Monetary policy

Winds of change 2026: managing opportunities

Shifts in monetary and fiscal policy are reshaping fixed income markets

Central bank watch: Measured moves

Franklin Templeton analysts assess the monetary policy outlook for the G10 central banks, and China, India and South Korea

The investors who aren’t fretting over Trump’s stat sulk

Some see dismissal of statistics agency chief as an assault on US institutional integrity; for others it offers a chance to throw off outdated methods

Elizabeth McCaul on supervision, new macrodynamics and investing in suptech

Former ECB Supervisory Board member speaks about the Covid-19 and Credit Suisse shocks, regulation debates, the rise of non-banks and what makes tech projects succeed

Central bank watch: Biased to ease, for now

A mid-year review of the monetary policy outlook for G10 central banks, India, China and South Korea

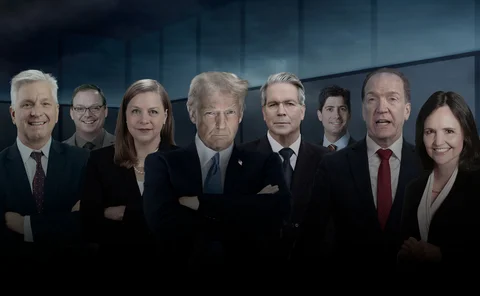

Fed succession planning: will Trump stick to the script?

The race to succeed Jerome Powell as head of the world’s most powerful central bank has already begun

BoE analysis sparks debate over reuse of repo collateral

Central bank policy analyst contends reuse of collateral may amplify volatility in repo rates

‘This is not a wobble’: Brunello Rosa on the path to de-dollarisation

Digital currencies will play a central role as China challenges US hegemony, says economist

2025 capital market expectations: slowing but not sinking

Monetary policy is the governor of the relationship between growth and inflation

Canada benchmark shaken by T+1 hedge fund influx

Shortened settlement cycle swept hedge fund trades into Corra, making the rate more volatile

US MMF investments near $7trn amid short-term yield chasing

Surging inflows led some managers to turn to Fed’s RRP facility for risk-free cash allocation

The market liquidity of interest rate swaps

The authors investigate dynamics and drivers of market liquidity in Euribor interest rate swaps, constructing seven liquidity swaps using data from centrally cleared trades.

Four US MMF managers return to Fed repos in May

Fidelity and American Funds among managers opting to increase investments in RRP

How steepener trades burned hedge funds, and what happened next

Delays to central bank rate cuts torpedo popular trade, causing funds to pull capital – to the chagrin of sell-side desks

How Argentina’s financial tango could become a dance of death

Central bank and government’s unholy alliance is storing up further trouble for economy

Cecilia Skingsley on monetary policy tech and a unified ledger

BIS Innovation Hub head discusses tokenisation, CBDCs and AI’s ‘black box problem’

Benchmark switch leaves hedging headache for Philippine banks

If interest rates are cut before new benchmark docs are ready, banks face possible NII squeeze

‘Brace, brace’: quants say soft landing is unlikely

Investors should prepare for sticky inflation and volatile asset prices as central banks grapple with turning rates cycle

TLTRO hedge unwinding bill tops €1.2bn at BNPP, SocGen

Exit from swaps tripped up by ECB’s tightening marred banks’ 2023 throughout

Anticipating Fed cuts, Huntington drops $15.5bn of pay-fixed swaptions

Bank terminates costly hedging strategy merely a quarter after upping notional values by a third

Deposit repricing shifts Zions’ IRR outlook

The bank reckons high pass-through of Fed hikes means its rate-shock exposure is lower than under standard modelling