This article was paid for by a contributing third party.More Information.

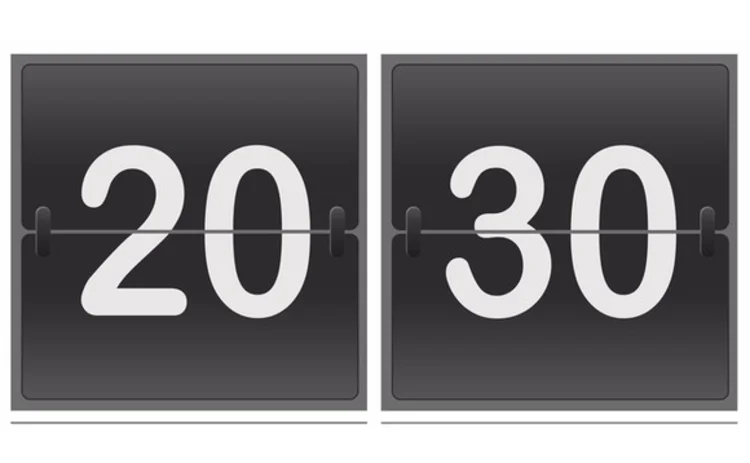

Valuing convertible bonds with 20-of-30 soft call provision

ITO33 is the leading provider of software and solutions to value and risk-manage convertible bonds and equity derivatives. At a time when many vendors are merely addressing issues of scope and volume, ITO33 remains convinced that firms specialising in trading convertible bonds should also demand rigorous handling of challenging valuation problems. These can have a significant impact on the theoretical value and greeks of the traded instruments.

Download/read the full article in PDF format

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net