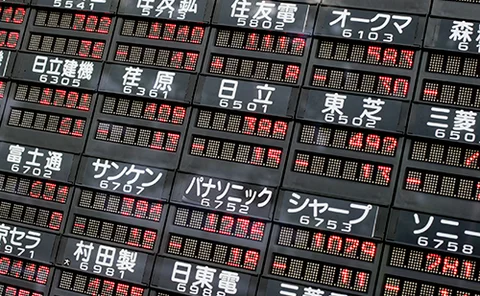

Nikkei

Inside Nomura’s European equities rebuild

Talking Heads: Global chief Simon Yates also addresses US crowding and Japan’s prospects post-carry trade

Berkshire Hathaway outruns index puts it sold pre-GFC

Options that netted Warren Buffett’s company hefty premiums would be worthless at end-2021 market levels

House of the year, Japan: Barclays

Asia Risk Awards 2021

Regulators should set ‘guidelines’ for CCP margins – Kemp

Citi’s former clearing head says CCPs are still competing on margin

TSE outage throws structured notes into tailspin

Trading shutdown on October 1 disrupted observation dates for some structured products

Asia CCPs forced to hike margins rapidly during equities rout

Margins for Nikkei 225 futures more than doubled at JSCC in a matter of days

Autocalls hit peak vega, where hedging costs mount

Eurostoxx and Nikkei losses flip structured product dealers into painful short vol territory

Autocall dealers wary of Nikkei volatility surge

Dealers caught in danger zone as losses lurk on upside and downside spikes

Nikkei faces hurdles in EU benchmark registration

Brexit confusion forces Japan index provider to look beyond UK

JP exec calls for derivatives margin changes

Move follows 13 significant margin breaches in 2018, with one breaching by as much as 245%

Nikkei sell-off puts Japanese autocall dealers on alert

Risk recycling may backfire if index slump continues

How Asia’s structured products dodged equities sell-off

Dealers deserve praise for improved structures, greater diversification and better risk transfer

Market mayhem hurts relative-value vol trades

Losses estimated at close to $500 million as US index volatility spikes

Asian administrators in denial on EU benchmarks regulation

Non-EU benchmarks have until 2020 to comply, but swaps contracts may need to change immediately

Traders blame short gamma positions for Nikkei vol jump

Uridashis, macro positioning and ETFs behind record 23% rise in volatility on November 9

Deal of the year: Credit Suisse

Addition of knock-outs to corridor variance swaps keeps investors happy and helps with risk recycling

SGX to charge negative interest to clearing members

Excess euro and yen cash deposits expected to generate 20–40bp charge

Japan equity derivatives trading stalls on Nikkei 15-year high

Abenomics had driven a surge in Japan equity derivatives activity, but now cash investors dominate

BNPP makes first big options trade on Nikkei 400 index

Hedging remains an issue until futures are launched in November

Nikkei 400 index tipped to become Japan equity derivative benchmark

Cash business likely to stay with Nikkei 225 but derivative trades may shift

Plunging Nikkei brings $40m vega losses to Japan dealers

Losses manageable now but if the Nikkei goes under 13,000, "there will be panic"