chinese stock market.

EU banks balk at new market risk models back test

EBA proposals introduce additional expected shortfall back test for market capital risk models under FRTB

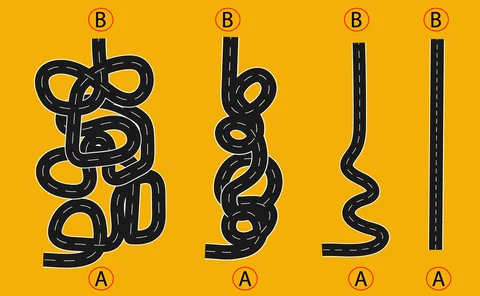

‘Guys far more experienced than me didn’t really know what risk was’

A flawed understanding of risk has made markets fragile, says Convex Strategies CIO David Dredge

Real-time repo needed for non-stop trading – DRW’s Wilson

Isda AGM: Veteran trader warns of “ugly tail risks” if market plumbing is not upgraded

Fat tails and optimal LDI portfolios

A portfolio optimisation technique for pension funds and insurance portfolios is presented

VAR tail grew fatter at Bank of America in 2022

Gap between 95% and 99% confidence levels widens to 10-year record

Measuring tail operational risk in univariate and multivariate models with extreme losses

The authors consider operational risk models and derive limit behaviors for the value-at-risk and conditional tail expectation of aggregate operational risks in such models.

Rifts widen across EU banks’ trading results

Largest fair-value hits from HFT assets moved further from median in H1

Modeling maxima with a regime-switching Fréchet model

The authors identify a regime-switching Fréchet model which can be used to identify the behavior of extreme values in financial series.

Assessing systemic fragility: a probabilistic perspective

Using new measure of systemic fragility, the author ranks euro area banks and sovereigns and according to their systemic risk contribution.

Keep risk parity simple, stupid

In times of volatility, simpler risk parity strategies may outperform more elaborate counterparts