Bonds

Bond investors look to convertibles to enhance portfolio returns

The change to convertibles

GAM Star Emerging Market Rates: GAM

Eleventh European Performance Awards 2011

EU support for naked CDS sets up collision with Parliament

Draft text would allow uncovered CDS but sketches out new reporting regime that could spook hedge funds

Senegal $500m 10-year bond spread tightening shows appeal of Africa debt

Yield on new 2021 Senegal bond tightens over 100bp after issue; investors suggest there is room for further tightening

Investors more pessimistic on global growth, according to BAML fund manager survey

Investors' expectations of global growth have dipped, according to a Bank of America Merrill Lynch survey of fund managers

FRN issuance on the rise, as investors go on defensive

An increase in floating rate issuance may be the start of a prolonged trend, as investors look for protection against possible interest rate hikes

Bondholder haircuts back on the agenda as Greece nears default

Despite previous announcements by European authorities that haircuts would not be imposed on investors in restructurings involving Eurozone sovereigns and banks before 2013, with each passing month that promise seems unlikely to be kept

CIBC plucks Banjo from Knight Capital

CIBC plucks Banjo from Knight Capital

High yield and emerging markets still attractive: Paul Griffiths interview

Q&A: Paul Griffiths

Multiple default threat for Indian foreign currency convertible bonds

Crunch time for convertibles

Russian Railways sterling bond issue garners strong investor support

Deals in Focus: Russian Railways

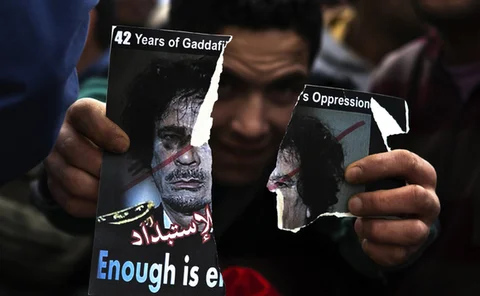

Middle East unrest raises risk of credit market volatility

Arabian fights

Credit investors still seeking emerging market exposure – JPM AM’s Robert Michele

In conversation with...Robert Michele

Thai linker issue pushed back to end of June

Mandate may be awarded to mix of foreign and local banks, PDMO official says

Deutsche Bank and PowerShares list first ETNs linked to foreign sovereign bond futures

Deutsche Bank and PowerShares list first ETNs linked to foreign sovereign bond futures

Prolonged Middle East conflict could hit broader markets, say bond investors

With anti-establishment protests sweeping across the borders of Middle Eastern countries, the financial markets are holding their breath in anticipation of the final outcome

Nomura launches India Local Government Bond index

The India Local Government Bond index is a tracking tool that investors can replicate in order to generate higher portfolio returns from liquid bonds.

Looking East for salvation

Looking East for salvation

US still shows no signs of addressing debt mountain

America’s balancing act

Bail-in proposals are not necessarily bad for investors – M&G

Bondholders: Time to take your medicine

RBC gets new European credit trading head

Ian Pearce leaves UBS after 10 years to take up new role with Canadian bank.

Get back into risky assets this year, says BNP Paribas

Get back into risky assets this year, says BNP Paribas

EU €5bn bond cheers fixed income investors

Deals in Focus: €5bn EU bond

Michael Hasenstab interview: the benefits of investing outside the benchmark

In conversation with...Michael Hasenstab