Chinese renminbi (RMB)

RMB is gaining traction with corporates, Deutsche survey finds

Smaller companies can realise savings of nearly 5% when dealing with Chinese businesses by transacting in renminbi, says Deutsche Bank

Hong Kong Exchange announces trading of deliverable US dollar/renminbi futures

HKEx broadens type of RMB derivatives available to the market

Renminbi liberalisation opens up hedging opportunities

Liberal measures

China prepares for automated renminbi trade settlement

Rise of the redback

Index roundup

Index roundup

Offshore renminbi bond market to take off in 2012

A maturing market combined with deregulation is sustaining demand for offshore renminbi bonds in the face of slowing RMB appreciation

Investors seek alternative forex hedges for euro crisis

Australian dollar, renminbi and CE3 currencies touted as alternative macro hedges for European debt woes

FX Week China: CNH/CNY forward divergence threat has stabilised

A reversal of the spread between offshore deliverable forwards and onshore NDFs that caused pain for speculators last year is unlikely to recur, say economists

HKMA offers banks RMB repo facility

RMB repo facility established as part of continuing process to internationalise currency and deepen RMB markets

HKMA focuses on offshore renminbi: Norman Chan interview

Proximity and tradeflows have seen Hong Kong emerge as the default centre for offshore renminbi trading. Norman Chan, chief executive of the Hong Kong Monetary Authority, explains how his organisation aims to facilitate the market’s further development

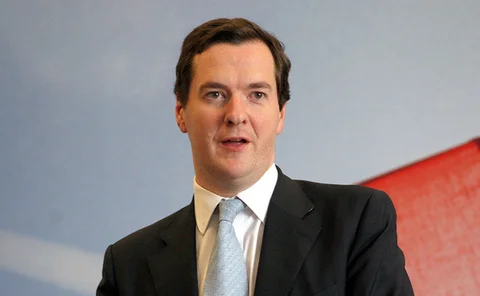

UK financial chiefs throw weight behind London’s RMB initiative

London will become the next offshore centre for RMB trading, vows UK chancellor George Osborne, supported by banking heads from Bank of China, Barclays, Deutsche Bank, HSBC and Standard Chartered

Bank of Korea to invest in renminbi in 2012

Head of reserve management Heung Sik Choo confirms Bank of Korea will make first investments in Chinese renminbi this year

China raises QFII quota by $50bn to $80bn

Chinese authorities more than double the investment quota available to approved foreign institutional investors wanting to invest directly into China’s restricted financial markets

LatAm corporates eye China for bonds and swaps

Latin lessons

China prepares for launch of cross-border ETF market

In the tightly regulated Chinese economy, the launch of ETFs linked to overseas shares marks a new form of investment vehicle available to mainland investors. However, challenges still remain due to structural differences in Chinese manufactured ETFs

Hong Kong retail investors look to ELIs for their yield needs

Retail investors in Hong Kong are favouring equity-linked investments on the back of more stringent regulatory requirements for structured products. At the same time, the appetite for foreign exchange-linked products – most of which escape the new rules …

HSBC appoints new head of European credit trading

Asif Godall to replace Paul Gooding, who will lead HSBC’s offshore RMB venture in London

HKEx mulls launching RMB commodities exchange

Potential first RMB commodities exchange to be launched in Hong Kong

Lack of long-dated instruments hampering offshore RMB market

A strong demand for long-dated offshore RMB instruments is not being met by the market, according to one Hong Kong corporate

Markets braced for tough 2012 in FX

Market participants share their expectations for a challenging year ahead in the foreign exchange industry

Video: Schroders HK chief bullish on development of offshore RMB bond market

Lieven Debruyne, chief executive of Schroder Investment Management (Hong Kong), is eyeing up opportunities in the dim sum bond market

Index roundup

Index roundup

Asia Risk Congress 2011: Offshore renminbi bonds held back by illiquidity in longer tenors

Investors and issuers remain concerned about China's capital account liberalisation programme, and their ability to hedge longer-term risk