This article was paid for by a contributing third party.More Information.

Banking redefined: Helping clients succeed in the new market structure

The relationship between banks and their clients is changing. Clients face a range of new challenges arising from higher capital requirements and changing market structure, notes Mark Goodman (pictured), UBS global head of electronic trading for foreign exchange, rates and credit. In this increasingly complex market landscape, successful banks will be those that deliver innovative, cost-effective ways to help clients find the right liquidity and achieve quality execution.

What is driving the changing role of banks?

What is driving the changing role of banks?

Mark Goodman: Banks have to rethink their business models because the challenges faced by their clients have changed. Clients are seeking to adjust to a new market environment created by the regulatory, market structural and economic changes over recent years.

How would you characterise the challenges clients face?

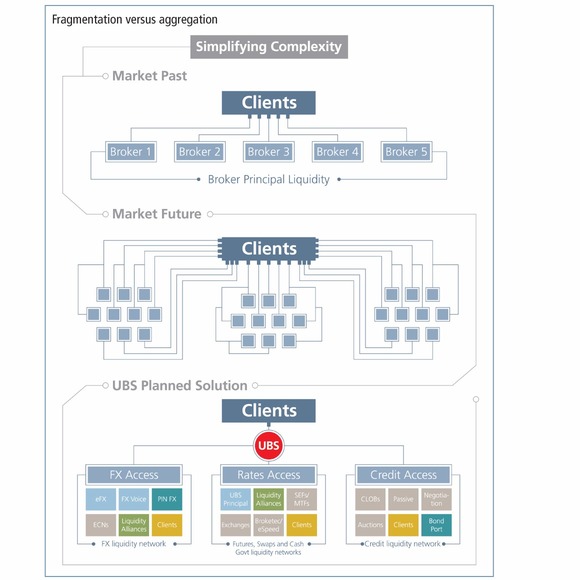

Mark Goodman: In the past, clients could be successful relying on a limited number of bilateral trading relationships with their banks. That has changed. Now they’re looking at a world in which the liquidity they seek is spread across a wide range of venues and channels. The sources of the liquidity they are interacting with are significantly more varied than they were in the past. To cite one example, by some estimates, proprietary trading firms account for 50% of the volume in the US Treasury market these days.

This complexity is such that electronic interactions are increasingly more efficient than traditional voice, and that has a cost implication as well as a workflow implication for clients.

How is this affecting your clients’ business models?

Mark Goodman: Faced with these challenges, clients are asking themselves a fundamental strategic question: in this fragmented, complex and volatile global market environment, how can I efficiently access liquidity at a cost that lets me deliver competitive investment returns to my clients and profits to my owners? Banks will be judged on how well they help clients meet this strategic challenge.

What could this fragmentation mean for clients?

Mark Goodman: Credit is a good example. Institutional clients have traditionally relied on their relationships with a relatively small number of banks. These banks may have made markets in perhaps 10,000 names in the credit markets. In the new regulatory environment, with its higher capital costs, the number of names supported by these banks would shrink to perhaps 3,000. So the number of banks needed to meet 100% of a client’s demand for liquidity needs to increase.

Clients will have to find additional banks as well as alternative, non-traditional sources of liquidity. That is true of the cash market but, in derivatives, where clearing requirements have moved a significant portion of swaps activity from a bilateral, over-the-counter environment onto alternative trading platforms – such as swap execution facilities and soon multilateral trading facilities and organised trading facilities – clients also need access to on-venue liquidity.

How are institutional clients coping with this new complexity?

Mark Goodman: Generally, clients are at different stages of adjustment and have different levels of resources, but all of them feel some degree of pressure. Connecting to this diverse group of trading platforms and liquidity sources is a daunting task, potentially involving significant investments in technology, compliance structure and management time. Each of these trading platforms has a rule book, different types of protocols, different types of participants and other features unique to their model. Each new bank relationship needs to go through the full cycle of know-your-customer (KYC) and credit checking, which also makes demands on finite resources.

To complicate matters further, many of these venues are start-ups. Institutional clients are put in the position of having to pick which ones are likely to survive and provide incremental value for sourcing liquidity. One of our clients counted 49 possible alternative trading platforms competing for flow in the credit space alone.

How does the UBS model help its clients address these changes?

Mark Goodman: Our approach to clients is based on ‘defragmenting’ the markets – building a network of liquidity sources in each asset class and then offering the tools to allow clients to interact with these in an efficient manner. UBS becomes a single point of entry and leverages its technology and its global reach to reduce the incremental costs to clients of accessing each additional end-point. This could help reduce technology costs, the complexity of deciding which new venues will be successful, and even the administrative burden of managing multiple relationships. Where appropriate, for example in corporate credit, foreign exchange and government bonds, UBS remains the client’s counterparty post-trade, so that also helps lighten the client’s compliance load for KYC as well.

So, technology plays a large role in your offering?

Mark Goodman: Advanced trading technology has long been part of UBS’s DNA, and that has given us an edge in this environment. It is fundamental to our offering. With our technology, we provide the window that lets our clients see and access liquidity across multiple trading platforms and exchanges, along with algorithms and other electronic trading tools needed to achieve significant efficiencies.

How comfortable are clients about accessing these alternative sources of liquidity?

Mark Goodman: They’re growing more comfortable, but conversations move quickly from what is the best price to the nature of liquidity with which they’re interacting. Our role is to help our clients look across all the pools and find the right trade for them, interacting with the appropriate types of liquidity. Sometimes that will result in a principal trade with us, and other times the trade will be with another liquidity source; our objective and how we grow the business is to use the liquidity that represents the best outcome for the client.

At the end of the day, our clients want to focus their attention on implementing their investment strategy and getting the highest-quality execution possible for their end-client. Our model is designed to help them achieve that goal.

How has the continuing electronification of markets and the access to alternative sources of liquidity changed how you work with clients?

Mark Goodman: We’re finding that many clients like the increased control over their orders that electronic trading brings them. We are increasingly working with clients on how they can best use these tools in specific situations, and are monitoring their use and effectiveness.

An interesting development along these lines is the emergence of the electronic sales trader, whose role is not to own the order but to help the client use the right algorithms on the right venues in the right conditions to maximise the trade outcome.

In some cases, clients are growing more comfortable placing passive orders onto venues as well as aggressively taking liquidity. This is particularly the case in credit, where clients are looking to fill the gaps left by principal trading desks.

How did UBS manage the transition to this new business model?

Mark Goodman: It required a significant change in mind-set. We have always been a client-focused institution, and early on we saw the need to align our business more closely with the changing needs of our clients. We made the mental leap from seeing ourselves as a principal business generating revenue on the investment of capital to combining this with a fee-based business providing our clients with critical access to liquidity and cost-efficient management of their trading activities. I think that focus differentiates us in a positive way as the industry goes through significant change.

Read/download the article in PDF format

Please note that venues shown are not available in all locations. This material is provided for informational purposes only and is not to be construed as a solicitation or an offer to buy or sell any financial instrument. The information provided is not investment advice, nor a recommendation and it was not prepared with regard to the specific investment objectives, financial situation or particular needs of any recipient. No representation or warranty, either express or implied, is provided in relation to the accuracy, completeness or reliability of the views expressed. UBS is under no obligation to update this material, and the views expressed herein are subject to change without notice. Neither UBS nor any of its employees accept any liability for any loss or damage arising out of the use of or reliance upon this material. Clients seeking to effect transactions should contact their locally licensed sales representative. © UBS 2016. All rights reserved.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net