Survey: CTRM system upgrades fail to impress

Energy trading and risk management software implementations are a huge investment, yet not all are considered worthwhile, according to a survey by Risk.net

To view the full results, click here

Whether they are built in-house or bought ‘off-the-shelf’, commodity/energy trading and risk management (C/ETRM) software systems come with a large price tag and require significant ongoing investment. Ownership of a large C/ETRM package can have upfront costs of more than $10 million with upgrade costs of $1–2 million every time, according to implementation specialists.

Yet despite this investment, a significant proportion of energy firms are not wholly satisfied with the end results of a new implementation or an upgrade, according to Risk.net’s 2017 C/ETRM software survey. Some 31% of respondents who had implemented a new system or upgrade in the last year described the result as being only “somewhat” worth the upheaval and cost. A further 5% said it was not worth it (see box: How the poll was conducted).

Implementation specialists suggest that a major reason for this lies in the contractual relationships between C/ETRM software vendors and clients, which require users to upgrade systems regularly in order to continue receiving support.

“You tend to find you don’t get free upgrades any more and the C/ETRM vendors often won’t support older versions of their software,” says David Campbell-Montgomery, Swindon, UK-based chief information officer, at RWE Supply & Trading. “Being without support is a big operational risk, so this effectively forces companies to make upgrades.” He stresses though that an upgrade can be an opportunity to standardise and automate key processes and applications.

You tend to find you don’t get free upgrades any more and the C/ETRM vendors often won’t support older versions of their software. Being without support is a big operational risk, so this effectively forces companies to make upgrades

David Cambell-Montgomery, RWE Supply & Trading

Upgrades often deliver new reporting capabilities, cover new instrument types, offer new modelling tools or contain new logistics capabilities. However, leveraging these involves training and often means reworking processes. Time and again consultants see these opportunities not being fully leveraged.

“We have seen firms burn through their budget for the upgrade and not have funds left to implement the new features and functionalities of the system,” says New York-based Lloyd Chapin, a director at Houston-based MRE Consulting. “They’ve spent money on an upgrade and they are still using the software in the same way as before.”

Another cause of frustration around new implementations is when they happen solely for compliance reasons, something that has occurred more often in recent years as more financial regulation has been rolled out to commodity markets, consultants say. For example, the reporting requirements in the Dodd-Frank Act, the European Market Infrastructure Regulation (Emir) and the European Union’s Regulation on Wholesale Energy Market Integrity and Transparency (Remit) all required significant systems work but brought little value-add to the business, market participants say.

With pressure to upgrade coming from vendors and regulation, it isn’t surprising energy firms are carrying out some form of upgrade fairly regularly. Consultants estimate that upgrades or new implementations take place on average every three years, and this is borne out in the Risk.net survey, where 35% of respondents said they had had a new implementation during the last 12 months.

It should be noted, however, that new implementations often don’t deliver their full benefits in the first year, consultants say. “Year one is not necessarily when organisations see the biggest impact in terms of operational efficiency,” says Baris Ertan, Houston-based managing director and global trading and risk lead at consultancy Accenture. “In fact, there can often be a small dip in performance as users adapt to the new solution and operational processes. We believe it is important to account for this period in the first year of a business case.”

Challenges

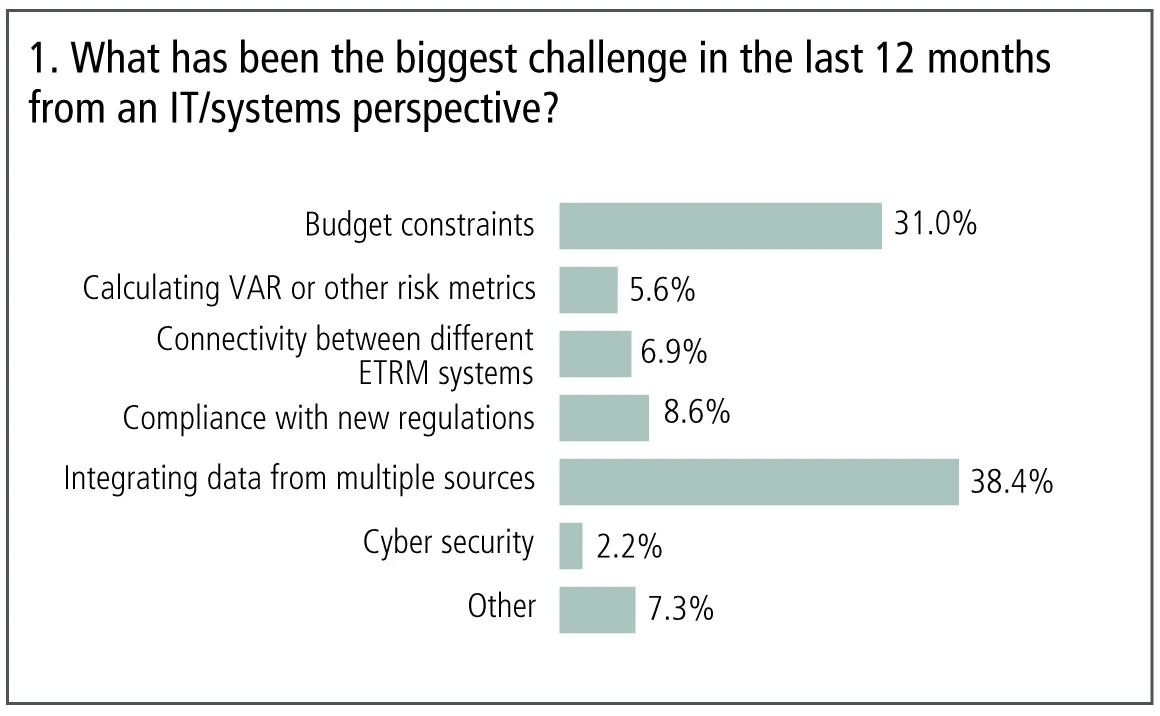

Respondents were asked what their biggest IT challenge has been over the last 12 months. The largest number of respondents – 38% – said it was integrating data (see figure 1). This age-old issue is particularly pronounced now for a number of reasons, say energy firms and consultants. Firstly, there has been an explosion in the amount of data available, and using this data to gain advantage has become essential in today’s world of narrowing profit margins. Additionally, regulations such as Dodd-Frank, Emir, Remit and the EU’s Market Abuse Regulation (Mar) are forcing firms to retrieve, track and send data in certain ways. Also, the recent increase in merger and acquisition activity in the energy sector means many firms now have to integrate data sets from different organisations, say consultants.

“In the past three to four years, trade workflow has become a lot more complex,” says Sidhartha Dash, London-based research director at risk technology research firm Chartis Research. “Data sources have exploded. There is more diverse and more granular market data available and this means there is more data to integrate, which is challenging.”

RWE’s Campbell-Montgomery agrees. His firm is now considering how to take in and validate unofficial data such as social media feeds, in addition to more conventional data such as that provided by New York-based Platts or television news networks. “The challenge is integrating data with different structures and varying quality and working out what to act on and what to reject,” he says.

Often around half the cost of a new implementation project is integration. People often imagine implementation is the most challenging part, but actually it’s integrating the system correctly. I think many firms underestimate this

Sunilkumar Ramakrishnan, IBM

The need for increased and improved data integration is also being driven by regulators, say consultants. In an attempt to better root out misconduct, regulators are becoming more sophisticated in their market surveillance and now want to be able to understand any anomalies they spot more thoroughly. This could mean tracing activity from a firm’s accounts right back to trade data, says MRE’s Chapin. “The expectation now is that a firm’s financial accounting data and risk data will be closely aligned, allowing traceability,” he says. “Historically, they were separate reporting tools and environments, but there’s now a big push to bring them back together, urged on by regulators.”

Regulatory requirements around position limits are another driver, requiring near real-time integration, say market participants. For example, the EU’s reworked Markets in Financial Instruments Directive (Mifid II), which will take effect in January 2018, contains a stringent position limits regime that requires firms to monitor their derivatives positions.

“Position limit monitoring requires a volume of data to be pulled from various systems, formatted and delivered almost in real time,” says RWE’s Campbell-Montgomery. “In the past, data could be provided up to a day after the event but the dynamic nature of the energy market and customer and regulator expectations are driving within-day reporting and this is driving a much higher performance requirement on processes, applications and data.”

Aligning different types of data is also being driven by economic imperative, say consultants. An example of this is a move many firms are now making to better align their contract management systems with market data and middle-office tools, says Chartis’s Dash. “People now realise there’s a lot of potential value in contracts, such as flexibility on terms, delivery dates, volumes and so on, that used to be left sitting on the table,” he says. “Contract management is nothing new but, in the past, it was typically done by a separate department outside trading, and the focus was on processing the contract rather than the business context. Now much more attention is paid to the underlying market dynamics and how they affect the contract.”

Sunilkumar Ramakrishnan, a London-based associate partner in IBM’s energy risk management division, believes integration should be given more thought at the start of a software implementation project. “Often around half the cost of a new implementation project is integration,” he says. “People often imagine implementation is the most challenging part, but actually it’s integrating the system correctly. I think many firms underestimate this.”

He urges firms to give greater attention to integration at software selection stage. “Integration should be a big consideration during package selection, and evaluation tests should be run as much as possible in a full end-to-end environment so you can check whether the system can, for example, get logistics or invoice data easily or whether it links to the credit system,” he says. “This can reduce a lot of risks in the implementation phase and shorten the development time.”

Budget

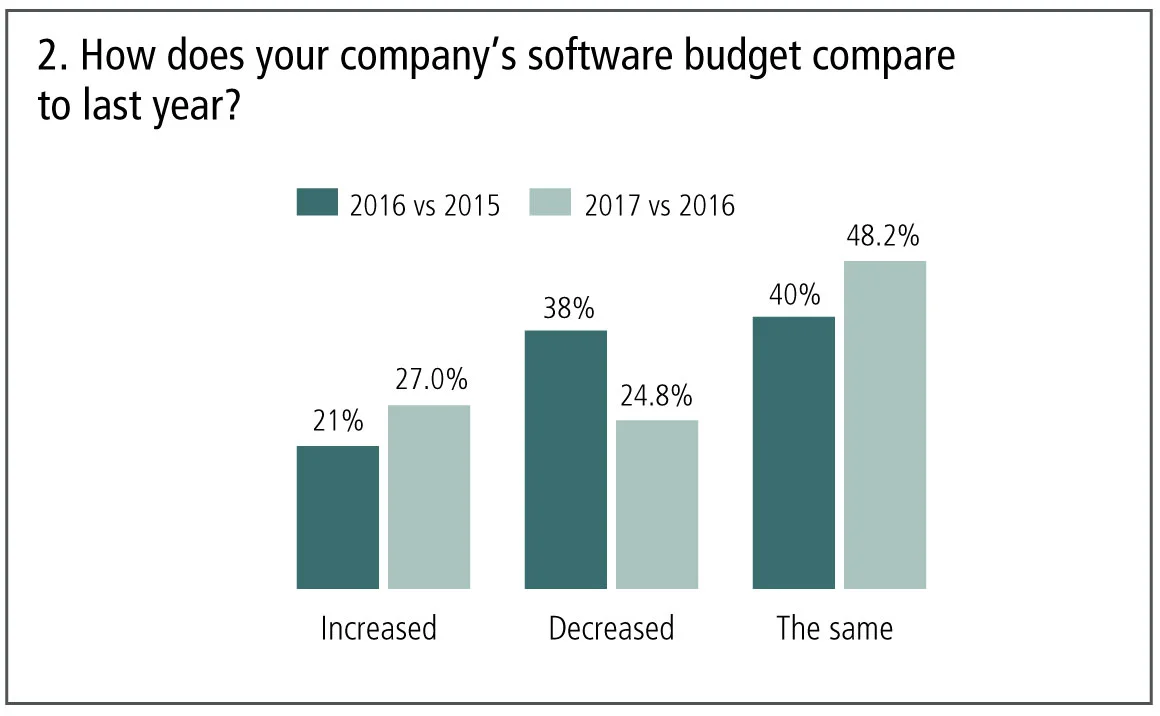

The survey also flagged up budget constraints as a major trial for some firms (see figure 1). Some 31% of respondents said budget constraints had been their biggest challenge of the past 12 months. This looks set to continue with only 27% of respondents saying their 2017 budget had increased from 2016, while 25% said it had decreased and 48% said it was unchanged. This is a slight improvement from last year when only 21% of respondents had a higher budget than the year before, 38% had lower and 40% were unchanged (see figure 2).

Campbell-Montgomery says RWE Supply & Trading’s 2017 IT budget is down around 5% from 2016, but this is a much smaller cut than in previous years and has stabilised. “The cuts are definitely getting less steep, and I would expect it to stay at this level for the next three years unless there are any large market changes or company restructuring or technical innovation,” he says.

As a result of budget constraints, IT managers at many energy firms are now having to do more with less, consultants say. The emphasis is very much on increasing operational efficiency and making savings. A robust business case needs to be made before any new investment is signed off and most likely there will need to be cost savings. Many firms are now doing huge amounts of upfront work, which includes intensive testing and analysis, before selecting new applications, say consultants.

Cloud

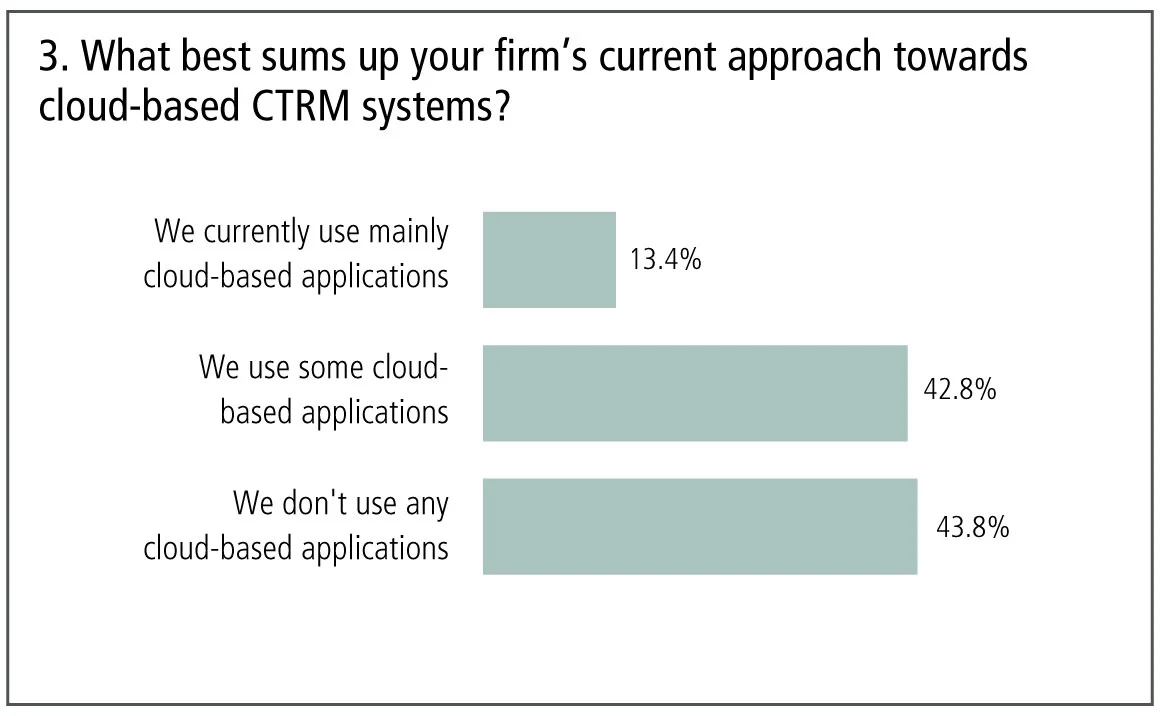

One potential avenue for cost savings lies in deploying applications in the cloud without the need for on-premise servers and maintenance. The survey indicated that the migration of C/ETRM systems to the cloud has begun but that obstacles remain in the way of full uptake.

Almost 43% of respondents said they use some cloud-based applications while a similar amount – 44% – said they don’t use any, with just 13% saying they use mainly cloud-based applications (see figure 3).

Consultants and industry participants said this chimed with their view of the market. “Around five years ago, cloud was almost not in the picture. Now almost every client wants to understand the benefits and how they would manage the security risk of C/ETRM applications in the cloud,” says IBM’s Ramakrishnan.

Campbell-Montgomery says RWE Supply & Trading has “embraced” the cloud, moving about 30 out of 150 of all its applications onto it since mid 2015. He stresses they are non-critical applications. “We don’t have our main C/ETRM system on the cloud or any of our data warehouses or reporting, but we are looking into this,” he says.

This is reflective of the wider industry, say consultants. “For certain standalone solutions such as regulatory reporting, and for some analytics, firms are happy to go on the cloud, but they don’t want to use it where there is core trading or proprietary data,” says Ramakrishnan.

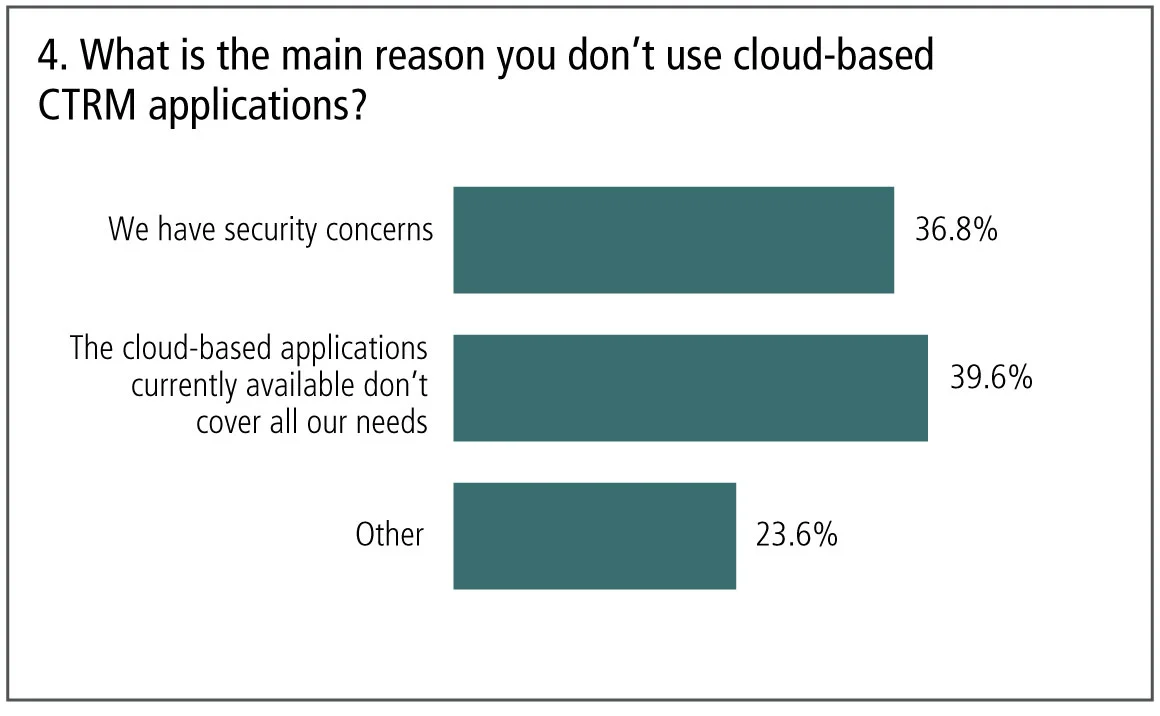

The top reason – given by almost 40% of respondents – for not using cloud-based applications was that those currently available don’t cover their needs (see figure 4).

“One of the main reasons for not adopting cloud more broadly is that many of the ETRM vendor solutions are still in early ‘proof of concept’ stages rather than operationally ready to be deployed into production,” says Accenture’s Ertan.

Integrating a core system such as an ETRM function with all the front-, middle- and back-office applications it needs to connect becomes more complicated when some are in the cloud and others on premise, say implementation specialists. Sending large files from the cloud back to on-premise servers can be costly and time-consuming, they warn.

Almost 66% of respondents said they would like to use more cloud-based C/ETRM applications, with 34% saying they wouldn’t.

Security also remains a concern with just shy of 47% of respondents citing this as their major barrier to entry (see figure 4). While cloud providers such as Microsoft Azure and Amazon Web Services have state of the art security controls, problems could still occur when exposing a C/ETRM system that has been built for internal use to the public cloud, say consultants. “It’s not that people will be able to hack the public cloud, rather it’s that when a firm moves its internal systems to the cloud, it exposes end points that weren’t designed to go into the public domain,” says Chartis’s Dash.

Surveillance

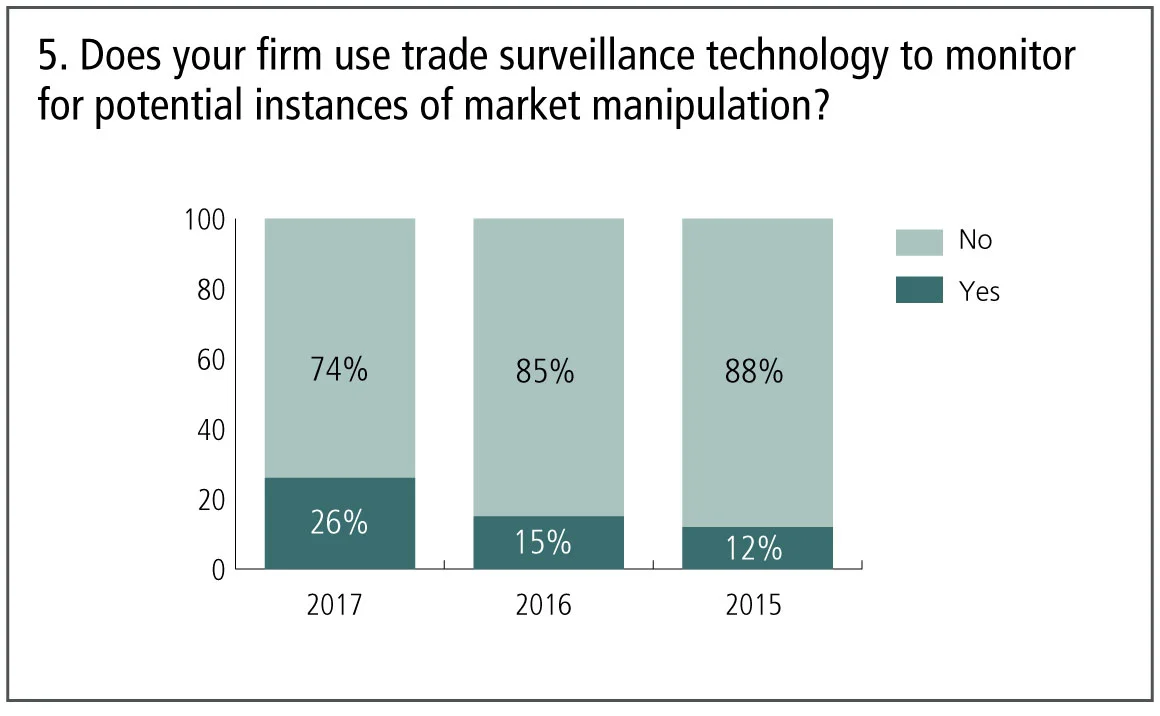

When it comes to market monitoring, the survey showed that growing numbers of energy firms are installing trade surveillance technology to monitor for market abuse. The percentage of respondents saying their firm uses trade surveillance technology has more than doubled over the last three years of the survey, to stand at 26% this year, up from 15% last year and 12% in 2015 (see figure 5).

“The uptake of trade surveillance technology is definitely increasing,” says RWE’s Campbell-Montgomery. This is being driven by regulation such as Mar and Remit as well as the increasing complexity of today’s markets, which means automated surveillance is operationally safer than manual checks, market participants say. However, implementing and maintaining surveillance technology is an expensive process and one that, today, is confined to only the largest energy firms such as oil majors and multinational utilities, say consultants.

“I think some small to mid-sized firms do not see a need to put in specific technology for surveillance when they have human interventions and controls in place,” says Accenture’s Ertan.

The biggest incentive for investment in surveillance technology would be another high profile market-abuse case, say consultants. “I think we’ll see a gradual creep up in the numbers and a spike if there is another story of fines being given out to energy firms,” notes IBM’s Ramakrishnan.

How the poll was conducted

The Risk.net energy trading and risk management (ETRM) software survey was carried out in January and February 2017. It received 266 valid votes.

Of the votes, 55% came from respondents at oil, gas and electricity firms; 20% came from consultants and IT implementation specialists; and the rest came from banks, brokerages, commodity traders, industrials and investors. The largest number of respondents (24%) were risk managers, followed by IT professionals (23%), consultants (19.5%), traders (13%) analysts and back office (both with 4%).

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Technology

What is driving the ALM resurgence? Key differentiators and core analytics

The drivers and characteristics of a modern ALM framework or platform

Are EU banks buying cloud from Lidl’s middle aisle?

As European banks seek to diversify from US cloud hyperscalers, a supermarket group is becoming an unlikely new supplier

Inside the company that helped build China’s equity options market

Fintech firm Bachelier Technology on the challenges of creating a trading platform for China’s unique OTC derivatives market

AI ‘lab’ or no, banks triangulate towards a common approach

Survey shows split between firms with and without centralised R&D. In practice, many pursue hybrid path

Everything, everywhere: 15 AI use cases in play, all at once

Research is top AI use case, best execution bottom; no use is universal, and none shunned, says survey

FX options: rising activity puts post-trade in focus

A surge in electronic FX options trading is among the factors fuelling demand for efficiencies across the entire trade lifecycle

Dismantling the zeal and the hype: the real GenAI use cases in risk management

Chartis explores the advantages and drawbacks of GenAI applications in risk management – firmly within the well-established and continuously evolving AI landscape

Chartis RiskTech100® 2024

The latest iteration of the Chartis RiskTech100®, a comprehensive independent study of the world’s major players in risk and compliance technology, is acknowledged as the go-to for clear, accurate analysis of the risk technology marketplace. With its…