Clearing members

Duffie: SEC plan heralds all-to-all Treasuries trading

Former Fed adviser welcomes long-advocated Treasuries clearing mandate

Eurex liquidity pool jumps 39% as required IM rises

Members of the IRS clearing unit saw the largest increase of required margin in Q2

IM at three LCH clearing units rose in Q2

Increase in clearing volumes pushed collateral up at EquityClear, RepoClear and SwapClear

Ice Credit’s required initial margin up 18% in Q2

CCP reported highest level on record, superseding Covid-19-induced peak

Liquidity risk up 138% at Eurex in Q2

CCP revised estimated worst-case payment obligation to highest level on record

Banks face capital hit on broader energy market collateral

Non-standard clearing house margin for energy trades would increase RWAs unless relief granted

European pension funds must start clearing next year – EC

Exemption preventing pension funds from mandatory clearing will come to an end permanently in June 2023

CFTC backs banks in tussle over clearing house governance

CME and Ice will need to pay more attention to clearing members on risk committees

Peak IM call at OCC jumps 38% in Q2

Outsized equity price moves behind third-largest IM call on record

Bypassing consent may aid CCP porting – report

CPMI-Iosco report says clearing houses cannot reasonably accommodate client preference; brokers favour rule book harmony

Interest rate vol triggered three breaches at CME in Q2

CCP’s interest rate swaps clearing unit reported its first initial margin shortfalls since Q3 2020

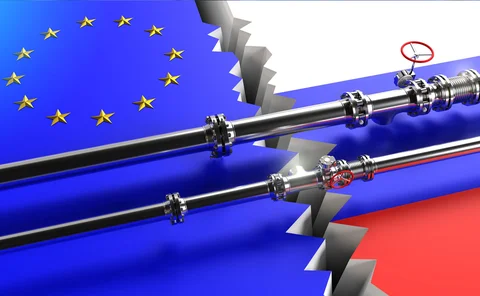

Esma to meet with clearing industry over EU energy crisis

Widening eligible collateral on table; ECB intervention would need government indemnities

JSCC’s bond and IRS units hit by almost 200 breaches

Q2 volatility triggered some of the largest initial margin breaches ever reported by the CCP

LME member default fund contribution jumps 89%

Following record-breaking margin breach in Q1, the CCP plumped up its line of defence

Banks shock commodities by 1,000% in stress-test rethink

Energy price spikes force clearing firms to consider extreme or even ‘implausible’ scenarios

Esma warns new foreign clearing house rules could backfire

Löber says euro swaps trading may move away from CCPs that face toughest EU scrutiny

Can the EC reach consensus in clearing countdown?

Brussels faces a cold, hard deadline to build clearing regulation accord in Europe

FCMs brace for ‘tough winter’ of energy market disruption

Banks stress-test clients, add big margin multipliers to insulate against risk of 100% price moves

Share of required margin increases at top EU CCP members

Number of clearing members with total requirements of €10bn and above has been increasing since 2017

At JSCC, required initial margin up 20% in Q1

The bulk of the increase came from members of the clearing service covering ETPs

Initial margin at Ice Europe up 15% over Q1

IM held against F&O positions hit all-time high, as number of margin breaches nudged higher

Eurex’s fixed income and IRS units hit by almost 700 breaches

Peak breaches in Q1 were €706 million and €214 million in size, respectively

BoE: regulators could push CCPs to publish margin shocks

Russia-Ukraine war has forced a tenfold margin funding burden, says BNP; Ice says smaller hedgers face disenfranchisement

Clearing industry braces for volatility ‘super-cycle’

Green transition may fuel higher cash demands and more risk events, FCMs warn