Settlement risk

Banks go live on CLS

Continuous Linked Settlement (CLS) - the long-awaited industry initiative to cut settlement risk for foreign exchange - will go live today.

CLS currency settlement system goes live

FRONT PAGE NEWS

Outsmarting rogue traders

ELECTRONIC CURRENCY TRADING

Switching on CLS

As the continuous linked settlement initiative prepares for a delayed launch later this year, firms that have been involved since the beginning outline how they hope to recoup and build on their investments.

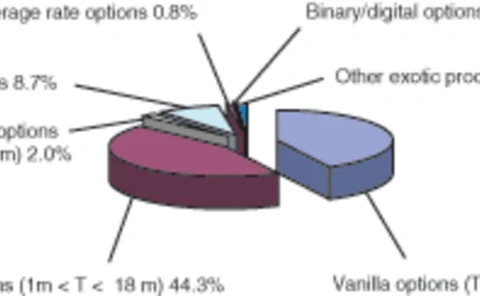

Fewer options in 2001 | A Risk survey

The foreign exchange options market cooled off significantly last year, as September 11 and lower forex volatility kept dealers away. Risk’s third annual survey of 13 large forex options houses reveals that their combined 2001 volumes fell by $1.1…

Electronic platforms short circuit

E-trading

BIS reports global slowdown in derivatives markets

Derivatives market expansion slowed significantly for the period 1998-2001 relative to the three years before, reported the Bank for International Settlements (BIS) today.

AIB loss poses questions for the banking industry

FRONT PAGE NEWS

Boom or bust?

In volatile markets, technology must enable managers to navigate these difficult conditions. Can the current systems feed the market?

Basel II sets the pace for operational risk reform

Basel II is set to come into play in 2005, bringing a host of opportunities for vendors along with the new framework for banking supervision. Andrew Partridge examines the potential and some of the challenges for the suppliers and users of financial…

Decline in OTC derivatives for Singapore

Over-the-counter (OTC) derivatives turnover in Singapore has fallen 44% in the last three years, the Singapore Monetary Authority (MAS) has reported to the Bank for International Settlements (BIS). Average daily OTC derivatives turnover was $6.3 billion…

Elimination Of A Major Op Risk In Currency Markets Looms

SETTLEMENT RISK

Technology News

NEWS

IN BRIEF

IN BRIEF

BACK OFFICE

BACK OFFICE

CLS Service Attracts Controversy At Sibos

FRONT PAGE

BIS Report Issues Policies for Managing FX Settlement Risk

METHODS & REGULATIONS

Banks Use Forum To Share Best Risk Practices

FRONT PAGE