Financial Services Agency (FSA) (Japan)

Nomura eyes FRTB models expansion for FX desks

With rates desks all now on FRTB internal models, markets head says FX is next

Japan regulator calls on laggards to keep Basel promise

After EU and UK delays – and amid fears of US divergence – Japan is keeping a close eye on its peers, says Shigeru Ariizumi

Japan, Basel III and the pitfalls of being on time

Capital floor phase-in delay may be least-worst option for JFSA as US and Europe waver

Japan’s regulator stands firm behind Basel as peers buckle

Japanese banks fear being at a disadvantage to rivals as Basel III implementation falters

Autocall curbs hit long-dated Nikkei and HSCEI options

Collapsing Asia structured products inventory saps market-makers of long-dated vol supply

Vega peak was foothill in historic Nikkei selloff

JFSA scrutiny has curbed issuance of autocallables, so stock plunge generated light re-hedging

Norinchukin hit with 54% rise in op RWAs

Recalibration of underlying parameters is first under new standardised measurement approach

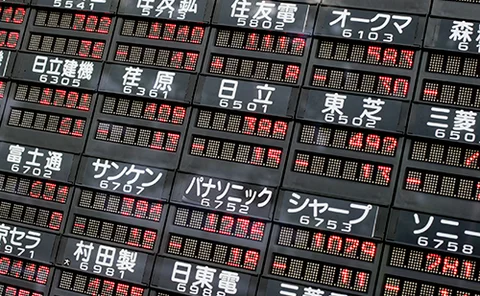

Japanese banks reap ¥9trn RWA savings from FRTB switch

Tokyo’s dealers fare better than overseas rivals on new CVA and market risk approaches

Japanese megabanks shun internal models as FRTB bites

Isda AGM: All in-scope banks opt for standardised approach to market risk; Nomura eyes IMA in 2025

Japanese banks’ leverage ratios keep rising as BoJ relief becomes permanent

Norinchukin reaps largest benefit on eve of Covid-19-era exemption being made permanent

People: Estrada, Horne out in Credit Suisse rout, Belsher to Barclays, and more

Latest job changes across the industry

Norinchukin’s RWAs up 21% as Basel III formulas react to market volatility

Market charges up 230% in harsh test of new standardised approaches

Norinchukin’s credit RWAs up 31% on early Basel III opt-in

Bank’s standardised charges surge 19-fold following overhaul of models’ scope and parameters

Japan autocall curbs upend Nikkei vol

Lack of reinvestment alongside FSA review forces scramble to buy back hedges as products knock out

FSB: third of climate stress tests not tackling physical risk

Six jurisdictions conducted exercises only for transition risk

LCH Japan plan signals new fight for global clearing model

UK-based clearing house faces “uphill struggle” against JFSA location policy on yen derivatives

Early FRTB adoption piles pressure on Japanese banks

Bankers fear competitive pain due to lack of NMRF data, possible EU and US deviations from Basel

EU’s Basel delay could cause problems for Japan

Asia Risk Congress: unaligned timetables creates difficulties for Japan's megabanks

Nomura understated VAR capital charges by 13% in H2 2020

VAR RWAs should have been ¥122 billion higher than originally stated at end-December

Yen swaps users stuck in clearing Catch-22

Lack of access to client clearing at JSCC poses problems for US buyers of Japanese government bonds

Covid policy risk hangs over bank stress tests

Banks and regulators are second-guessing the policy response to new outbreaks