Bilateral trade

Phase five margin queues spur calls for custody revamp

Custodians urged to update “antiquated technology” ahead of three-fold jump in phase six initial margin onboarding

Synthetic Libor gets cautious approval as swaps fix

‘Tough legacy’ solution could mop up $2.7trn-equivalent of non-cleared sterling and yen derivatives

Ethical derivatives strive to win over sceptics

New Isda standards are latest move to overcome client “hesitancy” to use contracts linked to ESG targets

Cleared portfolios surge at EU G-Sibs

Systemic banks post highest share of cleared trades in seven years, as IM phases five and six approach

Swaptions get fallback safety net, but crave CCP fix

Isda’s Ice swap rate fallbacks calm fears, yet CCP action needed to protect physical settlement

UK aims to beat EU in Mifid swaps reporting stakes

UK follows up proposed EU solution to confusion over post-trade transparency with its own fix

Euro RFR group calls for statutory Eonia fix

Legal designation for €STR as replacement rate would avert “confusion” in €9trn of legacy contracts

Bank of America cleared swaps jump $6.6trn

Bank’s quarterly increase leads US G-Sibs’ $25trn rise in Q1

Delays to IM model approvals causing ‘anxiety’ for MetLife

Isda AGM: US insurer says regulators unprepared to accept docs where model approval is obligatory

Corporates remain on swaps fallback sidelines

Risk.net analysis finds just 14 out of 100 large non-financial firms have signed up to Isda fallback protocol

FCA could get legal with USD Libor laggards

Incoming powers permit regulator to ban use of benchmarks with known cessation dates – but only for UK-supervised firms

EU’s initial margin relief may come too late for phase five

Long-awaited easing of model governance requirements unlikely to take effect by September

BoE to consult on Sonia clearing mandate

Long-dated Sonia swaps set to lose clearing exemption as liquidity shifts from Libor

Non-cleared margin logjam looms after squandered delay

Fewer than half of phase five firms have submitted documentation necessary to open custody accounts

Acadiasoft brings IM standards in-house with Quaternion buy

Deal will help data standardisation efforts and cut outsourcing risk in Simm calculation service

Bilateral streams slash FX trading costs by 80%, dealers claim

Risk Live: At some banks, 70% of spot is now traded via bilateral feeds

Systemic eurozone banks expand cleared portfolios

BNP Paribas is an outlier, having ratcheted up bilateral trading since 2013

SA-CCR adoption may spur wider FX swaps clearing

With up to 90% lower exposures on offer, dealers say capital benefits could outweigh margin costs

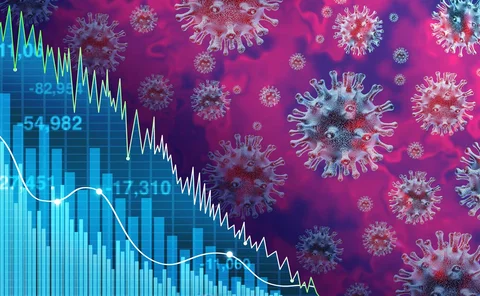

After coronavirus rout, concerns raised about Simm

Annual recalibration means March volatility will not be reflected in margin until end-2021

Industry calls for suspension of IM compliance dates

Associations warn phase five deadline may no longer be possible for hundreds of buy-side firms amid Covid-19 disruption

Seeing red over blue-chip swap in Argentina’s NDF fiasco

Emta protocol salve aside, peso settlement rate snafu is a warning for emerging market FX derivatives

Systemic US banks shed more than $7trn of non-cleared swaps in 2019

Cleared notionals stay flat on the year

Margin exchange threshold relief: get out of jail free?

‘Game-changing’ IM exchange threshold relief may not be the phase five free pass it first appears

Custody battle: competing tensions put IM prep in jeopardy

Conflicting custody interests and delayed docs call IM phase five readiness into question