Expected loss

Unexpected recovery risk

For credit portfolio managers, the priority is to properly incorporate recovery rates into existingmodels. Here, Michael Pykhtin improves upon earlier approaches, allowing recovery rates todepend on the idiosyncratic part of a borrower's asset return, in…

ANPR maps out US differences on Basel II implementation for banks

WASHINGTON, DC - US regulators are determined to go their own way when it comes to implementing Basel II, according to the government's ANPR, published in mid-July.

Unexpected recovery risk

For credit portfolio managers, the priority is to properly incorporate recovery rates into existing models. Here, Michael Pykhtin improves upon earlier approaches, allowing recovery rates to depend on the idiosyncratic part of a borrower’s asset return,…

Niche lenders brace for Basel

Banks with niche lending businesses are scrambling to assemble enough data to allow them to benefit from Basel II's most advantageous capital provisions. Gallagher Polyn reports on one successful initiative.

QIS 3 suggests Basel II op risk charges and insurance role

BASEL - The third Basel II quantitative impact study, or QIS 3, brings bankers up to date with the latest thinking of global banking regulators on the treatment of operational risk under the complex Basel II bank protective capital accord.

Credit risk measurement of securitisation structures

Peter-Paul Hoogbruin, Harmenjan Sijtsma and Viktor Tchistiakov of ING Group Credit Risk Management present a framework for valuing securitisation tranches from an investor’s perspective.

Calculating portfolio loss

For credit portfolios, analytical methods work best for tail risk, while Monte Carlo is used to model expected loss. However, products such as CDOs require a model for the entire distribution. Sandro Merino and Mark Nyfeler meet the challenge by…

Basel regulators hope for SME solution by mid-June

Global banking regulators said in late April they were optimistic they could resolve by mid-June the vexed question of the treatment of lending to small to medium-sized enterprises (SMEs) under the Basel II bank capital adequacy accord.

Credit risk in asset securitisations: an analytical model

How much capital should banks reserve against investments in portfolio securitisations? Asserting that recent proposals on this subject by Basel are inconsistent, Michael Pykhtin and Ashish Dev propose a new analytical model suitable for tranches of…

Basel II - Rules and Models

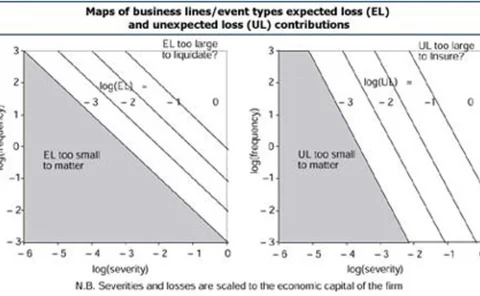

The proposed operational risk charge remains one of the most contentious areas of the new Basel Accord. Carol Alexander reviews the current proposals in the context of various simple models, and argues that practical implementation will require the use…

In search of clarity and focus

Greater precision is needed in defining operational risk, but the Basle regulators' latest thoughts are lost in generalities, says Jacques Pézier, in the final article of a three-part series.

Basel shortcomings: Danger lurks on the rocky road to Basel II

The Basel Accord proposals to define operational risk contain many fatal flaws, says Jacques Pézier. He argues that it would be better to focus management time on managing key risks than on developing op risk databases and measurement procedures.

A major improvement

In May, David Rowe wrote that the Basel Committee ‘could do better’ with respect to the inclusion of operational risk in the capital Accord. Here, he says the working paper the committee published in late September outlines a major and valuable…

Basel inflicts collateral damage

The current Basel proposals could lead to the global spread of the type of systemic loan loss problems Japan is now experiencing, argues John Frye of the Federal Reserve Bank of Chicago.

The shifting sands of Basel II

Four months after the Basel Committee on Banking Supervision closed the consultation period on its January 2001 draft for a new international capital Accord, it has already made major amendments to its proposal.

Advanced measurement approaches

The September working paper on operational risk from the Basel Committee on Banking Supervision confirmed that global banking regulators are looking at a range of advanced ways of calculating op risk capital charges instead of a single method.

Could do better

David Rowe argues that the Basel Committee can provide better incentives for improved operational risk management than those implicit in the draft revision to the capital Accord.

Basel’s flawed paradigm

David Rowe suggests some important tweaks to the new Basel Capital Accord, if it is not to be viewed as reflecting an obsolete definition of capital adequacy.

EU anticipates critics in its Op Risk charge proposals

While debates still rumble on over the new Basel capital accord, the European Union Commission's capital adequacy rules are prompting another set of arguments.