Margin models

Commodities threaten pain for initial margins

Market volatility and spot-based Simm approach may drive large margin spikes in little-tested asset class

SwapClear incurs record number of margin breaches

LCH’s interest rate derivatives clearing service reported over 4,000 backtesting exceptions in Q1

BoE: regulators could push CCPs to publish margin shocks

Russia-Ukraine war has forced a tenfold margin funding burden, says BNP; Ice says smaller hedgers face disenfranchisement

Procyclicality of central counterparty margin models: systemic problems need systemic approaches

In this paper the author argues that the focus on initial margin models is misplaced, and the reasons for this are illustrated by empirically testing the performance of standard initial margin models during the March 2020 events.

Back in time: a brief history of LME’s nickel meltdown

As prices went haywire, margin remained frozen and calls to suspend trading were rejected

Collateral resilience is more than just understanding initial margin

New regulations and extreme global events are seeing initial margin (IM) requirements rise in prominence, with investment managers needing to focus on more than just their regulatory and operational compliance

Banks, CCPs protest Esma’s ‘prescriptive’ procyclicality rules

Dealers welcome model transparency push, but call for greater say on methods to combat spikes

Don’t impose blanket margin model rules, say BoE advisers

Focus instead on outcomes and costs and factor in different clearing membership, say Murphy and Vause

At LCH, required IM rose over Q3

Required minimum demanded of clients increased at ForexClear, RepoClear and EquityClear, but fell at SwapClear

EU’s IM model validation rules may put Simm in jeopardy

Draft RTS creates validation hurdles and cross-border conflicts, industry warns

CME delays Span 2 rollout till at least mid-2022

FCMs ask bourse to postpone long-planned switch to new VAR model to allow more time for testing

UMR efficiency: optimising systems and processes for IM compliance

UMR are among the biggest collateral management issues faced by investors in over-the-counter (OTC) derivatives. At a specially convened session sponsored by IHS Markit at Risk.net’s Buy-Side Risk Global event, panellists discussed the latest phases of…

FICC calls for rehypothecation relief to scale US Treasuries clearing

Current prohibition on margin re-use penalises sponsored clearing of cash instruments

Procyclicality control in risk-based margin models

This paper revisits the procyclicality issue in risk-based margin models and provides additional insight on procyclicality mitigation techniques.

CME targets year-end rollout of new margin model

Clearing house testing new Span 2 framework with members, more work needed with vendors

JSCC issued $2.8bn VM call on a clearing member in Q1

The call was for a participant in the CCP’s clearing services that cover IRS, CDS and exchange-traded financial products

Delays to IM model approvals causing ‘anxiety’ for MetLife

Isda AGM: US insurer says regulators unprepared to accept docs where model approval is obligatory

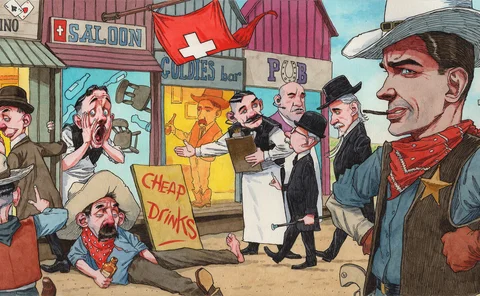

Credit Suisse and the Wild West of synthetic prime brokerage

Industry insiders describe a frontier business with few rules – and plenty of questionable practices

JSCC incurred 311 IM breaches in 2020

IRS service experienced the largest breach last year

LCH SA skin in the game fell in Q4

In contrast, pre-funded clearing member contributions to the default funds increased 10% to €6.1 billion

One FICC member paid record $102bn to cover dues in Q4

Previous highest payment obligation of a single participant was $77 billion in size

Initial margin at Ice CCPs surged over 2020

Required IM at Ice Clear US increased 42% year on year

IM at LCH Ltd fell to post-Covid low in Q4

Required IM for SwapClear dropped to £149.5 billion, down 3% quarter on quarter

Initial margin at the OCC topped $100bn in Q4

Exchange-traded derivatives hub cleared 7.5 billion contracts in 2020