Swaps

CFTC approves start-up SDR ahead of US reporting overhaul

KOR Financial expects 30–50% cost savings as participants prepare to adopt US rule rehash

It’s complicated: why backtesting is so challenging, but so important

Hiroshi Tanase, executive director of product analysis and design at S&P Global Market Intelligence, explores why, with the implementation of phase five of uncleared margin rules (UMR) last September and with the phase six roll-out just around the corner…

Citi’s share of cleared swaps hits new high

Latest quarterly increase, alongside that of Goldman Sachs, bucks trend across top US banks

Time’s up for UK banks to unwind swaps with VTB

Majority of contracts have been terminated, but laggards face prospect of default

US funds continue expansion of sold CDS protection

Counterparty Radar: Pimco leads charge with $57 billion in total sold positions

US rate caps under strain amid volatility surge

Market uncertainty hits liquidity in options on swaps, dealers say

Barclays, HSBC held $12trn of Libor swaps on eve of cessation

Both banks made significant progress over 2021, but more remains to be done

‘Dead’ derivatives market leaves big Russia dealers unhedged

VTB and Sberbank face directional exposure to local corporates after mass unwinds by foreign banks

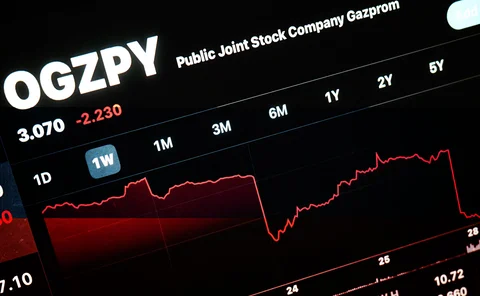

Credit default swaps on Russian companies face uncertain future

With CDS auctions on sanctioned companies unlikely, traders may have to rely on dealer estimates

EC ignores pleas to extend clearing consultation deadline

Despite industry appeals for more time on EU-wide clearing consultation, EC refuses an extension

Market begs EC for more time to mull euro clearing proposals

Firms given one month to respond on wide-ranging consultation around relocation of euro swaps

Boost for deal contingent hedging as M&As face waiting game

With M&As subject to regulatory delays, banks see renewed demand for deal contingent hedging

Legacy Libor swaptions face day of reckoning

Holders of physically settled swaptions in sterling and yen must switch to new risk-free rates, but it’s not simple

GM Financial’s derivatives fall 72% in value in 2021

A steeper forward interest rate curve paired with an appreciating dollar erased most of the gains booked by the carmaker’s lending arm in 2020

SOFR swaps surge past $1 trillion weekly

OIS make up the majority of SOFR-referencing swaps

Dealers slam alternative for Tibor Tokyo swap rate

Refinitiv activates synthetic version, but TSR’s cessation is on hold pending further consultation

Client margin at Credit Suisse down over $10bn last year

Bank's US clearing units slashed required funds for swaps and F&O

Market halts clearing shift to Eurex ahead of EU consultation

Participants hit ‘pause’ after proposed three-year equivalence extension for UK clearing houses

CFTC delays rewritten swaps reporting rules after industry plea

Firms still face multiple rounds of compliance to implement UPI and ISO standards

Pimco’s Brazilian real deal swells its swaps portfolio

Counterparty Radar: Bond investor held an 83% market share of BRL swaps traded with mutual funds at Q3 2021

Libor’s death propels SOFR swaps market

Trading in the risk-free rate jumped to a weekly high and long-dated swaps activity grew

Credit Suisse’s US clearing unit cuts client margin by over 40%

Required segregated customer funds for swaps, futures and options down sharply since Archegos default

Looking ahead to the post-Libor landscape

Libor’s days are coming to an end, so what does the future hold? A Risk.net expert panel discusses the original dream of a multi-benchmark world, and whether it is still alive

Counterparties clash over ‘dirty’ CSAs

Dealers and clients struggle to agree optionality value of posting bonds in cash-and-bond CSAs after Eonia conversion