Risk magazine

Moody’s: 2008 marks turning point for credit cycle

New York-based rating agency Moody’s Investors Service said the global corporate default rate had reached its lowest level in two decades by the end of 2007, although it expected a “sharp rise” in 2008.

Countrywide Home Loans dominates December US CDS trading

Credit default swaps (CDS) for the banking and financial services sectors dominated the most active trading in the US over December, led by Countrywide Home Loans, Lehman Brothers, CIT Group, Merrill Lynch and SLM Corp, according to interdealer broker…

Markit adds AJ tranche to CMBX indexes

London-based data provider Markit added a new tranche, the AJ tranche, to the off-the-run Markit CMBX indices on January 4.

Hunt leaves as State Street takes subprime charge

William Hunt, the president and chief executive of State Street Global Advisors (SSGA), has resigned, as the hedge fund’s Boston-based parent company announced it would take a $279 million pre-tax charge for costs stemming from US subprime mortgages.

UOB strengthens trading desk in Singapore

Singapore’s United Overseas Bank (UOB) has made several senior trading hires, including a new head of market-making and trading. Samuel Lin joined on December 3 from local rival OCBC Bank, where he was head of financial derivatives for group treasury.

Société Générale and Calyon launch new brokerage

Société Générale and Calyon have merged the brokerage activities of their respective subsidiaries, Fimat and Calyon Financial, and launched a new brokerage house called Newedge, based in Paris. The two banks will equally control Newedge and have…

Q4 writedown estimates raised for Citi, Merrill and JP Morgan

Citi, Merrill Lynch and JP Morgan could see writedowns totalling $33.6 billion relating to collateralised debt obligations (CDOs) over the fourth quarter, according to a report by Goldman Sachs on American firms, published on December 26.

Regulators in Accord

Basel II

Open to disclosure?

Contracts for difference

A unifying approach

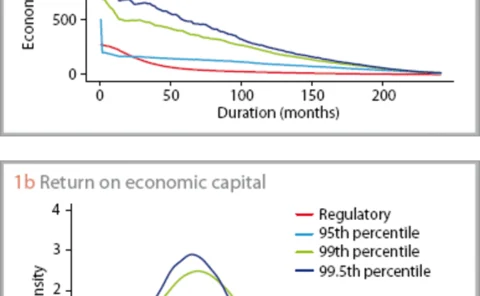

Economic capital

Getting off lightly

Securitisation

Current derivative trends in the Nordic markets

Sponsored Q&A

Economic capital ideas

Class Notes

Basel II backlash

Credit Risk

Simply the best?

Best execution

Marking to mayhem

Structured Credit

Heating up

Structured Products

A long way to go

Longevity

The probability approach to default probabilities

Default estimation for low-default portfolios has attracted attention as banks contemplate the requirements of Basel II's internal ratings-based rules. Here, Nicholas Kiefer applies the probability approach to uncertainty and modelling to default…

Getting the green light

Comment

Remapping the future

Inflation