Credit rating agencies

Large banks safer for CCPs than they get credit for

Plentiful pre-positioned liquidity softens the blow of resolution, new research argues

NAIC softens its rating overhaul. Insurers still don’t like it

Insurers worry that the regulatory body could override credit ratings without sufficient explanation

An NAIC plan to second-guess bond ratings is ‘nonsensical’, insurers say

Proposal to create “quasi rating agency” at regulatory body sparks backlash from industry and US Congress

EBA: more climate risk supervisory reporting is coming

Official anticipates effort to identify climate impact on internal models, concentration risk

UK pension funds rush to dirty CSAs

Fearing margin pain once BoE gilt-buying ends, funds fast-track revisions to post gilts and corporate bonds

Calls grow for more oversight of ESG ratings

Current metrics are too fragmented and should have regulatory oversight, panel argues

Ethical ratings stir debate over saints and sinners

Asset manager Aegon hits out at “flawed” ESG ratings methodologies

SOFR, credit quality and scenario construction

The week on Risk.net, June 13-19, 2020

Scared of fallen angels? So are the rating agencies

Data shows rating agencies more reluctant to downgrade firms at the investment-grade boundary

For ESG raters, clearer skies still signal stasis

As Covid-19 tamps down environmental risk, rating agencies are unmoving on ESG scoring

Left out of Fed action, lower-rated CMBS overheat

BBB yield-to-worst spirals as highly-rated bonds recover after central bank and government intervention

Index delays leave passive bond funds in purgatory

Moves to postpone index rebalancings could backfire as rating agencies press ahead with downgrades

ESG investing: It’s not just great to be good

Investing according to environmental, social and governance (ESG) criteria can be done in various ways, with continuing development of filters and ways of analysing companies. As the market in ESG indexes and investments linked to sustainability matures,…

S&P resists mapping new China onshore ratings to global scale

Uncertainty over state support and accounting prompts agency to keep Chinese ratings separate

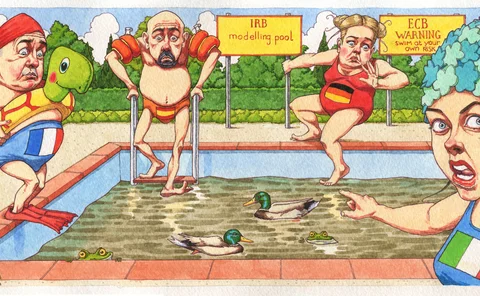

Pooled resources offer way to keep credit models afloat

Supervisors drive banks to seek more corporate default data and cost-effective model improvements

The DIY approach to China bond investing

Lack of international ratings means foreign investors will need research resources of their own

Rating aggregation flawed, but better than nothing, researchers say

New research finds errors still substantial even after combining ratings

Banks reject Basel’s IRB data shortage claim

Internal models remain more accurate than standardised approaches, say industry responses

ABN Amro cuts rates swaps from €24bn covered bond programme

High cost of downgrade triggers forces Dutch bank to use alternative hedge

Mixed industry reaction to Moody’s CCP ratings

Clearing members say narrow definition of default may limit ratings’ usefulness