Operational risk

Basel II will lead to more instability, critic argues

LONDON - The Basel II bank capital accord will result in more banking instability and more pro-cyclicality, where bank actions taken in response to solvency rules reinforce economic and market cycles, a leading critic of the accord said in October.

A question of priorities

Japan's banks are aware of the need to prepare for Basel II, but it is just one of a number of urgent issues that need to be resolved in the Japanese banking sector.

Europe allows wider role for op risk insurance in Cad 3 [full story]

BRUSSELS - European banks and investment firms would be able to use operational risk insurance to reduce capital charges in all approaches to measuring op risk under new European Union (EU) capital adequacy rules, banking industry and regulatory sources…

Basel II op risk charge will help tackle concerns, says McDonough

NEW YORK - Banking supervisors believe that a separate capital charge for operational risk under the Basel II capital rules will bolster efforts to find better ways of addressing concern about the operational hazards faced by banks, the world's chief…

Banding together for SME credit risk analytics

Germany's banking associations are taking a leading role in getting the country's fragmented banking sector ready to comply with the Basel II capital Accord. Germany's savings banks association, in particular, says it has internal ratings-based systems…

Data hurdles

The risk management rumour mill has been buzzing in recent weeks with the story that US banking regulators have told the senior management of the country’s 30 largest banks that they will be expected to implement the advanced internal ratings-based (IRB)…

IAFE releases op risk white paper for buy-side firms

The International Association of Financial Engineers (IAFE) yesterday released a white paper on operational risk for buy-side institutions, which concludes that business reputation rather than Basel-inspired regulation is the real driver for implementing…

Sponsor's article > Credit derivatives: will the market keep expanding?

This article aims to give a brief overview of some of the main trends in the credit derivatives market and also proposes to analyse some of the underlying reasons why this market is experiencing such a boom.

Sponsor's article > Preparing for Basel II - how urgent?

Delays in Basel II have lulled many into complacency. But despite lack of final details for the regulations, David Rowe argues it is not too early to begin planning and initial implementation.

Landesbanken's operational risk management tool

Many German banks lag behind their peers when it comes to operational risk management. The proposed new international bank capital accord, Basel II, which - for the first time - stipulates a separate capital charge for operational risk, has put the topic…

Tracing Transparency

Corporate bond traders are hesitantly embracing greater transparency and trying to figure out how to use it.

Budgeting for 2003

Deutsche Bank, Merrill Lynch and State Street outline how next year's budget will be spent. For starters, it will be spent cautiously.

Diversification of Morgan Stanley

One year after Sept. 11, Morgan Stanley contemplates a simple thought with complex repercussions: Don't put all of your eggs in one basket.

Back to Bayesics

Gerald Sampson, of Saratoga Consulting, argues that a Bayesian approach to analysing transaction failures produces superior results.

Legg Mason Gets a Leg Up on Disclosure

Baltimore-based Legg Mason is one of the first firms to tap software to comply with NASD Rule 2711 about disclosing conflicts of interest.

Reaping integration rewards

In the October issue of Risk, Clive Davidson discussed the integration of ALM and ERM technology. Here, in a second article, he profiles the firms that have tackled this project and reviews the challenges, advantages and pitfalls of the integration…

OpVar 4.2 unveiled

New York-based operational risk quantification firm OpVantage - a division of Fitch Risk Management - has launched version 4.2 of its OpVar operational risk product suite. The suite allows users to collect op risk data, analyze loss probabilities, scale…

Forced to fit in

Cover story

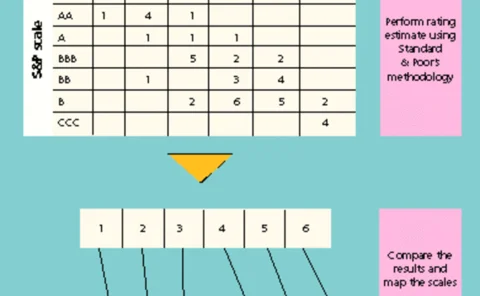

Internal risk rating systems for banks

Sponsored article

Deconstructing the market

High yield

EU Cad paper delayed to mid November

BASEL II UPDATE

Algorithmics strengthens European connection

TECHNOLOGY