Credit risk

Credit market complacency

The structured credit market has come under the scrutiny of regulators fearful that a credit downturn will bring significant systemic risk to the global financial markets. Participants in the credit derivatives market are, for the most part, nonplussed…

JP Morgan recommends changes to Basel II NPR

JP Morgan Chase has set out to US regulators what it considers to be the main operational concerns over the interagency notice of proposed rulemaking (NPR) to implement a new risk-based capital framework based on Basel II.

S&P looks at PD estimation in a Basel II environment

New S&P report states that there is a negative relationship between probability of default and speculative-grade post-default recovery values.

Italian regulator to use CDS data

Interdealer broker GFI has started providing credit default swap (CDS) data to the Commissione Nazionale per le Società e la Borsa, the Italian securities market regulator (Consob)- possibly for market surveillance purposes.

Merrill Lynch wins Derivatives House of the Year

Merrill Lynch has won Risk magazine’s Derivatives House of the Year award for 2007. Meanwhile, this year’s Energy Derivatives House of the Year award goes to JP Morgan, which talks exclusively to Risk about its acquisition of Amaranth Advisors’ energy…

Italian regulator to use CDS data

Interdealer broker GFI has started providing credit default swap (CDS) data to the Commissione Nazionale per le Società e la Borsa, the Italian securities market regulator (Consob)- possibly for market surveillance purposes.

Same underlying names dominate CDS trading in December, says GFI

Credit default swaps (CDS) offering protection against debt issued by US auto companies, European telecoms and Asian financial services institutions were again the most actively traded credit derivatives in December.

With a bang or a fizzle?

Basel II

GMO's emerging market high-flyers

Bill Nemerever and Tom Cooper, co-managers of GMO's emerging markets debt portfolio, have made their names sourcing cheap debt in unusual locations. Shunning roadshows and local currencies, they barely even travel to the countries they invest in. Dalia…

False dawn for first loss

CDO equity

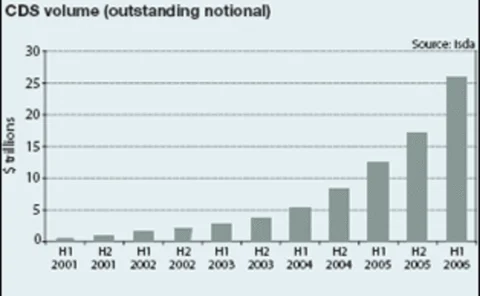

CDS volumes to top $30 trillion this year

According to Deutsche Bank estimates, the credit default swap market will continue to grow this year - albeit at a slower rate - as a wider pool of investors gain approval to enter the market

Back to basics

We take you back to the credit basics to review everything you thought you already knew but were too afraid to ask... In the second of a two-part series on credit derivatives, Saul Doctor, analyst at JPMorgan in London, discusses next-level CDS

Robert Lepone

The head of European loan trading at Morgan Stanley in London discusses issues surrounding the new loan CDS indices

CPDOs: A volatility game

A triple-A rated structure that pays Libor plus 200bp. Who wouldn't be interested in such a product? Perhaps the sceptics warning against the 15 times leverage and the instrument's high exposure to volatility. Laurence Neville reports

Buying in bulk

Features

Opening the door to credit

Cover story

Maintaining consistency

Credit