Basel III

WHAT IS THIS? Basel III is a set of bank soundness rules drawn up by the Basel Committee on Banking Supervision in response to the financial crisis. It hikes the minimum amount of capital banks must hold, introduces new leverage and liquidity ratios, and limits the use of internal models.

Impact of regulatory reform only 50% understood, warns KPMG's Topping

A substantial amount of the regulatory reform sweeping the US and Europe is still little understood and Asian institutions have yet to get to grips with the full impact of these changes, say speakers at industry event in Hong Kong. Intra-day data and new…

Australian banks still face many liquidity challenges

The liquidity conundrum

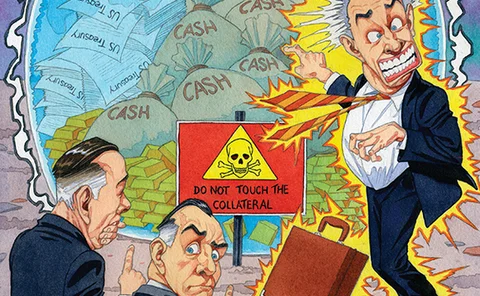

Collateral: look, but don’t touch

Collateral: look, but don’t touch

Push for lower Tier II capital fund raising prior to window closing

Investment banks are urging financial institution clients to issue old-style lower Tier II capital before the window closes on January 1, 2013, when the full force of Basel III capital rules come into effect.

Supervisors on the tracks of shadow banks

Chasing shadows

Quants continue to criticise counterparty risk measures

Adjusting the adjustments

Criticism of Basel III liquidity ratios continues

Rationalising ratios

Asia’s LCR challenge

Asia’s LCR challenge

Citi’s Gerspach: $12.7 billion accounting switch was legit

Switch of assets to trading book and subsequent sales meant to limit Basel III capital impact, says Citi's CFO

Fitch rates Australian covered bond legislation

Fitch Ratings endorses Australian draft legislation on covered bonds, but says market needs more detail on reporting requirements

Deutsche restructures Taunus to avoid unnecessary capital movement

Despite reports the German Bank is seeking to sidestep new US capital rules, the restructure of Taunus will help Deustche Bank put capital to better use

Risk Australia Autumn 2011

Counting the costs

Risk managers not convinced Basel III will help manage risk

Almost half of Fitch survey respondents say lack of regulatory clarity is the biggest issue facing the risk management industry

Video: Algorithmics' Michael Zerbs on the ‘unintended consequences’ from Basel III

Algorithmics' president and chief operating officer Michael Zerbs talks about the long-term impact of moving from Basel II to Basel III, including some 'unintended consequences' likely to emerge from the move to central clearing as well as the specific…

Video: Tsuyoshi Oyama on the conflicted role of central banks post crisis

Bank of Japan veteran and Deloitte Touche Tohmatsu partner, Tsuyoshi Oyama, discusses the changed role of central banks post-global financial crisis and potential conflicts with their new role.

ICB report could spell trouble for investment bank funding

Experts say fencing off retail deposits would leave investment banks struggling to meet key Basel III liquidity ratio

Risk data quality an issue for firms, finds survey

Firms waiting for clarity on regulatory requirements concerning risk data quality, but delay is a mistake, say panellists at a London seminar, hosted by think-tank JWG.

Leave liquidity rules out of Basel III legislation, says EBF

Industry group fears European Union legislative process will set LCR and NSFR flaws in stone

Risk Europe: Tweaks to Basel III will raise deadline pressure for banks

Changes to the detail of Basel III will make timely implementation a challenge, say attendees at Risk Europe

Risk Europe: no-go on CoCos, says panel

Traditional investors won't be won over by debt that converts into equity, says conference panel - and one CoCo issuer raises threat of feedback effects

Risk Europe: Dodd-Frank rating requirement has competitive implications under Basel III

The requirement under the Dodd-Frank Act to eliminate any reliance on external credit ratings could put US banks at a competitive disadvantage under Basel III, says the Basel Committee’s Stefan Walter

Risk Europe: 'Humble' Basel Committee open to liquidity rule changes

The Basel Committee's Stefan Walter says door is open to changing LCR and NSFR - but it's not open wide

Sponsored statement: Royal Bank of Scotland

Basel III and IFRS 9: A tightening of the regulations