United States

Is 2027 the new 24-hour trading target?

Slew of technical issues and dearth of SEC staff compound exchanges’ reluctance for round-the-clock equity trading

Eurex plans October launch for QIS futures

Long-only European equity strategies will be first out of the gate, with more to come

JPM piles into Treasuries with record $72bn AFS surge

Portfolio reshaped with shift to medium-term maturities as Q2 glut boosts holdings to all-time high

Marex customer funds steady despite short-seller claims

Marginal dip following Ningi report offset by rebound in following weeks

Ice’s US Treasury clearing proposal earns positive reviews

Rule book ticks many of the right boxes on default management – a prerequisite for ‘done-away’ clearing

US G-Sibs’ liquidity buffers swell amid record net cash outflows

Median LCR falls to 114.7%, lowest level since pandemic

How to solve the Fed’s $300bn FRTB problem

A sacrifice will have to be made to ensure new market risk rules meet demands for capital neutrality

US banks notch most VAR overshoots since pandemic

Dealers’ gauges underestimated trading inventory price swings on 34 occasions during Q2

Large US banks pile up CVA charges amid tariff shock

JP Morgan’s CVA risk-weighted assets saw largest jump in second quarter since Covid-19

As Fed meets, hedge funds buy ‘lottery’ FX options trades

Options bets reflect cautious pessimism over the dollar ahead of Jackson Hole conference

One in four Fed staff could benefit from GenAI, study finds

New technology could reshape US regulator’s operations – but only with top-down push

Foreign banks see steeper CET1 declines in US and EU stress tests

Strong starting capital buffers at overseas subsidiaries eroded by outsized hits

Cross-border lending to NBFIs hits record $678bn in Q1

Half of international bank credit flows to shadow banks, despite growing regulatory concerns

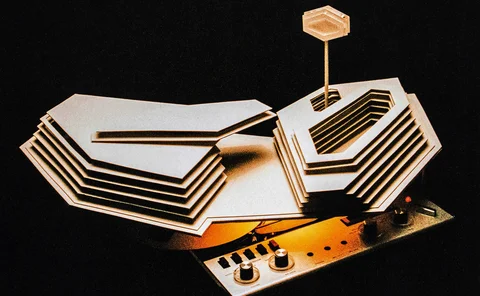

Cat on life support after appeals court ruling

Consolidated Audit Trail’s funding order setback could herald its demise

Fed’s new leverage ratio: the horse that never left the gate

Most of the biggest dealers aren’t leverage constrained now, and experts are sceptical that banks will use the extra capacity for Treasuries

Double VAR breach in Q2 adds $4.1bn to JP Morgan’s market RWAs

Sixth regulatory backtesting exception in nine months lifts the multiplier above minimum for the first time since Q3 2022

Generative AI brings testing times for modellers

Flagstar’s lead model validator offers some tips for safely integrating LLMs into risk models

Barclays edges past BofA in client swap margin

UK bank reclaims fifth spot in FCM ranking as margin tops $21bn

JP Morgan’s head of Emea rates joins Citi

Tom Prickett joins US bank as Emea head of G10 rates

Niche FX crosses pop up in mutual fund options activity

Counterparty Radar: Fund filings reveal unusual FX options crosses – some never repeated, many with unclear strategies

Judy Shelton on gold, tariffs and where the Fed went wrong

Potential successor to Jerome Powell makes the case for cutting rates and tamping down dollar volatility

Glass houses: US agencies urged to shore up cyber defences

Email hack at OCC raises concerns over more widespread frailty at regulators

US CRE provisions surge at Deutsche after model recalibration

Stage 2 loans drive provision hike after LGD assumptions updated

FICC’s new clearing model sparks praise – and intrigue

Some think collateral-in-lieu concept could be applied to a wider range of trades, beyond MMF repos