This article was paid for by a contributing third party.More Information.

A regulatory push is key for a post‑Libor world

An online webinar hosted by Tradeweb and convened by Asia Risk explores the importance of directives and timings being clearly laid out by regulators in the transition away from Libor

The Panel

- Andrea Sbalchiero, Director, Asia Interest Rate Swaps, Tradeweb

- John Henson, Head of Regulatory Response and Libor Transition, and Benchmark Reform Lead, Data, National Australia Bank

- Nags Sankaranarayanan, Chief Financial Officer and Chief Administrative Officer, Nomura

Greater emphasis by regulators is key for the transition to the fast-approaching market reality of using interest rates other than the near half-century-old Libor, says a senior Tradeweb executive in Singapore. His comments came during an online webinar hosted by the company alongside Asia Risk.

“We have noticed that market transitions happen faster when there is a regulatory push with clear directives and timing,” said Andrea Sbalchiero, Tradeweb’s Asia-Pacific (Apac) director for interest rate swaps. His point about the importance of regulatory momentum was a recurring theme throughout the webinar.

The session, entitled The Libor transition: leveraging technology to meet the 2021 deadline was well attended and covered key areas of concern, such as regional differences and the lack of direction in specific markets, how to adjust for lack of regulatory clarity and how fallbacks can be handled, how technology can aid financial institutions in tackling the liquidity problems for alternative risk-free rates (RFRs), and how to test systems to target and identify individual components for calibration.

Sbalchiero said Tradeweb had been working on RFR implementation for a long-time, to make the transition phase as seamless as possible for clients.

“For all the different currencies, we are working closely with regulators, who are asking us for information, data and our views on different markets. We are also co‑ordinating with dealers to ensure they can support all the different products and we help clients on the calibration side with [their] order management systems. We want to make sure the transition work goes smoothly for them,” he said.

To that end, Tradeweb is also working with external parties such as clearing houses to ensure pricing tools handle trades correctly, he said. Everything needs to be tested so there are no errors and that requires a lot of time and multiple checks to ensure clients “trade efficiently, on time and in a compliant way.”

The move towards a post-Libor world takes centre stage

Sbalchiero stresses that the focus right now in financial markets is the Libor transition and that market players are largely acting proactively: “We are seeing clients moving to RFRs … in Asia, the priority is yen, the Singapore overnight rate average [Sora], Australian and New Zealand dollars and, of course, [US] dollars are globally traded,” he said.

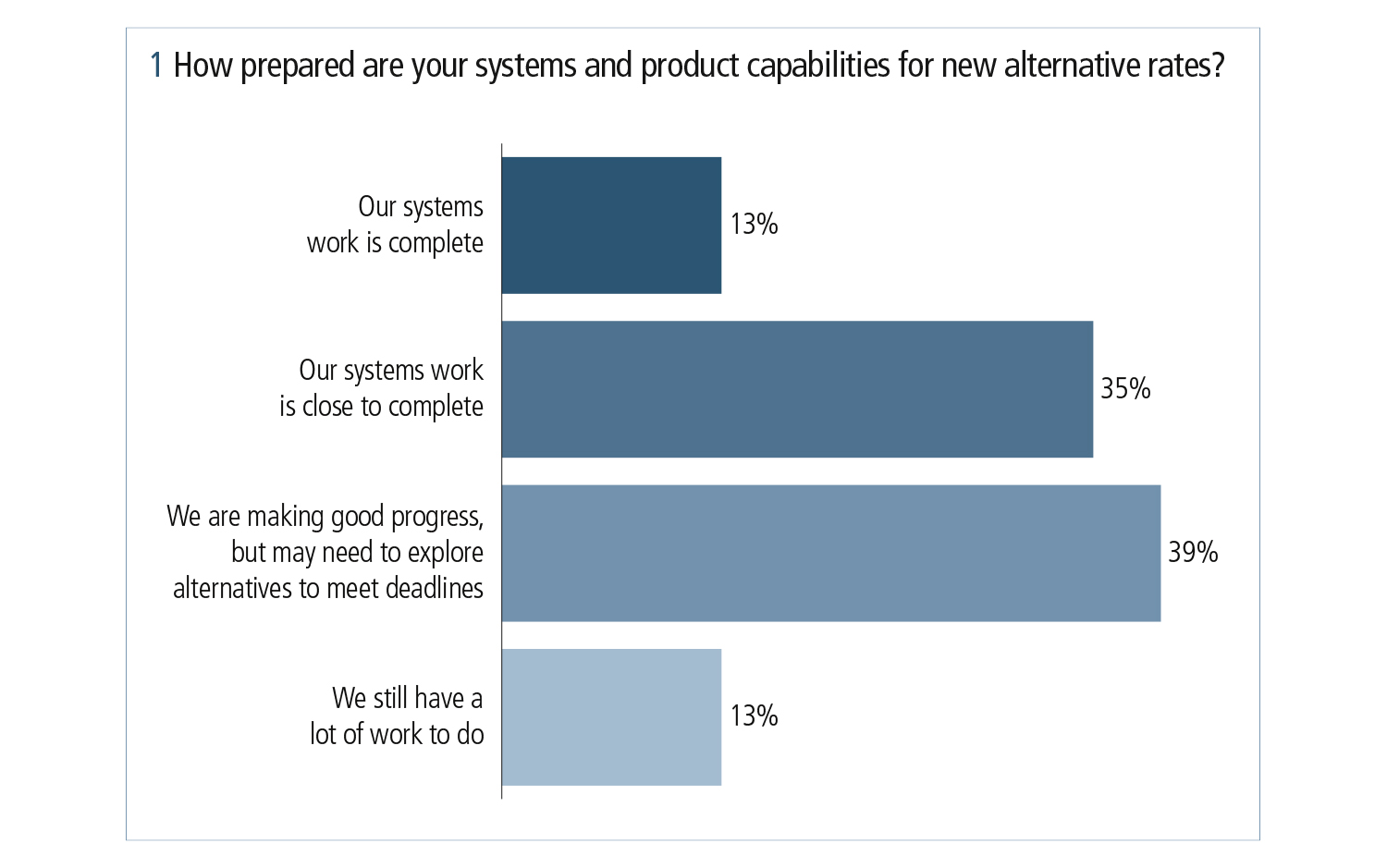

During the webinar, the first polling question posed to attendees was: How prepared are your systems and product capabilities for new alternative rates, including different conventions for new products and transition of legacy products? Thirteen per cent of viewers felt the matter was done and dusted, yet most concluded they were either close to being done but were still conducting tests (35%) or that they have made good progress but, with deadlines looming, may end up having to use some spreadsheets or end-user computing for alternative rates calculations (39%).

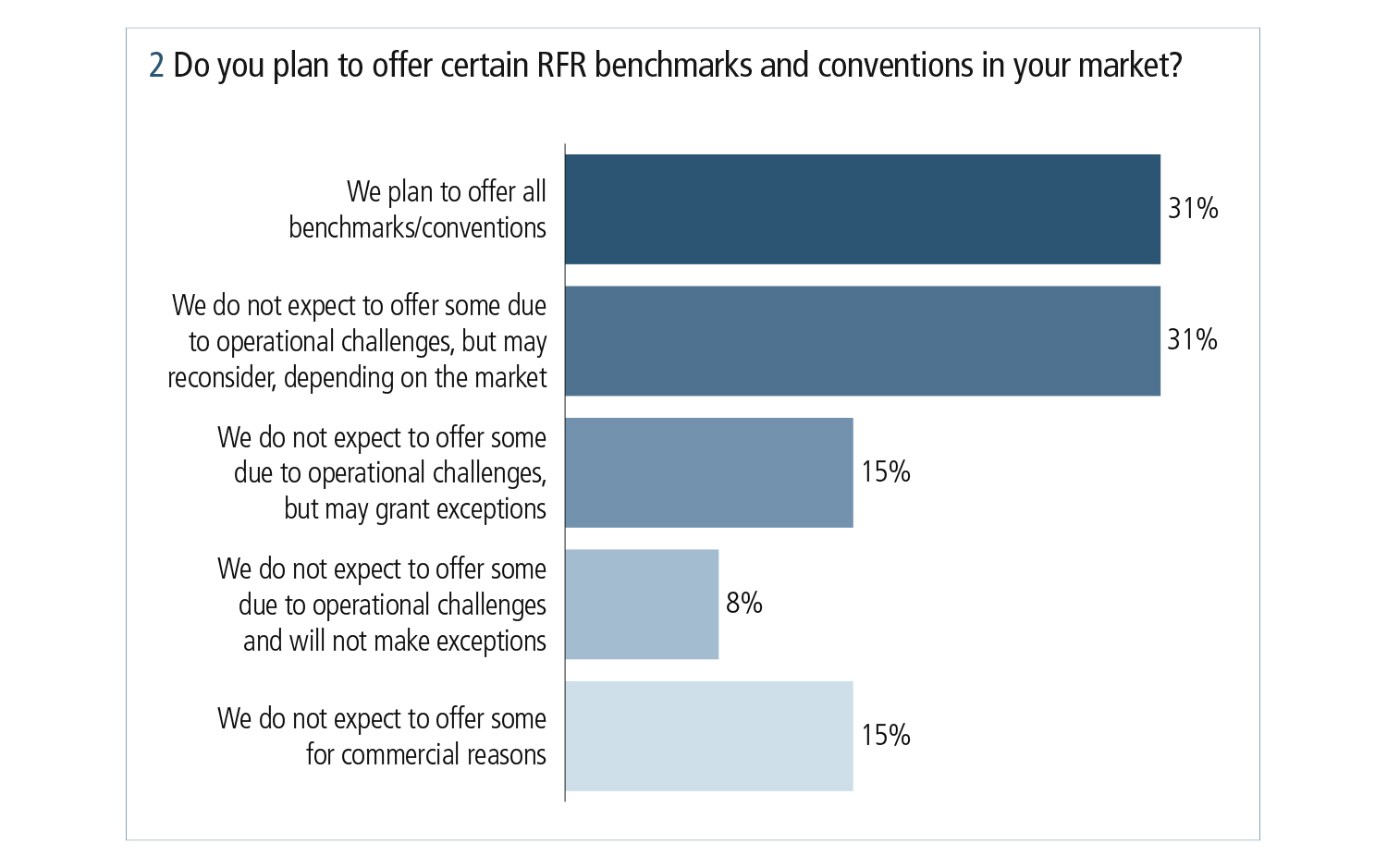

The session’s second polling question was: Do you plan to offer certain RFR benchmarks and conventions in your market?

An equal number (31%) say they would offer all benchmark conventions common in their markets. This is more than those that say that, while they do not expect to offer everything, they may revisit their positions depending on market appetite for different rates that have emerged, such as sensitive rates or term rates. Some are handling restrictions based on business needs, with others providing no exceptions.

It is worth noting that some regulators have criticised credit-sensitive rates. Although they are irksome to many regulators, general consensus is that, as long as they are robust and International Organization of Securities Commissions-compliant and one has fallbacks, such rates can be used.

The aforementioned figures perhaps underscore other reasons to impose limits on clients – including contractual reasons. There are an infinite number of different conventions that can be offered, and many providers may simply opt to broadly do what industry bodies want or expect of them, albeit with a limited number of flavours for highly specialised needs.

Sbalchiero said there had been “a lot of hand-holding” with both liquidity providers and takers, guiding them through the process. He adds that, for Tradeweb – as with everyone else in the market – the move to a post-Libor world was revolutionary, as the firm had spent many months refining its platform to create new indexes for new instruments before the new protocols become the norm.

“We have been testing our functionality across multiple currencies. We had to modify, create and adjust all the trading pages we display. We are already seeing new trades flowing through. Luckily, there was overlap time during which both Libor and RFRs co‑existed, so it gave everyone enough time to do their homework,” he said.

Sbalchiero also said, since all market players have known since the beginning Libor reform would happen, there was no reason to delay their projects: “We were the forerunners. Everything was done in advance so our clients had the … smoothest transition possible. We noticed that no one wanted to be the first mover but, little by little, the problem is disappearing and it is just a matter of time.”

Liquidity feedback loop

While transitions do not happen overnight, they certainly require confidence among clients. Yet, liquidity is perhaps more important.

“The more liquidity providers, the more clients will engage. The more clients engage, the more liquidity providers you will have,” Sbalchiero said, likening the matter to a dog chasing its tail. “We will see exactly the same path across all the currencies, I imagine. It depends how much push there is from regulators. We saw it with the secured overnight financing rate [SOFR] … clients and dealers want to be there to be as soon as possible, and we will be there for them as we were for all other currencies to make the transition as smooth as possible.

For example, Tradeweb has modified its list-rating functionality to be able to handle commingled indexes. Its platform also now has an uploaded converter, so clients can easily upload their existing Libor position calculation, reverse it, close it out and fit into a new RFRs position.

Clearing houses such as LCH and CME have already said they will pre‑emptively convert trades in advance of cessation of non-US dollar Libor in December this year. For International Swaps and Derivatives Association (Isda) derivatives transactions, all new trades are covered by the Isda Supplement. For legacy trades, many entities have acceded to the Isda protocols.

Clearly, the transition is under way and is being pushed by regulators and corporates. While it may be overly ambitious to think everyone will get everything done by year’s end, that is not a sound reason not to push forward.

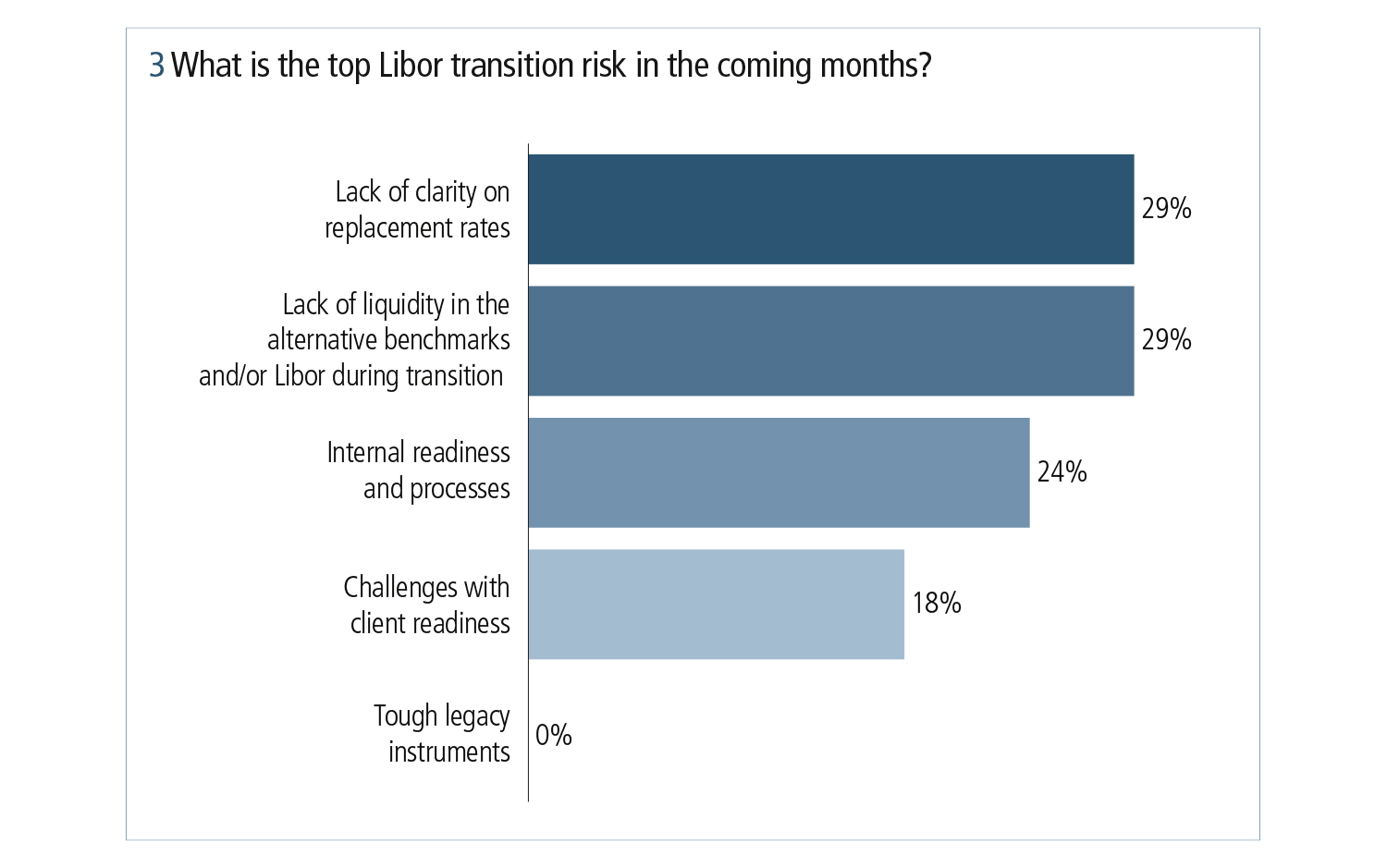

The session’s third and final audience question was about the main risks on the horizon: What do you consider the top Libor transition risk in the coming months?

Finally, tough legacy instruments were not a top risk for anyone, yet lack of clarity appears to be a recurring theme (29%). The emergence of credit-sensitive rates and term SOFR rates in US dollar markets and market-surprising client readiness was only 18%. Many institutions are worried their clients are not ready for the post-Libor transition in last two quarters, with transition execution proving more challenging. Internal readiness continues to be a big theme (24%), with a lack of liquidity (29%) also weighing on respondents.

Giving regulators what they want

Having sound risk management and settlement capabilities is critical. Firms must consider suitability and conduct cost/benefit analyses to gauge whether pricing structures even make economic sense for them. Systems must also contain feedback loops so that, when necessary, matters can be escalated and regulators notified swiftly. Doing so will ensure compliance and proper reporting, as well as create more sensitivity to looming variations and changes. Certain Asian regulators are asking for monthly updates, which certainly keeps them on their toes.

As for US markets, Apac is closely watching for the development of other non-Libor reference rates. The US appears to be more focused on meeting the system capabilities of RFRs. Moving forward, all markets will have to consider how to also adopt credit-sensitive rates.

More technical and operational readiness will be needed to pivot towards alternative reference rates. The guideposts will be market needs in tandem with regulatory guidance, with the latter more pressing as financial watchdogs are closely monitoring how players are referencing and how they meet customer demand via new products.

The Monetary Authority of Singapore, for example, has been a very proactive regulator and has been on top of the transition to non-Libor rates from the start with its Steering Committee for SOR and Sibor Transition to Sora – known as SC‑STS. Singapore has been very active in working with participants as well, and has already announced the cessation of offering products with reference to Sora on March 31, 2021, and for Sibor starting in September 2021.

Ultimately, firms need to get ready for what clients need and regulators want, but must also craft their own strategies for where they want to go and how they will drive their businesses forward. Only when you are operationally ready can you work with clearing houses and other counterparties and be considered a serious market player.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net