Italy

Italian bank boards: empowered, professional and accountable?

In Italy, bank governance is handicapped by the composition of the boards of directors, argues Federico Bottarelli Bernasconi

Greek bailout deal fails to dent CDS spreads

Sovereign spreads flat or wider despite agreement on fresh bailout for Greece

CDS market holds breath as Greek bail-out talks continue

Spreads are static and volumes light as EU finance ministers and the Greek government try to reach agreement over bail-out terms

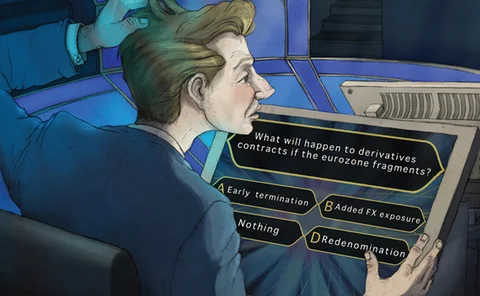

Dealers tackle euro redenomination risks

Back to the drachma?

Structured products linked to real assets and credit back on the menu in Italy

The Italian structured products market is seeing a pick-up as institutional investors demand exposure to physical assets and credit

Basel Committee considers use of credit ratings in LCR shake-up

The scrapping of the level 1 and level 2 distinction for liquid assets is also discussed as the committee reviews the liquidity coverage ratio

ECB in talks with dealers on buying inflation-linked bonds

Dealers will present their case as to why the ECB should buy linkers as well as nominal bonds in a conference call today

Risk Return Italia: slowdown in secondary bond market hits structured products

Out with the new, in with the old

Interest rate derivatives house of the year: Deutsche Bank

Risk awards 2012

Credit derivatives house of the year: Deutsche Bank

Risk awards 2012

Inflation derivatives house of the year: Royal Bank of Scotland

Risk awards 2012

Dealers call for ECB to buy inflation bonds as Italy faces exit from key index

Further downgrades for Italy would cause its inflation-linked bonds to drop out of a Barclays Capital index, prompting mass selling by fund managers, dealers fear

Supervision not regulation, says SEB's Hansen

Rather than rushing to increase regulation and potentially creating compliance costs and regulatory risks, authorities should be getting involved at the ground level to improve supervision, says Lars Hansen, Swedish insurer SEB Life’s chief risk officer

Germany downgrade threat sees eurozone CDSs widen

Eurozone CDS spreads were back on the rise today after Standard & Poor's warned it could downgrade 15 eurozone member states, including Germany

Eurozone CDS spreads fall on French-German fiscal deal

Risk perceptions in the eurozone fell today as France and Germany agreed new treaty plans that will sanction fiscally irresponsible member states

Has the bubble burst for Italy's renewables market?

Renewables: has the bubble burst?

Risk Italia Rankings 2011

Italy in the spotlight

German CDS spreads level out after weak debt auction spooks markets

Cost of insuring against a German government default remains stable after yesterday’s lacklustre debt auction, but risk perceptions on German banks surge

Political crisis in Europe brings volatility back to forex options

Volatility returned to eurodollar last week, as forex traders priced further downside risk into euro options

Italy reaches crisis point as bond yields soar

Announcement that Italian prime minister Silvio Berlusconi will resign does little to calm markets; bond yields hit euro area record high, raising the stakes for a potential default

Best in Italy

Best in Italy

Dealers predict CVA-CDS loop will create sovereign volatility

A recipe for disaster?

Europe's democracy deficit contributing to crisis

The democracy deficit