Margin

Dollar funding squeeze eases after March madness

Fed action helps restore equilibrium, leaving fears of quarter-end crunch unfounded

Sluggish back-office systems added to margin pressures

Systems supplied by FIS struggled to handle massive spike in March trading volumes

Asia CCPs forced to hike margins rapidly during equities rout

Margins for Nikkei 225 futures more than doubled at JSCC in a matter of days

Coronavirus rout revives attacks on futures margining

FCMs call for permanently higher margins following “unprecedented” number of breaches

Banks rail against China CCPs’ loss-sharing policy

Controversial loss allocation technique remains unused during recent market routs, but banks want it banned

Systemic US banks shed more than $7trn of non-cleared swaps in 2019

Cleared notionals stay flat on the year

India preps margin regime as parliament debates netting law

Lawmakers thrash out bill on close-out netting; margin rules likely to follow in H1

Oil price shock triggers big margin calls

Banks and exchanges worked through weekend in anticipation of oil collapse

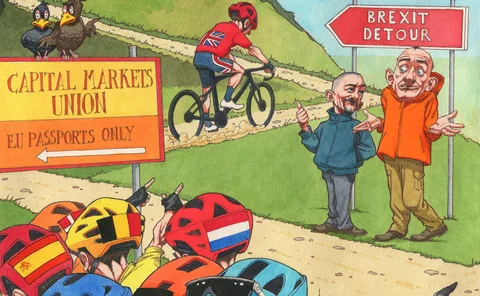

The UK’s path to EU equivalence: détente or detour?

Race to meet post-Brexit cross-border trading requirements will go down to the wire

Citi shed over $32bn of counterparty exposures in Q4

Risk-weighted assets for CCR exposures dropped -12%

FCMs clamour for formal rule on separate account margin

Costly compliance effort will be to no avail if CFTC relief expires in June 2021

EU banks rue SA-CCR mismatch with US

European clearers are stuck with CEM until 2021, but some US banks are reluctant to switch early

Margin exchange threshold relief: get out of jail free?

‘Game-changing’ IM exchange threshold relief may not be the phase five free pass it first appears

EU bank clients pressed for better trade terms in 2019

Hedge funds saw price and non-price conditions tighten in Q4

Eurex members divided over liquidity risk charges

Banks say proposed charge too conservative, debate whether add-on should be charged directly to clients

Custody battle: competing tensions put IM prep in jeopardy

Conflicting custody interests and delayed docs call IM phase five readiness into question

At CCPs, sovereign bonds are top IM collateral

Government debt makes up 48% of IM on average among top clearing houses

On eve of Brexit, PPF’s chief risk officer isn’t too worried

Stephen Wilcox talks about getting pensions paid without the benefit of controlling ‘UK Plc’

At CME, required IM up 18% in Q3

Surge follows busy August and September for the swaps clearing business

SwapClear model update causes IM hike

Maximum aggregate IM call for Q3 was £3.7 billion

Margin test, open access, repo stress

The week on Risk.net, December 14–20, 2019

US firms must rerun non-cleared margin test in March

Proposed CFTC calculation delay offers in-scope firms chance to trade out of phase five compliance

Smarter trading in a fragmented world

FX Week recently hosted a webinar in partnership with Refinitiv to ask foreign exchange industry leaders to discuss geopolitical challenges, market changes and developments, and evolving technologies, and how they have shaped forex markets in Asia

Coping with uncleared margin rules – the tricks, traps and tools

A unique insight on the evolving UMR strategies of 110 banks and buy‑side firms