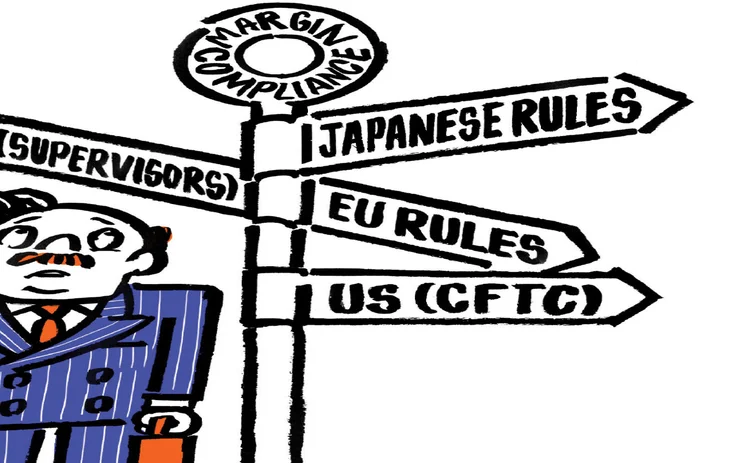

Double standards: CFTC margin rules redefine key concepts

Recently de-guaranteed foreign affiliates of US banks face having to comply with US swap rules under new proposals, but only when posting margin on non-cleared swaps. In all other respects, earlier guidance will let them escape. How this will work in practice no-one really knows

Try to keep up. The foreign office of a US bank is subject to Commodity Futures Trading Commission (CFTC) rules on swaps clearing, execution and reporting, unless it is an affiliate that is not guaranteed by the US parent. These non-guaranteed affiliates (NGAs) and, crucially, their non-US clients are in the clear.

If, however, the NGA is not overseen by one of the US prudential supervisors, its

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Dodd-Frank Act

US Treasury hands CCP resolution powers to FDIC

Mnuchin regulatory review explicitly refers to FDIC as receiver under a Title II resolution

Treasury review not rollback of reforms – CFTC counsel

Trump order is a chance to ease some rules and promote cross-border regulatory deference

Industry pushes CFTC to prioritise cross-border clarity

Approaching Mifid II deadline adds urgency to Giancarlo’s overhaul of Sef rules

Final US position limits rule will take ‘at least a year’

CFTC expected to draft a narrow list of contracts in scope

Covered funds seen as starting point for Volcker rule reform

Inter-agency consensus may prove more elusive on altering prop-trading definitions

US gives 21 banks another year to solve resolution problems

Banks including Societe Generale, Santander and BNP Paribas have until end-2018 to file plans

Bailout obsession holds back US CCP resolution regime

Dodd-Frank leaves legal uncertainty, but proposed alternatives could be even worse

Fed paper reignites debate on bank capital ratios

US industry association criticises official analysis suggesting optimal Basel ratios of up to 26%