Economic value of equity (EVE)

Why banks don’t believe each other’s IRRBB models

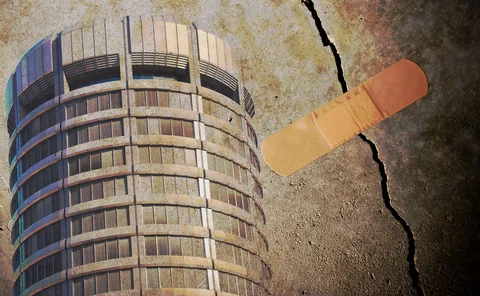

Regulatory outlier test results prompt mutual suspicion of unrealistic deposit assumptions

Was a big US bank close to collapse in 2023?

PNC’s Bill Demchak says it was. And the data suggests he was talking about BofA

Two years after SVB, EVE transparency remains sluggish

Only three US banks began publishing EVE figures since 2023

Seeking muted rate sensitivity, NYCB scraps all IR hedges

IRRBB simulations show sizeable income drain from lower rates, despite bank claiming rate neutrality

Progress on US banks’ EVE transparency grinds to a halt

No additional disclosures of key metric linked to SVB collapse in latest round of public filings

The boy who cried ‘outlier’: false alarms could dog EBA test

Analysis reveals banks deemed outliers by net income test are profitable post-shock, so how useful is the test?

EU banks hedge net interest income to pass new IRRBB test

Would-be outliers look to cut sensitivity of cashflows to rate moves, but at what cost?

Banks cry foul over shock decision from Basel Committee

Asset and liability management professionals question severity of criteria in revised IRRBB tests

Shocks to the system: how Basel IRRBB update affects new EU test

Disclosures suggest more banks will be classified as outliers on net interest income assessment

Seven banks under SEC scrutiny over interest rate risk disclosures

Regulator-issued letters aim at boosting transparency on EVE and NII sensitivity

The American way: a stress-test substitute for Basel’s IRRBB?

Bankers divided over new CCAR scenario designed to bridge supervisory gap exposed by SVB failure

US banks’ IRRBB transparency: one step forward, two steps back

A year on from the 2023 crisis, more lenders monitor EVE sensitivity, but full Basel-like disclosures remain the exception

Basel’s cherry-picking toughens IRRBB shock scenarios

European banks want higher outlier thresholds to offset higher confidence level in new standard

Review of 2023: a hard road to a soft landing

Banks and regulators were caught in the crosswinds of the fight against inflation

Commerzbank’s rate-shock loss sensitivity rises 33%

Bank’s liabilities modelled to reprice faster than assets in a 200bp parallel hike scenario

EC to adopt NII outlier test within ‘weeks’

New IRRBB rules could come into force in early 2024; industry hoping EBA draft is softened

Filling the gaps in Basel’s interest rate risk measures

Reverse stress-testing or VAR may work better than existing outlier tests, but are hard to manage

Zions model change reverses positive EVE projections

Estimated impact of interest rate shocks up to 17.7pp higher under adjusted assumptions

Regulators’ remorse: SVB and the case for IRRBB capital charges

Basel Committee chair among those who say Pillar 1 capital requirement could have helped control SVB risks

Basel’s IRRBB shock scenario update hit by US crisis

Recalibration of shocks had been touted for Q3, but wider rethink may now cause delay

Western Alliance’s rate-risk gauge breaches internal guidance

EVE depletion for 100bp and 200bp hike scenarios highest disclosed by any US regional bank