Risk magazine - July 2014

Articles in this issue

Hedge funds face higher prime broker charges under Basel III

Funds urged to build treasury savvy as prime brokers retrench

Elections show Europe's leaders are playing with fire

Attempts to forge ever-closer union could destroy the EU

Banks track US-facing business to avoid swap dealer tag

Some try to stay below $8 billion threshold while others see it as an opportunity

Four questions raised by CFTC’s plans for non-US CCPs

US regulator will lean on international principles – but to what extent?

Bloomberg Sef success leads to fee criticism

Rivals claim they are being undercut; others say company is obstructing agency trading

Default fund capital will halve under final rule, banks say

Clearing members welcome Basel's fifth – and final – version of charge

Cutting Edge introduction: The trouble with algorithmic execution

New set-up allows fast, tractable optimisation of trade execution, without neglecting downside risk

Deutsche Bank hires Banque de France’s Matherat

Central banker takes on top regulatory job at German bank

Retreating FCMs spark systemic risk fears

There may not be enough banks to handle rising cleared swap volumes

Industry nervy as Esma faces Mifid liquidity challenge

Discussion paper asks 139 questions on new transparency regime

Get real: asset managers ditch swaps for loans

Margin liquidity risks behind demand for physical, long-dated assets

Nasdaq OMX NLX: access all areas

Futures open interest will follow cleared swaps, says Charlotte Crosswel

LCH.Clearnet needs to join cross-margin club

Contest with futures rivals is focusing attention on cross-product efficiencies

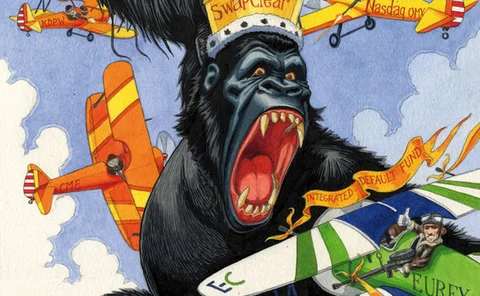

Eurex vs LCH.Clearnet: clash of the titans

German exchange woos big clearing members with promise of capital savings