Index options

Growth in China snowball lookalikes sparks questions

New products include tweaks to sidestep restrictions, but some believe they don’t go far enough

Calamos’s $200m inflows trigger autocall ETF ‘frenzy’

First mover expands to US tech, Innovator ETFs plans rival listing on September 25

Hybrids go for gold

Spot gold surge sees investors eye dual digitals on new highs

More than arb: the short signals behind Jane Street’s India troubles

Prop trader ran parallel strategies, source says. That mix may have given rise to manipulation claims

Sebi unravels Jane Street’s ‘sinister’ trades

US trading firm barred from Indian securities market after “disregarding” February warnings

Did tariff rout expose ‘autocallification’ in US dividend futures?

Bank of America cites curve flattening and beta surge as evidence of autocall hedging

QIS 3.0 ‘bonanza’: hedge funds pivot from options to swaps

Pod-level scramble for max-loss exposure gives way to central risk books seeking overlays

AI and Trump tariffs spur hyped-up dispersion trade

Popular vol strategy pays off in January despite highest entry costs on record

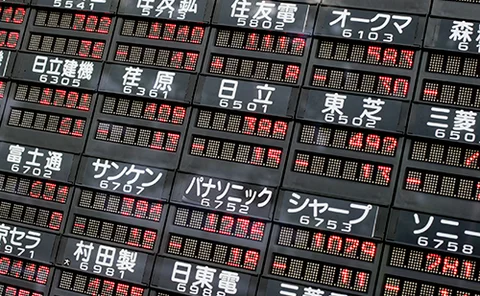

Autocall curbs hit long-dated Nikkei and HSCEI options

Collapsing Asia structured products inventory saps market-makers of long-dated vol supply

Reverse dispersion gains traction as implied spread jumps

Inverted strategy on Euro Stoxx 50 gains popularity for profit-taking and correlation play

Traders dredge 0DTE data for intraday gamma insights

Firms such as UBS, BofA and OptionMetrics are investing in continuous net options position monitoring

Long gamma puts brakes on post-election US stock rally

Call selling by ETFs helped fuel largest net gamma positioning among dealers since July

Pre-market trades blamed for record Vix surge

Traders rushed to cover short vol positions before the market opened on August 5

After the selloff, competing theories on dealer gamma

Tier1 Alpha sees $74 billion short gamma catalyst; SG says rapid return to positive territory had calming effect

Vega peak was foothill in historic Nikkei selloff

JFSA scrutiny has curbed issuance of autocallables, so stock plunge generated light re-hedging

Continued decline of the one-stop shop

Dealer Rankings 2024: Only two banks make the top 10 across all rankings tables – others have focused on vertical dominance

Often fluid. Not always liquid

Dealer Rankings 2024: On the buy side and the sell side, the make-up and depth of OTC mini-markets can change rapidly

SG trader dismissals shine spotlight on intraday limit controls

Risk experts say many banks rely on daily reports and can’t effectively monitor intraday limits in real time

‘Fear gauge’ within expectations, some say

Several options specialists dismiss claims that structured products are distorting the Vix

Zero-day hedging takes root in new asset classes

Option users move beyond equity indexes in search of cheaper, sharper hedging tools

Professional investors behind ‘witching day’ options spike

Study says retail investors are the losers from anomaly that costs more than $3.8 billion