Basel II

Land of giants

Canada's banking community comprises a small group of very large banks. Working together, and with their sole, principles-focused regulators, this tightly-knit, risk averse group has avoided the worst of the financial crisis and taken internal op risk…

A variable response to pro-cyclicality

Ensuring banks put in place counter-cyclical capital buffers has become a key area of focus for regulators across the globe, with some proposing capital buffers be based on financial or macro variables. Alessandro Conciarelli and Mario Quagliariello…

The liquidity lifeline

The Basel Committee intends to introduce internationally binding liquidity standards, to include both a requirement for a liquid assets buffer and longer-term structural funding constraints. How will the measures be calculated and what will the…

Divine illumination

Last year's OR&C top 100 banks study identified 'A new dawn for disclosure'. Things have hotted up since then, and now banks face not only a level of exposure and transparency never seen before, but also stricter regulation on almost every front…

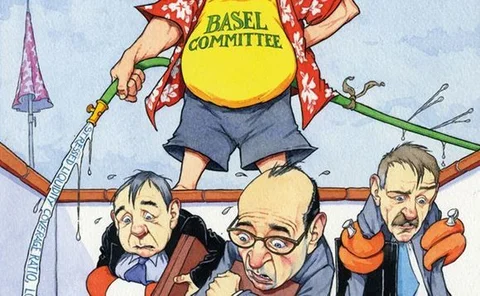

Torrential reign

It never rains but it pours. International negotiations over the best way to regulate banks and financial markets continue, but bankers had better be prepared because much of what has been discussed in recent months will find its way into

Moody’s: Basel II and CRD changes ‘positive for banks' creditworthiness’

Credit rating agency says Basel enhancements will help banks' ratings

Australian regulator proposes enhanced liquidity requirements

Prudential framework for liquidity risk management under review

Basel group agrees on banking crisis response

The Basel Committee’s oversight body has met to discuss key measures to strengthen banking regulation

ECB defends Basel II against US Treasury plans

Nout Wellink and Christian Noyer have rallied to Basel II’s defence against plans for a US-led replacement

FDIC: crisis validates US Basel II delay and leverage ratio

The decision by the US to retain the leverage ratio has been validated by the events of the financial crisis and spared the country from an even more severe fiscal implosion, a senior Federal Deposit Insurance Corporation (FDIC) official has claimed.

Can-do

Julie Dickson, superintendent at the Office of the Superintendent of Financial Institutions in Canada, talks to Risk about how the country's regulatory framework has helped institutions weather the financial crisis. By Joel Clark

2008 Loss Data Collection Exercise results released

Daily news headlines

Basel Committee releases Basel II capital enhancements

Daily news headlines

BIS outlines 'narrow path ahead' in annual report

Daily news headlines