Risk magazine - Volume 23/Number 8

Articles in this issue

Passage of Dodd-Frank Act heralds start of rule-making process

Financial reform legislation passes in the US Senate, as focus turns to the complex issue of implementation

Smooth calibration of Markov functional models for pricing exotic interest rate derivatives

The Libor market model is widely used but often criticised for its slowness. Nick Denson and Mark Joshi develop an accurate and stable calibration procedure that allows for the effective use of a control variate

Dealer-led market may be disrupted by Dodd-Frank

Banks could lose margins and competitive edge as a result of derivatives reforms in Dodd-Frank Act

Two curves, one price

The financial crisis has multiplied the yield curves used to price plain vanilla interest rate derivatives, making classic single-curve no-arbitrage relations and pricing formulas no longer valid. Marco Bianchetti shows that no-arbitrage can be recovered…

Safer instability

Regulators are preparing to introduce a host of new regulations to improve the resilience of the financial system. But this should go hand in hand with the use of policy tools to prevent asset price bubbles, argues Ryozo Himino

OTS pays the price of failure

The US Office of Thrift Supervision will be abolished under the Dodd-Frank Act, but is the agency being made a scapegoat for the financial crisis or will its dissolution help mitigate regulatory arbitrage and raise supervisory standards? Peter Madigan…

LCH.Clearnet may offer 'lite' membership to sovereigns

Clearer's plans to create a special membership category for central banks and other sovereigns could undermine CCPs' risk-mutualisation model, rivals claim

Scor looks to Solvency II

Philippe Trainar, chief risk officer at Scor, talks to Alexander Campbell

Organisational aspects of risk management

In the last of this four-part series, David Rowe looks at organisational issues and argues the chief executive and board must accept responsibility for strategic risk management decisions

Liquidity takes centre stage for banks and regulators

Regulators and banks have increased their focus on liquidity risk management significantly since the crisis. William Perraudin discusses some of the possible implications

A focus on gone-concern contingent capital

Regulators have found it easier to reach consensus on a standard for contingent capital that converts at the point of a bank’s insolvency, but continue to struggle with the definitions for going-concern conversion. How will supervisors proceed? Joel…

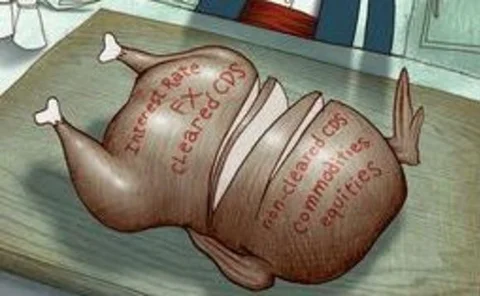

Clearing dilemma for CCPs

Dealers have made progress towards clearing swaths of the over-the-counter derivatives market. But market participants are likely to have to clear more awkward products to satisfy regulators’ demands. Mark Pengelly investigates

Bespoke solutions for an Islamic CSA

Islamic derivatives users are still getting to grips with a new sharia-compliant master agreement, but some argue the market will be stunted without an accompanying collateral document. Lawyers say that is some way off, so they’re cooking up bespoke…

Surviving the liquidity squeeze

Excess liquidity in the euro funding markets halved at the beginning of July, causing Eonia to leap higher. The extent of the move surprised traders and caused problems for some participants. Christopher Whittall reports

Lufthansa wary of OTC regulations

Corporates across the globe have lobbied to ensure end-users are not subjected to new clearing requirements for derivatives. For Lufthansa’s treasury department in Frankfurt, ensuring it is able to continue to hedge its foreign exchange and interest rate…

Playing on forex correlation

The eurozone crisis sent market participants scrambling to put on macro hedges. A popular trade was to short the euro, but with the cost of this strategy escalating, some turned to correlation products. By Christopher Whittall

Saying no to algos

A number of banks have launched algorithmic trading systems for foreign exchange, intended to provide more efficient execution for clients. But some question whether algorithmic models are actually needed in the highly liquid foreign exchange market. By…

Basel CVA changes criticised

The Basel Committee on Banking Supervision has adapted its proposals for a capital charge on counterparty risk following industry feedback, but banks were hoping supervisors would go further. By Mark Pengelly

The end for one-way CSAs

Sovereign derivatives users have been able to avoid posting collateral to their dealer counterparties in the past, but pending reforms to bank capital and funding rules are changing the equation. If sovereigns refuse to budge, they will have to accept…

The swaps carve-out conundrum

Section 716 of the Dodd-Frank Act will force swap dealers to hive off certain derivatives businesses into separate affiliates. But the legislation is fiendishly complicated, riddled with oversights and requires daring interpretative leaps, which has left…

Basel Committee sets out plans for completion of Basel III

Regulators announce a longer transition period and changes to CVA charge

Bank results suffer after May volatility

Short volatility positions contribute to poor equity derivatives results

The rise of multi-currency options

Adrian Campbell-Smith (RBS Currency Options Trading) and Ben Hamdani (RBS Currency Structuring) examine the realm of multi-currency options and explain some of the reasons behind their increasing popularity

Regulators to present living wills proposals to G-20

Banks asked to draw up blueprints for resolution as part of a pilot scheme