Europe

Valuation model risk on the rise at EU banks

Over two-thirds of fair value assets priced using banks' models

Nasdaq default came at time of mass margin breaches

CCP's clearing members incurred 49 margin breaches as of end-September

Ice Clear Europe posts $1.2bn margin breach in Q3

In total, 55 margin breaches reported at end-September 2018

Many EU banks’ sovereign portfolios highly concentrated

Forty-eight lenders have more than three-quarters of sovereign risk allocated to home country

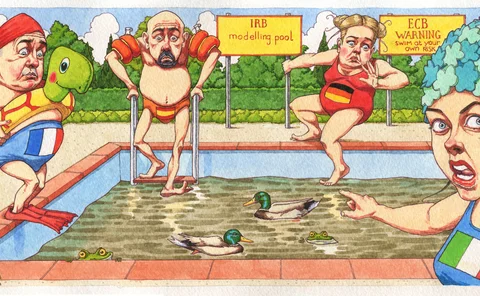

Pooled resources offer way to keep credit models afloat

Supervisors drive banks to seek more corporate default data and cost-effective model improvements

Bond trading dominates EU bank market risk

Traded debt position risk accounts for 60% of market risk capital requirements

Nordic banks shoulder weightiest capital buffers in EU

DNB Bank has 9.10% combined buffer, the largest of stress-tested banks

EU banks most exposed to French, German, US sovereign risk

French bonds make up 17% of all EU bank sovereign exposures

BIS slams Nasdaq Clearing for risk management failures

Clearing member says it is giving notice to quit bourse, citing concerns over concentration of risk on venue

Euro term rate likely to be OIS-based, says RFR group chair

Committed quotes “the most viable methodology”, but some insist rate creates new risks

IFRS 9 hits standardised banks harder than IRB peers

Capital wallop over eight times greater for SA banks than IRB

NatWest kick-starts Brexit swaps transfer

Bank follows Barclays and UBS with plans to continue serving EU clients as ‘no-deal’ looms

EU countries accelerate countercyclical buffer increases

Eleven EU members currently apply CCyBs, with Bulgaria the most recent country to join the club

Italian banks lead EU on cutting soured loans

Intesa Sanpaolo, Banco BPM, UniCredit shed most NPLs in H1

Industry lukewarm on proposed ‘quick fixes’ to Priips rules

Many fear performance scenarios will remain misleading and expose providers to mis-selling claims

FX swaps to avoid year-end basis blowout, banks say

Earlier rollovers likely to ensure no repeat of previous cross-currency volatility

Italian banks hold most of Europe's loan reserves – EBA

Italy accounts for €84 billion of stage 3 allowances alone

A buy-side swaps order book – with a difference

First client joins Trad-X Clob as dealers get nervy about large-scale RFQs

Brexit may spur higher op risk losses – EBA

Largest five op risk losses in 2018 cost equivalent of 2.1% of EU bank's average CET1

What’s Finnish for ‘too big to fail’?

Strange case of Nordea highlights flaw in G-Sib assessments

G-Sib leverage makeups differ by region

Median US G-Sib has higher share of exposure measure made up of derivatives and repo than EU peer

BNPP leads big EU banks in growing IRB exposures

French bank adds €25 billion of modelled exposures in third quarter

EU G-Sibs outpace rivals in growing repo books

Large European banks' increase exposures by €230 billion

EU lawmakers delay FRTB capital charges

Leaked paper potentially pushes market risk capital charges beyond Basel’s 2022 deadline