Risk magazine

JP Morgan's Daniels Webster to retire

JP Morgan Chase’s global head of market risk and fiduciary risk management, Lesley Daniels Webster, is to retire in February.

BNP Paribas reorganises fixed-income business

BNP Paribas is set to reorganise its fixed-income business by splitting its marketing and trading activities. The new set-up replaces a structure where the division was split into three areas: foreign exchange, interest rates and credit.

TriOptima launches oil swap tear-up service

TriOptima, the Stockholm-based financial technology firm specialising in an over-the-counter swap 'tear-up' service, has extended its capabilities to oil swaps.

Private bankers buying more FX-linked structured products

Private bankers are buying an increasing number of structured products linked to currency movements in a bid to provide more attractive yields to their clients.

Collins Stewart merges G-7 currency options desks

Collins Stewart Tullett has merged the Group of Seven currency options desks of its Tullett Liberty and Prebon Yamane subsidiaries in London and Asia.

Wachovia seeks to improve risk data

Wachovia is implementing the AC Plus data management system from Dutch vendor Asset Control within its corporate investment bank to improve risk management.

NAB forex derivatives rejig continues

National Australia Bank (NAB) has continued its rebuilding process by hiring David Hicks as an Australian dollar forwards dealer.

Markit signs up 50th Red customer

Markit has signed its fiftieth customer to its reference entity database (Red) for credit instruments. The move means the St Albans-based company has signed up 35 additional clients to Red from its base of 15 institutions in January 2004.

Ubitrade launches margin risk management tool

Ubitrade, the Paris-based provider of derivatives trading technology acquired by GL Trade in the first quarter of 2004, has released RiskUbix, a new margin risk management module.

HKEx targets derivatives growth

Hong Kong Exchanges and Clearing has scheduled a number of new initiatives for 2005 to combat flagging investor interest in derivatives. It also plans to expand and promote its distribution of market data to a wider user base in the Far East.

DDQ re-issues commodity-linked structured product

Dawnay Day Quantum (DDQ), a division of London-based financial services and property investment company Dawnay Day, has re-issued its commodity-linked structured product aimed at both the institutional and retail markets.

Front Capital wins $5 billion hedge fund client

KBC Alternative Investment Management (KBC AIM), a hedge fund subsidiary of Belgium's KBC Bank and Insurance Group that manages more than $5 billion in assets, plans to implement Front Capital's Arena trading, risk management and distribution system.

HSBC provides clients with forex charting tools

HSBC has begun rolling out a web-based currency data charting application from UK vendor TraderMade to its corporate and investment clients. The application, called FX Charting, will support trading and hedging strategy decisions.

Icap buys out GovPX for $13 million

UK inter-dealer broker Icap is buying out the outstanding shares in GovPX, a US fixed-income and derivatives data provider, for $13 million, it was announced last week.

BNP Paribas snares six from Freddie Mac for US mortgage business

French investment bank BNP Paribas has hired six former Freddie Mac professionals, as part of an initiative to build its US mortgage business.

BarCap boosts German coverage with Frankfurt hires

Barclays Capital, the investment banking arm of Barclays Bank, has made several appointments to its Frankfurt office, extending its coverage in Germany, Austria and Switzerland.

Eurex US offers three-year Treasury derivatives

Eurex US will list futures and options on futures in the three-year Treasury note market starting on February 1. The electronic derivatives exchange, which is part of the Deutsche Börse Group, already offers these products on two-, five- and 10-year…

Barclays Capital wins derivatives house of the year in 2005 Risk Awards

Barclays Capital, the UK-based investment bank, scooped the prestigious Derivatives House of the Year Award in Risk magazine’s sixth awards for achievement in risk management.

Liquidity majors back SwapsWire's equity options service

The top 12 equity derivatives dealers will process over-the-counter equity option transactions through SwapsWire’s automated confirmation service when it launches in the second quarter of 2005.

HSH takes a long-term view

Company profile

Nomura makes Hong Kong derivatives appointment

Nomura International has hired Alan Mak as head of structuring and marketing for Asia-Pacific derivatives.

Market models for CDS

In August 2004, Risk published an article on the pricing of credit default swap (CDS) options entitled A measure of survival by Phillip Schönbucher. Here, Damiano Brigo provides an alternative derivation of the CDS option pricing formula based on Cox

Estimating default correlations using a reduced-form model

Credit risk : Cuttingedge

From Basel II to Basel III

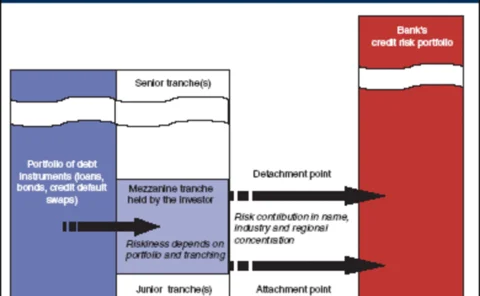

Portfolio risk