Risk magazine

Sizing up skew

Structured products providers' methods for hedging skew are fairly homogeneous. Some banks, however, are searching for ways to refine their approach to hedging by transforming skew risk into an investment palatable to sophisticated investors. By Rachel…

The power law

MasterClass

The derivatives watchdog

Thomas Huertas, FSA director of wholesale firms, talks to Alexander Campbell

Under pressure

Interest rate swaps

The stress-testing trident

While stress testing is a much discussed topic, an accepted definition of best practice remains elusive. David Rowe proposes a three-pronged approach

Data's destiny

Grid Computing

Mid-cap emerges

Equity derivatives

Icap and JLT partnering in insurance derivatives

London-based interdealer broker Icap and insurance group Jardine Lloyd Thompson (JLT) are to form a joint venture to trade derivatives based on insurance risk.

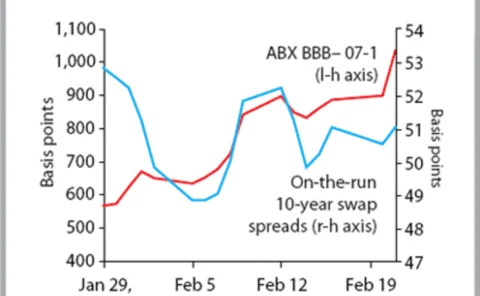

ABX widening stokes credit fears

Credit market worries are growing, as widening spreads on US subprime home equity securities shake US and European credit markets.

Tullett moves into energy

Market data provider Tullett Prebon Information has named Craig Tee as its first head of global energy and commodities.

ABN and Merrill launch first industrial property swap

Dutch bank ABN Amro and US bank Merrill Lynch have this week launched the first industrial property derivative.

Apollo poaches distressed debt team from Credit Suisse

New York-based private equity firm Apollo Management has poached two distressed debt bankers from Credit Suisse’s leveraged finance department.

IPD: Launch failure for property sector derivatives

Growth is levelling off in the UK property derivatives market, with disappointingly few sector trades, according to figures released by the Investment Property Forum (IPF) in London today.

OTC property derivatives to launch in Australia

A deal paving the way for an Australian over-the-counter property derivatives market was announced yesterday between RP Data, Rismark International and GFI.

Deutsche Bank names head of complex risk syndication

Deutsche Bank has named Martin Fisch as head of complex risk syndication, a newly created post in the global markets division.

Islamic bonds widen appeal

Demand for Islamic bonds is extending beyond the original customer base, with growing issuance and strong secondary trading among non-Muslims.